La Rosa Holdings Corp. (NASDAQ:LRHC) rallied 18% in premarket trading after the real estate and PropTech firm announced it has lined up as much as $1.25 billion in financing to accelerate its transition into AI-focused data center infrastructure.

The funding package consists of a previously disclosed $1 billion equity purchase agreement along with a newly arranged $250 million private placement of convertible notes. La Rosa said the capital will support development of advanced data center assets tailored for AI computing, as well as fuel strategic acquisitions and joint ventures with technology and infrastructure partners.

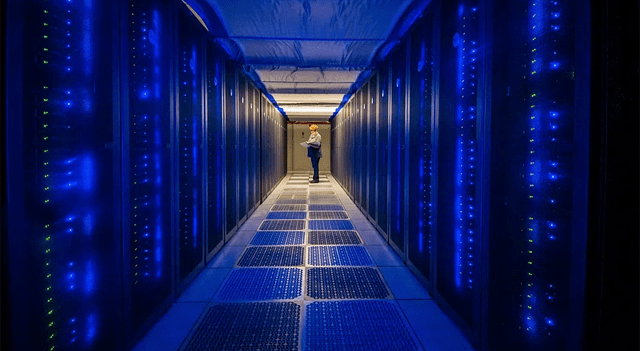

As part of its shift, the company plans to utilize its real estate background to convert existing properties and develop new sites into high-performance data centers built to accommodate intensive artificial intelligence workloads. The move expands on La Rosa’s PropTech initiatives, which have centered on AI-powered real estate tools and blockchain-based platforms.

“This is a defining moment for our Company,” said Joe La Rosa, CEO of La Rosa. “Our strategic pivot builds on our strong PropTech foundation, which has fueled innovation in real estate through AI-driven tools and blockchain-enabled platforms.”

The company added that some of the initial capital will be set aside as a strategic reserve to support growth opportunities, giving La Rosa added flexibility as it considers acquisitions and partnerships tied to its AI data center vision.

Curvature Securities LLC served as sole placement agent for the equity purchase facility, while A.G.P./Alliance Global Partners acted as financial advisor. For the convertible note arrangement, A.G.P./Alliance Global Partners also served as the exclusive placement agent.