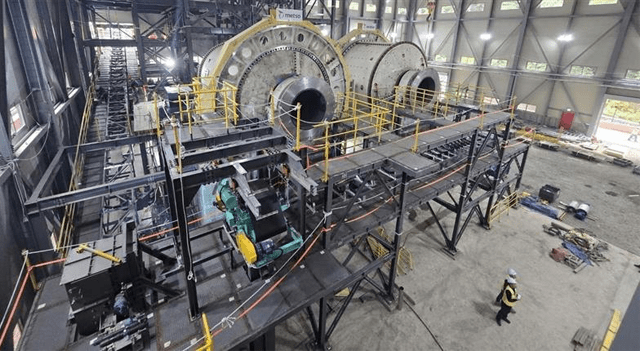

Mills grinding tungsten ore at the Sangdong mine. Source: Almonty Industries

Relations between the United States and Chinese governments are currently contentious, marked by public spats to and fro, in unwavering attempts to gain the upper hand in the global industrial complex.

As the world’s two largest economies, their cooperation places a great deal at stake, including unmatched consumer demand, essential technologies from defense to AI to biotech, and the critical minerals required to produce them that lie at the heart of national security.

China, well-aware of its leverage when it comes to critical metals, instituted export restrictions on ‘dual-use’ technologies – with both civilian and military applications – in December 2024, including antimony, gallium and germanium, sending US and allied nations scrambling to replace the shortfalls.

The US responded swiftly with the beginning of its most aggressive tariff regime in history, including a 10 per cent tariff on all Chinese imports in February 2025, which Trump has threatened to raise to more than 100 per cent beginning in November, with China prepared to reciprocate. US President Trump and Chinese President Xi Jinping are scheduled to meet at the Asia-Pacific Economic Cooperation summit in South Korea beginning on October 31 in an effort to work out a more tenable long-term commercial trade deal.

Ongoing trade discussions have not dissuaded the Communist nation, expanding export controls to 5 critical metals in February, including tungsten and molybdenum, and later expanding to all rare earth elements and associated technologies in October, in a bid to reinforce national security and reassert its critical minerals leadership position.

In the midst of this faceoff, President Trump signed a series of executive orders in March and April 2025 prioritizing domestic critical mineral production, leading to expedited permitting, funding and development of key projects across the country, marking the US supply chain’s pronounced shift away from China after relying on the country for about half of its critical mineral imports. Recent examples of government funding and investment into strategic operators across the mining lifecycle include:

- Nevada-based Lithium Americas, developer of Thacker Pass, the largest lithium resource in the world, which received a US$2.23 billion loan from the US Department of Energy to cover processing facility construction. News of the loan hit the wire on September 23 and has sent the stock soaring by 63 per cent to date, last trading at C$6.89.

- Ucore, a specialist in critical mineral extraction, which has parlayed funding from the US Department of Defense (DoD) and the Canadian Government into steady progress towards initial rare earths production in Louisiana in 2026. The stock has added 837.50 per cent year-over-year.

- Trilogy Metals, a polymetallic explorer whose flagship project in Alaska is prospective for copper, zinc, lead, gold and silver in one of the world’s top copper-dominant mining districts. When news broke in October about the US Department of War taking a direct 10 per cent stake in the company, shares spiked by more than 400 per cent, settling into a 92 per cent return to date.

- MP Materials, currently the only fully integrated rare earths producer in the US, and its multi-billion-dollar partnership with the US DoD to accelerate the domestic rare earth magnet supply chain. Investors have responded positively to the deal, lifting the stock by 260 per cent year to date.

These miners, representing dual opportunities for profit and national security enhancement, are bringing US financial institutions to the table, as evidenced by JPMorganChase’s Security and Resiliency Initiative, under which the firm has earmarked up to US$10 billion to invest in primarily US companies advancing critical minerals, products and manufacturing.

Institutions are, in turn, de-risking a pathway for retail investors to identify prospective companies for the US Government’s next critical mineral investment, careful to focus on commodities in a robust tailwind and pair them with operators whose assets and leadership teams are optimized for shareholder value creation.

The gap in conflict-free tungsten supply

Tungsten is recognized as a critical metal in the US because its hardness, density and high melting point of more than 3,400 degrees Celsius make it essential for mission-critical applications. Here are some key uses-cases for context:

- For enhanced charging capabilities in EV and other electric batteries.

- For electrodes, interconnects and contacts in semiconductors.

- For maximizing lifespan and reducing downtime in mining and construction equipment.

- For durability in aircraft components.

- For effectiveness in hypersonic weapons, bullet-proof vehicles and tank armor, as well as armor-piercing bullets.

Tungsten’s utility and irreplaceability across the global industrial complex grants it a more than US$5 billion market on pace to double by the early 2030s, satisfying our tailwind requirement with aplomb, though there’s a catch.

According to the US Geological Survey, China currently controls more than 80 per cent of the global tungsten supply chain, with Russia and North Korea coming in a distant second and third, meaning that only about 13 per cent of the critical metal stems from conflict-free nations on any given year, with North America representing about 17 per cent of overall demand.

This imbalance, hindering US interests, has only been exacerbated by China’s aforementioned critical mineral export restrictions and the DoDs plan to ban military procurement of tungsten and other critical minerals from China, Russia and North Korea beginning in January 2027, compounding an ongoing deficit and placing a tight timeline on the US Government to secure reliable ex-China supply.

With global armed conflicts at a multi-generational high – as highlighted by the DoD increasing its munitions budget by 230 per cent from 2014 to 2024, and NATO members increasing defense spending from two to five per cent by 2035 – demand for tungsten is accelerating, lifting prices by more than 85 per cent year to date to an average of US$642.50 per metric ton unit (MTU=10 kg) – according to FastMarkets – creating an opportunity for miners on the path to conflict-free production to step into market awareness.

Introducing Almonty Industries

Enter Almonty Industries (TSX:AII) (NASDAQ:ALM), market capitalization C$1.97 billion, a tungsten producer and developer in Portugal, South Korea and Spain on track to become the world’s top supplier of conflict-free tungsten by the second half of 2027, as detailed on slide 6 of the company’s most recent investor presentation.

This article is disseminated in partnership with Almonty Industries Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Almonty’s mineral-rich projects make it a key pillar in meeting Western allied tungsten demand, with emphasis on the US, given that it’s redomiciling to Delaware by year-end 2025, keen to capitalize on a well-established rule of law to grow into a leadership position in the conflict-free market.

The company’s growth plans, as we shall soon see, are well underway, making a strong case for US Government and/or institutional support to expedite what is shaping up to be the free world’s most important tungsten story.

The Sangdong mine

Let’s begin with Almonty’s flagship Sangdong mine in South Korea, which stands as one of the largest and highest-grade tungsten deposits in the world.

The past-producing mine, last active in 1994, houses an estimated ~36,000 tons of tungsten trioxide (WO3) concentrate in probable reserves, ~41,000 tons in indicated Mineral Resources and ~218,000 tons in inferred Mineral Resources, representing more than US$10 billion in the ground at prices as of October 24.

Almonty crew at the Sangdong mine. Source: Almonty Industries

Sangdong is fully funded for phase-1 development to a throughput capacity of 640,000 tons of ore per year. The project is expected to be completed by the end of Q4 2025, with a potential production capacity for nearly half a century, doing so at production costs expected to be in the lowest quartile, according to the mine’s technical report, coming in at US$126.8/MTU.

The majority of phase-I production is already contracted under a 15-year offtake agreement with top global tungsten products manufacturers Plansee Group and Pennsylvania-based Global Tungsten & Powders, including a floor price guarantee based on US$235/MTU of ammonium para tungstate, representing a minimum value of C$750 million.

Almonty plans to break ground on phase-2 development shortly after initial production, increasing capacity to 1.2 million tons annually by 2027, when Sangdong would be in a position to supply approximately 80 per cent of ex-China tungsten production all on its own, meeting the vast majority of US demand.

The Panasqueira mine

Sangdong will complement ongoing operations at Almonty’s Panasqueira mine in Covilhã, Castelo Branco district, Portugal, where tungsten has been continuously produced since 1896, making it one of the world’s longest-running tungsten mines.

The mine’s high-grade material, containing low levels of impurities, commands premium pricing, justifying leadership’s plans to double production capacity from ~58,750 MTUs (≈ 588 tons) in 2024 to up to 124,000 MTUs (1,240 tons) by 2027.

Investors from OeKB and KFW Bank visiting the Panasqueira mine. Source: Almonty Industries

Almonty’s current management team, who we’ll meet later on, has delivered reliable production from Panasqueira over almost a decade, granting it the technical background required to realize Sangdong’s multi-billion-dollar potential.

The company’s target operating model at Sangdong and Panasqueira, assuming US$350/MTU, aims for a gross margin of 50-60 per cent and a net income margin between 30-40 per cent, with these figures likely to come in even higher as operations diversify and flow downstream.

Downstream tungsten oxide production

As activity ramps up across Almonty’s pair of large-scale mines, the company is planning to pursue vertical integration through near-term tungsten oxide production, initially sourced from Sangdong ore, with a ton of the advanced material running just over US$57,000 according to Shanghai Metals Market as of October 24.

Construction of an initial facility will begin in 2025, backed by a letter of intent for up to $50 million from KfW bank, as well as a memorandum of understanding for the location, setting Almonty up to bring about 4,000 tons per year to market by 2028, entailing more than US$225 million in potential revenue.

Production is extendable to 6,000 tons per year contingent on demand, with broad appeal across the battery, semiconductor and other essential industries, pushing annual revenue past the US$340 million mark.

Gentung – Almonty advances intent to become the leading US integrated tungsten producer

Almonty Industries has taken a major step into the US critical minerals landscape with the acquisition of the Gentung Browns Lake Tungsten Project in Beaverhead County, Montana – one of the most advanced undeveloped tungsten assets in the US. This expansion marks Almonty’s formal entry into the US market and reinforces its strategy to build a fully integrated, Western-based tungsten platform spanning Europe, Asia and North America.

The project hosts 7.53 million tons grading 0.315% WO₃ under an NI 43-101 Technical Report and is one of the most advanced undeveloped tungsten assets in the country. Located in a historic district that once supplied the US strategic stockpile, the site benefits from road access, water rights, nearby power and a permitted mill location, with the acquisition also providing exclusive rights to explore and develop the broader Gentung-Browns Lake corridor and a complementary second transaction adding a plant permit, additional water rights and tungsten processing equipment.

With potential production starting as early as the second half of 2026, Gentung Browns Lake is positioned to reinforce America’s domestic tungsten supply at a time of rising demand from defense, aerospace, semiconductors and advanced manufacturing. Almonty has secured exclusive rights to explore and develop the broader Gentung-Browns Lake corridor, with initial design expectations targeting annual output of roughly 140,000 MTU.

The company will pay US$750,000 in cash and issue US$9 million in shares, and has also agreed to acquire a second Montana corporation holding a plant permit, processing equipment and additional water rights. The moves align with Almonty’s strategy to build an integrated Western tungsten platform, complementing construction progress at the Sangdong mine in South Korea and ongoing production in Portugal.

By establishing a direct presence in the United States, Almonty strengthens its ability to supply allied industries with secure, high-quality tungsten and advances broader efforts to fortify critical mineral supply chains across North America.

A second ex-China critical metal supply catalyst

Almonty’s profitable growth runway is further enhanced by its clear path to molybdenum production, exposing it to the metal’s fervid demand for similar applications to tungsten, harnessing its extreme temperature resistance for industrial motors, military armor, aircraft parts and electrical components, combining into a more than US$340 billion market.

Demand in 2024 reached a record high of more than 600 million pounds, according to the International Molybdenum Association, with approximately 43 per cent supplied by China, also the top producer in this critical metal market, with ongoing export restrictions threatening to tighten its stronghold.

Concurrently, Almonty is actively developing a large molybdenum resource adjacent to the Sangdong mine expected to begin production in 2026 and deliver 5,600 tons per year at full capacity over an estimated 60-year mine life. With molybdenum averaging more than US$50,000 per ton in Q3 2025, nursing a more than 150 per cent gain since 2020, that places revenue at about US$280 million per year.

A drilling program on the land package broke ground in September to validate reserves and de-risk production with an offtake agreement already in hand with South Korea’s SeAH, the second-largest molybdenum oxide smelter in the world, establishing a hard floor price of US$19 per pound across the mine’s entire operating life.

Almonty’s strategic partnerships

Almonty’s value proposition as a foundational player in the Western tungsten supply chain is protected on an institutional level through strategic partnerships that make clear where its loyalties lie.

On March 2025, the company signed on for a collaboration with American Defense

International, a top government relations firm in Washington, DC, to leverage its established relationships with the US defense and technology sectors and make strides towards secure and sustainable domestic tungsten and molybdenum supplies.

The company followed this up by joining the Critical Minerals Forum in May 2025, adding its voice to the US DoD-sponsored defense agency, whose mission is to facilitate access to critical minerals for the US and its allies.

Almonty’s efforts to position itself as a partner to the Western world were further recognized the following month, when the company received recognition from US Congress for its contributions to the country’s critical mineral independence and supply chain resilience.

A leadership team as tough as tungsten

Almonty’s value proposition is further de-risked by a leadership team replete with relevant tungsten mining and military sector experience.

The team is headed by chief executive officer, Lewis Black, who has built up a unique knowledge base over an almost two-decade career in tungsten. Previous roles include chairman and CEO of Primary Metals, a tungsten miner previously listed on the TSXV, vice president of the International Tungsten Industry Association, as well as head of sales and marketing for SC Mining Tungsten in Thailand.

Black, currently a partner of Almonty Partners LLC, a private investor in tungsten mining projects, is supported by Brian Fox, a chief financial officer with more than 25 years of leadership across public and private companies, including senior roles at United Subcontractors and Arthur Andersen, in addition to a well-rounded board with ex-military directors that will continue opening doors for offtaking the company’s conflict-free tungsten resources. Recent standout additions include:

- General Gustave F. Perna, a former Commander of US Army Materiel Command from 2016-2020, overseeing more than 190,000 soldiers, civilians and contractors in charge of optimizing the country’s land force capabilities, and the former Chief Operating Officer of Operation Warp Speed from 2020-2021, the US nationwide initiative to develop, produce and distribute vaccines to combat COVID-19.

- Alan Estevez, a former Under Secretary of Commerce for Industry and Security under the Biden-Harris Administration from 2022 to 2025, leading efforts to stymie adversarial militaries, including China and Russia, by blocking access to mission-critical technologies. Estevez previously held senior roles at the US DoD, including Principal Deputy Under Secretary for Acquisition, Technology & Logistics, where he led defense acquisition and supply chain operations. He has also advised Fortune 500 companies on logistics as part of Deloitte Consulting.

With globally relevant projects in its portfolio and bespoke executives in its corner, well-versed in tungsten from the ground to end-users, Almonty has what it takes to fill the Chinese supply gap and lever this inflection point for the critical metal into a generational investment opportunity.

A turnkey solution to a nation’s pressing need

The broader investing public has keyed into Almonty’s diligent ramp-up in tungsten production, lifting the stock by more than 700 per cent since 2020, including more than 500 per cent year-over-year, as tensions between economic superpowers, among them China and the US, and major conflicts across the world, such as Russia’s invasion of Ukraine and the Israel-Hamas war, leave governments with no choice but to do everything they can to secure the materials required for the safety and flourishing of their citizens.

The US, however, has yet to take decisive action against the oncoming tungsten shortfall within its borders, with a deal to secure high-quality, conflict-free supply remaining a pressing need. This, despite there being a particular company with enough resources to quell demand and the wherewithal to align itself with US interests, in no uncertain terms, ready and waiting to deepen its allegiance to the Red, White and Blue.

Whether or not the US Government takes a stake in Almonty, the company is positioned to continue securing offtake agreements with Western allies, and potentially expand its multi-decade production runway with Los Santos and Valtreixal – a pair of prospective tungsten mines in Spain – as more investors, public and private, come knocking on the company’s door in recognition of its emergence on the critical mineral stage.

Join the discussion: Find out what investors are saying about this tungsten miner on the Almonty Industries Inc. Bullboard and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Join the discussion: Find out what investors are saying about this top tungsten stock on the Almonty Industries Inc. Discussion Board and check out more top talked about stocks on our Breakout Boards.