U.S. stock index futures were little changed early Thursday, suggesting Wall Street may open without a clear direction following two sessions of mostly upward movement.

After the sharp swings seen earlier in the week, many traders appear ready to step back and reassess the short-term outlook.

Markets retreated on Monday after the prior week’s strong rally, but regained lost ground through uneven trading on Tuesday and Wednesday. Expectations that the Federal Reserve will approve another interest rate cut next week helped major indices more than erase Monday’s pullback.

Futures held near the unchanged mark even after new Labor Department data showed initial claims for U.S. unemployment benefits unexpectedly dropped to their lowest level in three years for the week ending November 29th.

According to the report, first-time jobless claims fell to 191,000, down 27,000 from the previous week’s revised figure of 218,000. Economists had forecast an increase to 220,000 from the originally reported 216,000. The decline pushed claims to their lowest reading since September 24, 2022, when they hit 189,000.

On Wednesday, stocks spent the early session drifting before turning broadly higher. The Nasdaq and S&P 500 logged modest improvements, while the Dow outperformed with a stronger advance.

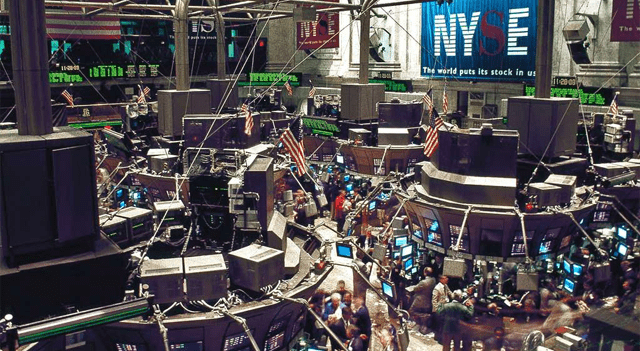

All three benchmarks closed in positive territory: the Dow climbed 408.44 points, or 0.9 percent, to 47,882.90; the Nasdaq added 40.42 points, or 0.2 percent, to 23,454.09; and the S&P 500 rose 20.35 points, or 0.3 percent, to 6,849.72.

The Dow’s strength was supported by a 4.7 percent surge in UnitedHealth (NYSE:UNH), alongside solid gains from Goldman Sachs (NYSE:GS), McDonald’s (NYSE:MCD), and Amgen (NASDAQ:AMGN).

Conversely, Microsoft (NASDAQ:MSFT) slid 2.5 percent after a report from The Information indicated the company had reduced its growth targets for artificial-intelligence software sales.

Broad market sentiment improved further after ADP released data revealing an unexpected decline in private-sector payrolls for November. The firm reported a loss of 32,000 jobs, following an upwardly revised gain of 47,000 in October. Economists had expected an increase of about 10,000, compared to the originally reported 42,000 rise in October.

The ADP figures reinforced hopes that the Federal Reserve will deliver another rate cut at next week’s policy meeting. According to CME Group’s FedWatch Tool, there is currently an 89.0 percent probability of a quarter-point cut.

“This morning’s ADP data confirm what a lot of the doves are saying – it’s more important to focus on a weakening labor market than to worry about inflation in the 2-3% range (but still above the 2.0% target),” said Chris Zaccarelli, Chief Investment Officer for Northlight Asset Management.

He continued, “Although there may be some dissents at next week’s Fed meeting, it is a sure thing that a 25-bps rate cut will be announced, but going forward is where things get more confusing.”

A separate report from the Institute for Supply Management added another surprise, showing an uptick in service-sector activity. The ISM’s services PMI rose to 52.6 in November, up slightly from 52.4 in October. Economists had expected a dip to 52.1. This latest reading marks the strongest level since February, when the index reached 53.5.

Oil-service companies were standout performers as crude oil prices rebounded, driving the Philadelphia Oil Service Index up 3.7 percent to its highest close in ten months.

Airline stocks also rallied, with the NYSE Arca Airline Index jumping 2.7 percent to its best finish in nearly three months. Strength also emerged across steel, financial, and housing stocks, while computer-hardware names lagged notably.

UnitedHealth Group stock price