Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX) shares rallied 19% after the company reported a strong early commercial performance for PALSONIFY alongside favorable clinical data for its congenital adrenal hyperplasia (CAH) pipeline program.

The San Diego–based endocrine specialist said unaudited, preliminary net product revenue for PALSONIFY exceeded $5 million in the fourth quarter of 2025, marking the drug’s first full quarter of sales following FDA approval in September. The acromegaly therapy has already generated more than 200 enrollment forms and attracted over 125 distinct prescribers by the end of December, signaling rapid adoption.

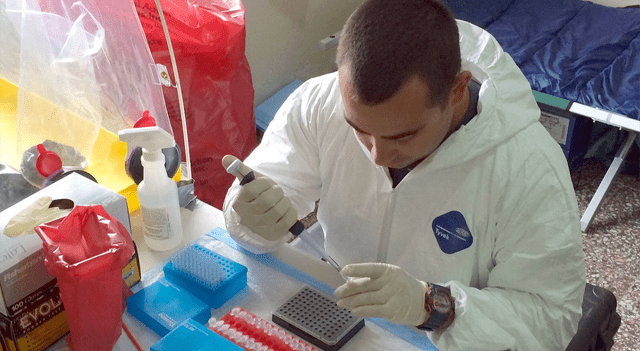

At the same time, Crinetics disclosed positive findings from the fourth cohort of its Phase 2 study evaluating atumelnant, an oral ACTH receptor antagonist in development for CAH. Patients receiving the 80 mg dose recorded a 67% average reduction in androstenedione levels, while 88% of participants who completed 12 weeks of treatment were able to taper glucocorticoid use to physiologic replacement doses.

“I’m very proud of our team’s strong execution of Palsonify’s launch in acromegaly,” said Scott Struthers, founder and CEO of Crinetics. “We are delivering impressive results, highlighted by over 200 enrollment forms in the first three months after FDA approval, a broad prescriber base, and continued momentum toward favorable payer coverage.”

Crinetics added that roughly half of newly filled PALSONIFY prescriptions were reimbursed without the need for bridge supplies, and that most prior authorizations carried 12-month durations—an indication of supportive payer dynamics.

The company also noted that atumelnant continued to demonstrate a favorable safety profile, with no serious or treatment-related severe adverse events reported in the trial, and no hepatic transaminase issues observed among participants.