Shares of Hyperscale Data, Inc. (AMEX:GPUS) climbed about 14% in premarket trading on Wednesday after the company released early estimates of its total assets and net asset value per share as of December 31, 2025.

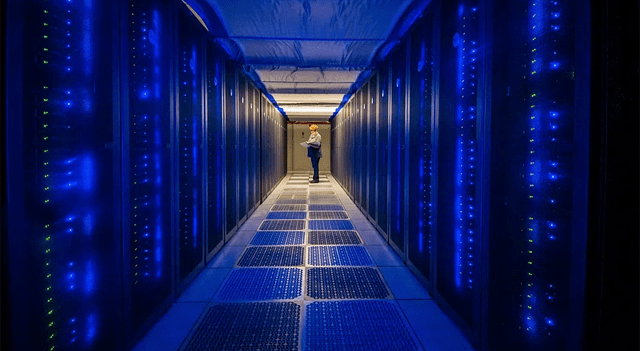

The AI-focused data center operator, which describes itself as an “AI data center company anchored by Bitcoin,” said it estimates total assets at roughly $369 million, equivalent to around $1.14 per Class A common share. Estimated net assets were put at approximately $168 million, or about $0.50 per share.

Hyperscale Data noted that cash and Bitcoin holdings of about $91 million account for a substantial portion of its asset base, a result the company linked to what it described as its “disciplined approach to digital asset accumulation and treasury management.”

The disclosure forms part of a newly introduced monthly reporting framework intended to increase transparency for investors. Executive Chairman Milton “Todd” Ault III said: “We are following through on the first issuance of our monthly estimated total assets and estimated net assets per share as we previously announced at the end of 2025.”

The company added that its shares have “historically traded below what the Company believes reflects its underlying asset value and long-term strategy.” It cautioned that the figures are preliminary and have not been reviewed or audited by its independent registered public accounting firm.

During the fourth quarter of 2025, Hyperscale Data said it continued to build its digital asset holdings, invest in high-performance computing infrastructure and refine its capital structure.

Looking ahead, the company said it intends to provide shareholders with regular monthly updates on its asset position going forward.