Commercial Metals Company (NYSE:CMC) reported a strong start to fiscal 2026 on Thursday, delivering first-quarter results that came in well ahead of market expectations, supported by solid execution and favourable industry conditions.

The update lifted investor sentiment, with the company’s shares rising about 2.4% in pre-market trading.

For the quarter ended November 30, 2025, Commercial Metals posted adjusted earnings of $1.84 per share, comfortably above the consensus forecast of $1.56. Revenue reached $2.12 billion, exceeding analyst estimates of $2.06 billion and representing an 11% increase from $1.91 billion a year earlier.

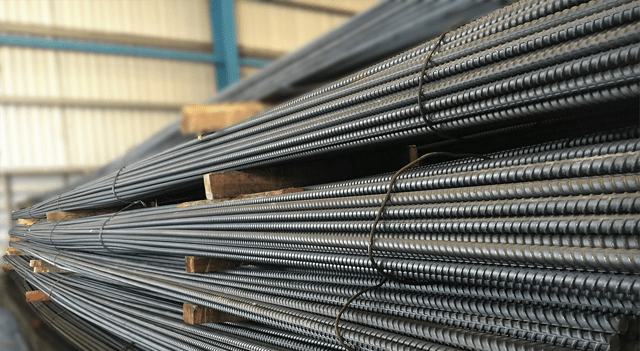

Core EBITDA surged roughly 52% year on year to $316.9 million, translating into a core EBITDA margin of 14.9%. Performance was driven in part by higher steel product metal margins, which improved sequentially for a third straight quarter and reached their strongest level in nearly three years.

Commenting on the results, president and chief executive officer Peter Matt said: “The first quarter marked an exceptional start to 2026 for CMC as we built on the strategic groundwork laid during fiscal 2025.” He added: “Financial results were bolstered by strong operational and commercial execution across our footprint, which allowed CMC to capitalize on constructive market conditions.”

By segment, the North America Steel Group led growth, with adjusted EBITDA rising 57.9% to $293.9 million. The Construction Solutions Group, previously known as the Emerging Businesses Group, delivered an even sharper increase, with adjusted EBITDA jumping 74.7% to $39.6 million.

During December, CMC completed the strategic acquisitions of CP&P and Foley, deploying more than $2.5 billion to establish a new growth platform in the precast concrete market. The company expects these businesses to contribute between $165 million and $175 million in EBITDA during fiscal 2026.

Looking ahead, Commercial Metals said it anticipates a modest sequential decline in consolidated core EBITDA in the second quarter, reflecting typical seasonal factors, although this is expected to be partly offset by contributions from the newly acquired precast operations.