Clean energy stocks could find renewed support heading into 2026, helped by a more benign U.S. budget outcome than initially expected and the continued expansion of data-center infrastructure, according to analysts at Wolfe Research.

In a research note, analysts including Steve Fleishman and Dylan Nassano said the sector is moving into 2026 “with the wind at its back,” adding that valuations look “much healthier” after a “huge” rally in the second half of last year.

“2025 was a year of extreme volatility for clean energy investors,” the analysts wrote.

Early-year sentiment was pressured as markets assessed the implications of President Donald Trump’s second term, given his long-stated intention to roll back clean-energy and climate policies introduced under former President Joe Biden.

However, Wolfe said concerns eased after Trump’s flagship tax and spending legislation passed in July with “very manageable impacts” on the sector. In addition, an executive order targeting regulatory and guidance measures tied to clean-energy tax credits proved “less impactful […] than initially feared,” the analysts noted.

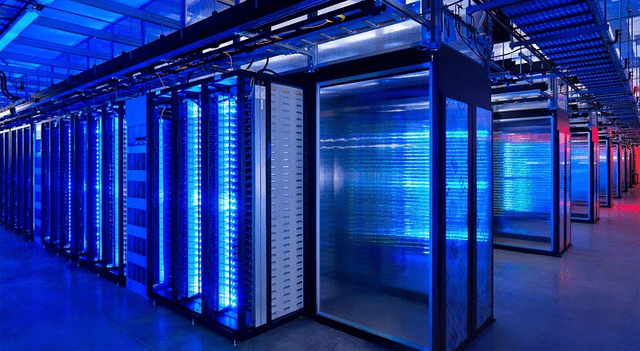

Attention then shifted to the rapid acceleration of artificial intelligence investment, which has driven what Wolfe described as an “unprecedented cycle of power demand growth that would require electrons from every available generation resource, including clean energy.” The analysts highlighted that the vast data centers supporting advanced AI models are expected to consume enormous amounts of electricity.

Reflecting this shift, roughly two-thirds of the 48% gain recorded last year by the Invesco Solar ETF came between August 14 and December 31.

After such a sharp move, Wolfe said it is now taking a more cautious stance, favoring a “selective approach from here given how quickly stocks ran up and continue to favor quality cash flows over more speculative outlooks.”

Against that backdrop, the analysts pointed to electrical infrastructure service providers Quanta Services (NYSE:PWR) and MasTec, citing their broad exposure to power, gas, transmission and distribution networks, as well as their leverage to rising corporate investment in data centers.

They also highlighted energy technology provider NextPower, which Wolfe believes is positioned to “expand its leadership in solar, both in the U.S. and globally.”