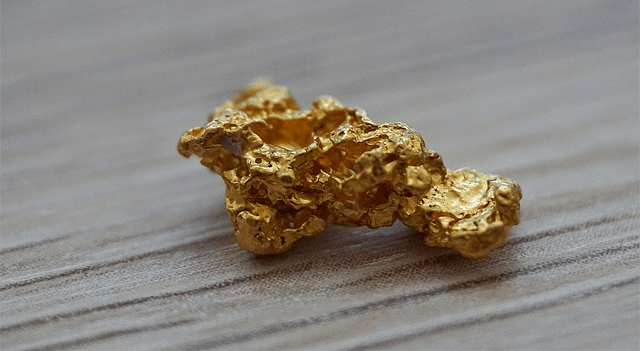

Gold prices extended their pullback during Asian trading on Friday, pressured by continued profit-taking after U.S. President Donald Trump indicated he would reveal his choice for the next Chair of the Federal Reserve later in the day. The prospect of greater clarity on U.S. monetary leadership prompted investors to trim positions after a strong rally earlier in the month.

Spot gold fell 3.6% to $5,180.26 an ounce, while April gold futures slipped 2.8% to $5,199.24 per ounce by 01:28 ET (06:28 GMT). Even with the sharp decline, bullion remained on track for an exceptional January, having surged to multiple record highs earlier in the month.

Other precious metals also retreated after a volatile week. Spot silver dropped 5.5% to $109.2920 an ounce, pulling back from a record high reached on Thursday, while platinum slid 6.5% to $2,474.98 an ounce. Prices across the complex had spiked a day earlier, with gold touching levels near $5,600 an ounce, as reports of potential additional U.S. military action against Iran boosted safe-haven demand. Trading conditions were briefly unsettled by a technical disruption at the London Metal Exchange, adding to short-term volatility.

Trump set to name Fed Chair nominee; Warsh seen as frontrunner

Trump told reporters on Thursday evening that he plans to announce his nominee for the next Federal Reserve Chair on Friday morning. Multiple media reports suggest that former Fed governor Kevin Warsh is the leading candidate, with Trump’s own remarks reinforcing that view. “A lot of people think that this is somebody that could have been there a few years ago,” Trump said.

Warsh, who lost out to Jerome Powell for the role in 2017, has broadly backed Trump’s calls for more forceful interest rate cuts by the Fed. His potential nomination comes at a time when markets are increasingly sensitive to questions around the central bank’s independence, following repeated public pressure from Trump for sharply lower rates.

The Federal Reserve left interest rates unchanged at its meeting earlier this week, with Powell warning during the post-meeting press conference that his eventual successor should avoid involvement in electoral politics. Trump’s announcement is expected to remove a key source of uncertainty for markets, potentially reducing some of the safe-haven demand that has supported gold in recent weeks.

That said, expectations of a more aggressive easing cycle under new Fed leadership could still underpin gold over the longer term. The smaller decline in gold futures relative to spot prices suggested that markets may already be factoring in this possibility.

Gold up around 20% in January as silver leads metals rally

Despite Friday’s sharp losses, spot gold was still up about 20% for January, with other precious metals also on course for substantial monthly gains. The rally has been driven by a strong shift into safe-haven assets amid heightened geopolitical tensions, particularly involving the United States and other major powers.

A weakening U.S. dollar—linked to concerns over fiscal stability and uncertainty around interest rate policy—has also supported metals, alongside broader unease over the outlook for U.S. monetary policy. Silver has been the standout performer, on track to surge more than 50% over the month, while platinum was up around 20% and palladium had gained close to 18%.