U.S. stock index futures are signaling a largely flat start to trading on Monday, suggesting markets may struggle to find clear direction after the strong rebound seen at the end of last week.

Investors appear to be pausing to digest recent market swings, which included a sharp, technology-led selloff midweek followed by a powerful recovery on Friday. With little in the way of fresh U.S. economic data due at the start of the week, some traders may remain cautious ahead of several high-impact releases in the days ahead.

Attention is likely to focus on the Labor Department’s monthly employment report, a closely followed indicator that was postponed last week due to the brief federal government shutdown. Economists expect the data to show job growth of around 70,000 in January, up from 50,000 in December, while the unemployment rate is forecast to remain unchanged at 4.4%.

Additional reports on retail sales and consumer price inflation are also on the radar, as they could influence expectations around the future path of interest rates.

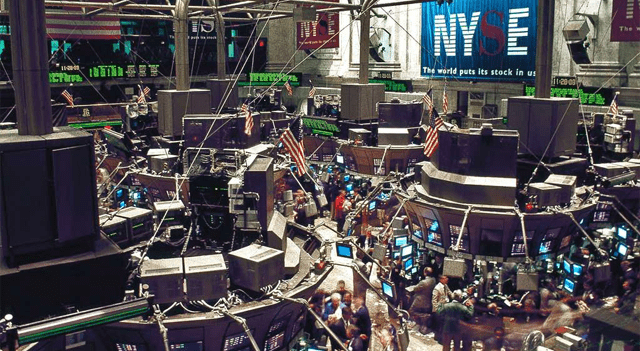

After sliding sharply over several sessions, equities staged a strong comeback on Friday. All three major benchmarks posted sizable gains, with the Dow Jones Industrial Average closing above the 50,000 mark for the first time.

The indices reached fresh intraday highs late in the session before paring some gains into the close. The Dow jumped 1,206.95 points, or 2.5%, to finish at 50,115.67. The Nasdaq rose 490.63 points, or 2.2%, to 23,031.21, while the S&P 500 advanced 133.90 points, or 2.0%, to 6,932.30.

On a weekly basis, the Dow gained 2.5%, while the S&P 500 slipped 0.1% and the Nasdaq fell 1.8%.

The rally was largely attributed to bargain hunting, as investors moved in to buy stocks at lower levels following the recent pullback. Technology shares had led the earlier decline, pushing the Nasdaq to its lowest closing level in more than two months, while the S&P 500 briefly touched its weakest intraday level in over a month early on Thursday.

Market sentiment also received a boost from data released by the University of Michigan, which showed U.S. consumer confidence unexpectedly improved again in February. The survey’s consumer sentiment index rose to 57.3 from 56.4 in January, defying forecasts for a decline to 55.5 and marking its highest reading since August 2025.

The improvement was driven in part by stronger confidence among households with the largest stock market exposure.

The broader market rebound came despite a steep drop in Amazon shares. Amazon (NASDAQ:AMZN) fell 5.6% after reporting slightly weaker-than-expected fourth-quarter results and projecting capital spending for 2026 that exceeded analysts’ forecasts.

Elsewhere, airline stocks rallied sharply, with the NYSE Arca Airline Index surging 7.1% to its highest close in more than three years. Computer hardware and semiconductor stocks also rebounded strongly after recent weakness, lifting the NYSE Arca Computer Hardware Index by 6.8% and the Philadelphia Semiconductor Index by 5.7%.

A jump in gold prices added further support to equities tied to precious metals, with the NYSE Arca Gold Bugs Index climbing 5.5%. Gains were also seen across networking, financial and oil services stocks, contributing to a broadly positive tone across most major sectors.