PG&E Corporation (NYSE:PCG) declined more than 2% in premarket trading Thursday after posting fourth-quarter earnings that came in just below expectations, even as the company lifted its 2026 earnings outlook above consensus.

The California-based utility reported adjusted earnings of $0.36 per share for the fourth quarter, narrowly missing analyst estimates of $0.37.

For full-year 2025, PG&E generated non-GAAP core earnings of $1.50 per share, up 10.3% from $1.36 in 2024. Fourth-quarter revenue totaled $24.9 billion, representing a 2.1% increase year over year.

Looking ahead, the company tightened its 2026 non-GAAP core earnings guidance to a range of $1.64 to $1.66 per share, above the $1.60 consensus forecast. PG&E also improved its projected customer bill inflation range to 0%–3%, compared with a prior outlook of 2%–4%.

“In 2025, our PG&E team made real progress delivering safe, reliable, affordable, and clean energy to customers. We lowered electric prices four times in two years—bucking a national trend—and we achieved a third consecutive year of preventing major wildfires,” said CEO Patti Poppe.

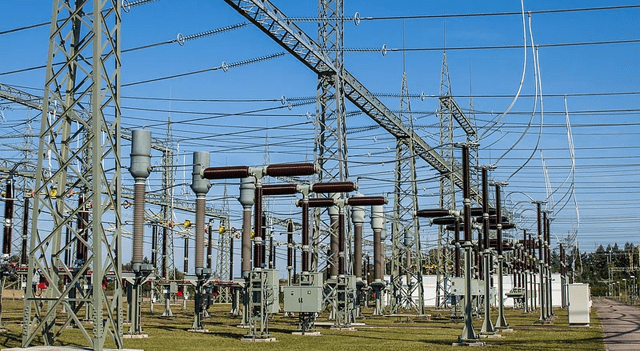

PG&E pointed to several operational milestones, including a 2.5% reduction in non-fuel operating and maintenance costs in 2025, the undergrounding of 334 miles of power lines and a 19% improvement in systemwide electric reliability versus 2024.

The utility also said it has moved 2 gigawatts of data center projects into final engineering since its third-quarter update, bringing the total to roughly 3.6 GW in advanced development. Management believes this potential load growth could help ease electricity prices for customers over time.