Category: Latest News

-

Dow Jones, S&P, Nasdaq, U.S. Markets Respond to Rising Israel-Iran Conflict as G7 Summit Approaches

U.S. stock futures showed modest gains on Monday, reflecting cautious optimism despite mounting tensions between Israel and Iran alongside lingering economic uncertainties. Meanwhile, oil prices climbed once more after a wave of weekend attacks, placing the Middle East crisis at the forefront ahead of the upcoming Group of Seven (G7) summit in Canada. Separately, activist…

-

Oil Prices Rise as Israel-Iran Conflict Escalates and Supply Risks Mount

Oil prices advanced during Monday’s trading session in Asia, extending a recent rally driven by growing concerns over potential supply disruptions amid escalating tensions between Israel and Iran in the Middle East. Although prices moved higher, they remained slightly below the peak levels seen on Friday, which followed Israel’s initial airstrikes on Iranian targets. Over…

-

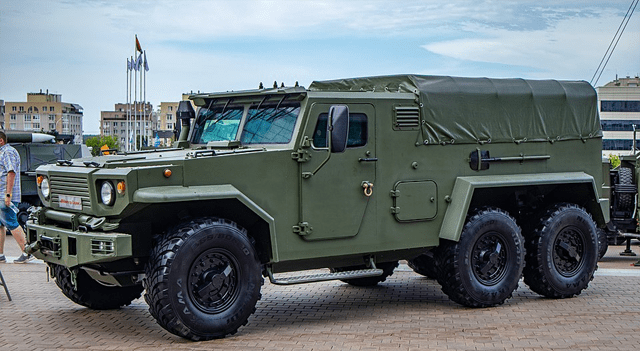

Energy and Defense Stocks Rise as Israel-Iran Conflict Drives Market Volatility

Shares in sectors like energy, defense, shipping, and travel are set to see increased activity on Monday as tensions between Israel and Iran continue unabated for a fourth consecutive day. Brent crude prices initially surged by as much as 5.5%, hitting $78.32 per barrel early in trading before pulling back from those gains. This price…

-

Rare Earth Supply Challenges: Is Tesla Being Singled Out by China?

Recently, China approved rare earth export licenses for major automakers like GM (NYSE:GM), Ford (NYSE:F), and Stellantis (BIT:STLAM), yet conspicuously left out Tesla (NASDAQ:TSLA). This exclusion has sparked speculation that Tesla might be deliberately targeted amid escalating trade frictions and CEO Elon Musk’s outspoken geopolitical stance. According to Wells Fargo, referencing expert Dr. Gracelin Baskaran,…

-

Could a Decline in Foreign Tourists Help Lower Inflation in the U.S.?

Analysts at Capital Economics suggest that the ongoing reduction in international visitors to the U.S.—still around 15% below pre-pandemic numbers—may be subtly easing inflationary pressures. Fewer foreign tourists mean less spending in key service areas such as hotels, restaurants, and entertainment venues, which traditionally rely heavily on international guests. As a result, inflation in U.S.…

-

Bitcoin Price Outlook: ETF Inflows and Corporate Treasury Trends Bolster Bullish Sentiment

On Saturday, June 14, Bitcoin (BTC) slipped by 0.59%, reversing the previous day’s modest 0.26% gain to close at $105,482. This decline mirrored the broader cryptocurrency market, which fell 0.87%, bringing total market capitalization to $3.23 trillion. Geopolitical tensions—particularly rising concerns over the Iran-Israel conflict—dampened appetite for risk assets. Despite this pressure, Bitcoin held above…

-

Oil Prices Surge 7% as U.S. Stocks Tumble Amid Middle East Tensions

Oil prices soared and U.S. stocks fell sharply Friday as investors reacted to rising geopolitical tensions following Israel’s strikes on Iranian nuclear and military facilities. The escalation raised fears of disruptions to global oil supplies and broader economic fallout. The S&P 500 dropped 1.1%, erasing earlier weekly gains. The Dow Jones Industrial Average plunged 769…

-

Gold Weekly Forecast: Safe-Haven Demand Drives Gold Near Record Highs

Gold Rallies on Safe-Haven Flows and Dollar Weakness Gold (XAU/USD) rallied sharply, reaching its highest level since early May, climbing above $3,400. The move was fueled by a combination of softening in the U.S. dollar and renewed geopolitical tensions. The Federal Reserve’s upcoming policy decision and continued developments in the Israel-Iran conflict are likely to…

-

U.S. Stocks Pull Back Sharply After Israeli Airstrikes Against Iran

After moving modestly higher over the course of the previous session, stocks pulled back sharply during trading on Friday. The major averages all moved significantly lower, with the Dow and the S&P 500 pulling back well off yesterday’s three-month closing highs. The major averages staged a recovery attempt in late morning trading after an early…

-

Quest Diagnostics Reaches Record High of $180.11 Amid Strong Financial Performance

Quest Diagnostics Incorporated (NYSE:DGX), a prominent provider of diagnostic testing and information services, has hit a record-breaking share price of $180.11, pushing the company’s market capitalization to nearly $20 billion. Analysts currently view the stock as trading above its estimated fair value, signaling robust investor confidence. The achievement follows a year of steady growth, during…