Category: Latest News

-

BMO Financial Group tops forecasts with strong earnings and revenue growth

Bank of Montreal (NYSE:BMO) reported fiscal first-quarter 2026 adjusted earnings per share of Cdn$3.48, exceeding analyst expectations of Cdn$3.23. Revenue for the quarter totaled Cdn$9.82 billion, beating the consensus estimate of Cdn$9.43 billion and increasing 6% from Cdn$9.27 billion recorded in the same period a year earlier. Shares of the bank rose 1.19% in premarket…

-

Lineage posts mixed fourth-quarter results as softer 2026 outlook weighs on shares

Lineage, Inc. (NASDAQ:LINE), the world’s largest temperature-controlled warehouse REIT, reported fourth-quarter results that met profit expectations but showed a slight decline in revenue, with shares edging lower in premarket trading as investors assessed the company’s 2026 outlook. The stock slipped 0.11% ahead of the market open following guidance that came in weaker than anticipated. Adjusted…

-

Taboola rises nearly 3% after earnings beat offsets revenue shortfall

Taboola (NASDAQ:TBLA) reported fourth-quarter results on Wednesday that exceeded profit expectations but came in below forecasts on revenue, sending shares up 2.87% in after-hours trading as investors reacted positively to stronger profitability. The digital advertising company posted adjusted earnings per share of $0.17 for the quarter, beating the analyst consensus estimate of $0.11 by $0.06.…

-

Panasonic, Samsung SDI, and NEO Battery Materials: Three paths into the battery age

Whether it is due to failures on the part of the Western automotive industry or China’s locational advantages, Beijing dominates the global battery market and openly uses this power as a geopolitical lever. Since November 2025, drastically tightened export regulations have been in place for lithium batteries, graphite anode materials, and related equipment. Production machinery…

-

HP shares slip in premarket as cautious outlook weighs on sentiment

Shares of HP Inc. (NYSE:HPQ) declined in U.S. premarket trading on Wednesday after the company reiterated its full-year profit guidance but indicated results are likely to land near the lower end of its projected range. The printer and PC manufacturer reported earnings at a time when tightening global supplies of memory chips have increased cost…

-

Workday shares fall after softer-than-expected subscription revenue outlook

Shares of Workday (NASDAQ:WDAY) declined in U.S. premarket trading on Wednesday after the company issued a subscription revenue growth forecast for the current fiscal year that disappointed investors. The stock has dropped more than 36% since the start of 2026 and is down over 48% compared with a year ago, as markets reassess the long-term…

-

Oil holds near seven-month highs as markets await U.S.-Iran negotiations

Oil prices remained close to seven-month highs on Wednesday, supported by investor concerns that escalating tensions between the United States and Iran could threaten global supply, with diplomatic talks between the two sides scheduled for Thursday. Brent crude futures rose 42 cents, or 0.6%, to $71.19 per barrel at 07:30 GMT, while U.S. West Texas…

-

Gold recovers amid tariff uncertainty as silver, platinum and copper extend advances

Gold prices climbed on Wednesday, bouncing back from the previous session’s decline as investors evaluated the effects of newly introduced U.S. tariffs and looked ahead to upcoming U.S.-Iran negotiations later this week. At 04:25 ET (09:25 GMT), spot gold rose 0.9% to $5,187.64 per ounce, while U.S. gold futures advanced 0.6% to $5,206.10 per ounce.…

-

Nvidia and Salesforce earnings in focus as markets watch AI impact; gold and oil edge higher: Dow Jones, S&P, Nasdaq, Wall Street Futures

U.S. equity futures pointed modestly higher on Wednesday, with investors awaiting key earnings releases from Nvidia (NASDAQ:NVDA) and Salesforce (NYSE:CRM). The results arrive amid ongoing debate about how the artificial intelligence boom could reshape multiple industries. Meanwhile, gold and oil prices advanced as markets turned their attention to upcoming talks between U.S. and Iranian officials…

-

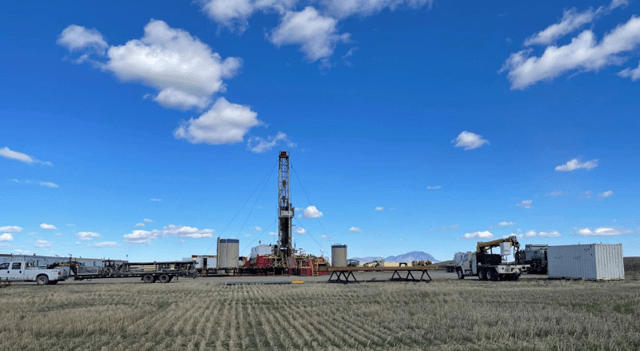

Building a multi‑platform industrial gas and carbon management powerhouse

In the evolving landscape of North American energy, few companies have repositioned themselves as boldly—or as deliberately—as U.S. Energy Corp. (NASDAQ:USEG). What once resembled a traditional exploration and production company is now transforming into something far more ambitious: a vertically integrated industrial gas and carbon management platform positioned at the crossroads of energy security, helium…