Category: Market Summary

-

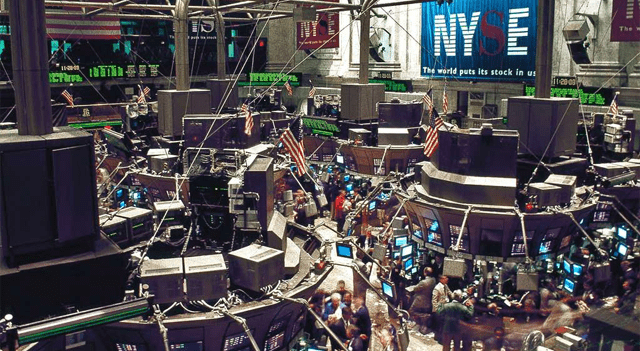

Dow Jones, S&P, Nasdaq, Futures, Wall Street Set to Open Higher as AMD–OpenAI Deal Lifts Tech Stocks

U.S. stock futures were pointing to a positive start on Monday, with major indexes expected to move higher following last Friday’s mixed performance. Technology shares appeared poised to drive the early momentum, as Nasdaq 100 futures climbed 0.9 percent ahead of the opening bell. Advanced Micro Devices (NASDAQ:AMD) led the pre-market rally, soaring 35.7 percent…

-

Dow Jones, S&P, Nasdaq, Wall Street, U.S. Futures Climb as Federal Shutdown Persists

U.S. stock futures edged higher Monday amid continued uncertainty over the ongoing federal government shutdown, which has delayed key economic reports ahead of the Federal Reserve’s next interest rate decision. A senior White House official warned that mass federal layoffs could be imminent, as negotiations between Democrats and Republicans show little progress. Meanwhile, Constellation Brands…

-

U.S. Stocks Close Mixed On The Day But Post Strong Gains For The Week

After moving mostly higher over the past few sessions, stocks saw further upside in early trading on Friday but gave back ground over the course of the day. The major averages pulled back well off their highs of the session before eventually closing mixed. While the tech-heavy Nasdaq fell 63.54 points or 0.3 percent to…

-

Dow Jones, S&P, Nasdaq, Wall Street Futures Point to Higher Open Amid Ongoing Shutdown

U.S. equity futures were modestly higher early Friday, suggesting the market could build on its record-setting run even as the government shutdown drags on with no clear resolution in sight. Markets Defy Political Gridlock The rally in stocks has persisted despite warnings from policymakers that the standoff in Washington could weigh on the broader economy.…

-

Dow Jones, S&P, Nasdaq, Wall Street, U.S. Futures Tick Up Ahead of Services Data, Applied Materials Slides

U.S. stock futures were slightly higher Friday as traders appeared unfazed by the ongoing government shutdown, which has delayed the release of several critical economic reports. Investors are now focusing on private-sector indicators to gauge the health of the services sector, while corporate developments also impacted after-hours trading. Shares of Applied Materials (NASDAQ:AMAT) fell after…

-

U.S. Stocks Close Higher For Fifth Consecutive Session

Stocks fluctuated over the course of the trading session on Thursday before once again ending the day mostly higher. With the upward move, the major averages closed higher for the fifth straight session, reaching new record closing highs. The major averages all finished the day in positive territory. The Nasdaq climbed 88.89 points or 0.4…

-

Dow Jones, S&P, Nasdaq, Futures, AI Optimism Fuels Continued Gains on Wall Street

U.S. stock futures are signaling a higher open on Thursday, with investors poised to extend the upward momentum seen over recent sessions. The positive sentiment surrounding artificial intelligence is lending support to technology stocks, as reflected by a 0.6% advance in Nasdaq 100 futures. AI-focused leaders like Nvidia (NASDAQ:NVDA) are climbing 1.4% in pre-market trading,…

-

Dow, S&P 500 Reach Record Closing Highs Despite Government Shutdown

Stocks came under pressure early in the session on Wednesday but staged a significant turnaround over the course of the trading day. The major averages climbed well off their lows of the session and into positive territory. The major averages gave back some ground going into the end the day still finished higher. The Nasdaq…

-

Dow Jones, S&P, Nasdaq, Futures, Wall Street Eyes Lower Open as U.S. Shutdown Sparks Uncertainty

U.S. stock index futures were pointing to a weaker start on Wednesday, with markets bracing for a potential pullback following a string of recent gains. The shift in sentiment came after the federal government entered a shutdown early this morning, as lawmakers once again failed to agree on a short-term funding measure. The standoff stems…

-

Dow Jones, S&P, Nasdaq, Wall Street Futures, Markets React to U.S. Shutdown, Nike Earnings, and Record Gold

U.S. stock futures tumbled Wednesday as the federal government shut down, pushing investors toward gold as a safe haven amid worries over potential economic fallout. Nike provided a rare bright spot, with first-quarter results suggesting that its turnaround plan is gaining traction. U.S. Government Shutdown Takes Effect The U.S. government ceased most operations Wednesday after…