Category: Include on Menu

-

Li Auto Slides as Q3 Results Miss Expectations and Guidance Disappoints

Li Auto (NASDAQ:LI) shares slipped in U.S. premarket trading on Wednesday after the Chinese EV maker released a weaker-than-expected third-quarter report and delivered guidance that fell well short of market forecasts. By 04:18 ET, the stock was down 1.8%. The company posted earnings per share of RMB0.36, missing analyst expectations of RMB0.64. Revenue came in…

-

Oil Prices Stabilize After Hitting One-Month Low as Markets Weigh Supply Outlook and Peace Talks

Crude prices held near flat on Wednesday, pausing after a sharp drop in the previous session that pushed benchmarks to their lowest levels in about a month. Traders continued to evaluate the likelihood of oversupply heading into 2026 and monitored renewed diplomatic efforts aimed at brokering a Russia-Ukraine peace agreement. Brent crude slipped 5 cents…

-

Gold Climbs as Softer U.S. Data Strengthens Expectations for December Fed Cut

Gold prices pushed higher in Asian trading on Wednesday, lifted by a weakening U.S. dollar after a run of underwhelming U.S. economic reports added momentum to bets that the Federal Reserve will lower interest rates in December. Investor appetite for safe-haven assets remained firm even as risk markets extended their rally this week. Ongoing strains…

-

Dollar Rebounds After Steep Drop; Sterling Firms Ahead of U.K. Budget

The U.S. dollar nudged higher on Wednesday, recovering slightly after its sharp slide in the prior session as traders continued to position for a potential Federal Reserve rate cut in December. The British pound, meanwhile, held steady as markets awaited the U.K.’s Autumn Budget announcement. At 03:50 ET (08:50 GMT), the Dollar Index — which…

-

Dow Jones, S&P, Nasdaq, Wall Street Futures, AI Trade Shows Signs of Fracturing; Dell Lifts Outlook; Deere Earnings on Deck – What’s Moving Markets

U.S. stock futures ticked higher early Wednesday as investors assessed shifting dynamics in the artificial intelligence trade. Dell Technologies (NYSE:DELL) lifted its full-year outlook on the back of soaring demand for AI-focused servers, while Deere & Co prepares to issue its latest quarterly numbers. Traders will also be watching for the Federal Reserve’s upcoming release…

-

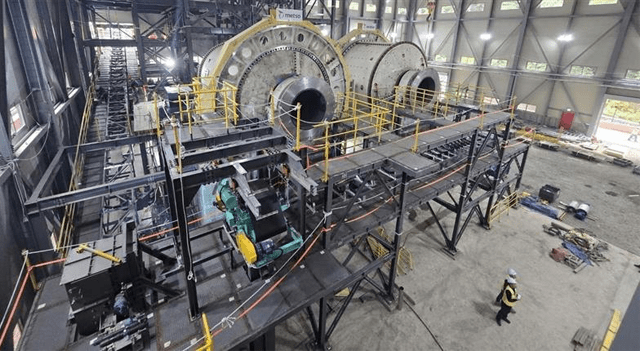

A tungsten miner positioned to bolster US national security

Mills grinding tungsten ore at the Sangdong mine. Source: Almonty Industries Relations between the United States and Chinese governments are currently contentious, marked by public spats to and fro, in unwavering attempts to gain the upper hand in the global industrial complex. As the world’s two largest economies, their cooperation places a great deal at stake, including unmatched consumer…

-

U.S. Stocks Move Notably Higher Following Early Volatility

After showing a lack of direction early in the session, stocks moved notably higher over the course of the trading day on Tuesday. The major averages all moved to the upside, with the tech-heavy Nasdaq joining the Dow and the S&P 500 in positive territory after an initial pullback. The major averages pulled back off…

-

Peloton stock rebounds after report suggests slow initial uptake of new AI-driven equipment

Peloton Interactive (NASDAQ:PTON) shares dipped about 0.5% early Tuesday but quickly rebounded after a Bloomberg report indicated that the company’s latest AI-enabled fitness products are off to a soft start. Bloomberg stated that Peloton’s new Cross Training Series has seen only limited early traction at major U.S. retail partners in the eight weeks since launch.…

-

Silexion stock jumps after toxicology studies show no systemic toxicity

Silexion Therapeutics Corp. (NASDAQ:SLXN) shares climbed 5.9% on Tuesday after the company reported encouraging results from toxicology studies for its pancreatic cancer candidate SIL204, confirming the absence of systemic organ toxicity in two animal models. The outcome marks a key milestone for the clinical-stage biotech firm, which remains on schedule to launch a Phase 2/3…

-

PharmaCyte Biotech stock surges following profitable exit from Femasys investment

PharmaCyte Biotech Inc. (NASDAQ:PMCB) shares skyrocketed 67.8% on Tuesday after the company announced it had completed the successful monetization of its stake in Femasys Inc. (NASDAQ:FEMY), significantly bolstering its liquidity. The sale is projected to lift PharmaCyte’s combined cash and marketable securities to roughly $20 million, up from $13.3 million reported as of July 31,…