Category: Top Story

-

Extended Crude Oil Surge, Jobs Data Trigger Sell-Off On Wall Street

Stocks moved sharply lower during trading on Friday, adding to the losses posted in the previous session. With the steep losses on the day, the Dow and the Nasdaq dropped to their lowest closing levels in over three months and the S&P 500 hit a two-month closing low. The major averages all finished the day…

-

NorthStrive urges enVVeno to pause clinical spending, calls for shareholder vote on strategic options

An activist investor holding a stake in enVVeno Medical Corporation has called on the company’s board to halt clinical spending and allow shareholders to vote on potential strategic alternatives, including liquidation or a merger. NorthStrive Companies Inc. said its subsidiary NorthStrive Fund II LP, which owns about 5.05% of enVVeno’s outstanding shares, sent an open…

-

Escalating Middle East conflict, soaring oil prices and weak payrolls data pressure U.S. market outlook: Dow Jones, S&P 500 and Nasdaq Futures

Dow Jones, S&P 500 and Nasdaq index futures are currently pointing to a sharply lower open on Friday, with stocks likely to see further downside following the weakness seen in the previous session. The futures saw further downside following the release of a closely watched Labor Department report showing U.S. unemployment unexpectedly decreased in the…

-

U.S. jobs report shows payroll decline of 92,000 in February as unemployment rate rises to 4.4%

Employment in the U.S. unexpectedly decreased in the month of February, according to a closely watched report released by the Labor Department on Friday. The report said non-farm payroll employment slumped by 92,000 jobs in February after jumping by a downwardly revised 126,000 jobs in January. Economists had expected employment to increase by 60,000 jobs…

-

Ford recalls 1.74 million vehicles in U.S. over rearview camera malfunction

Ford (NYSE:F) is recalling about 1.74 million vehicles in the United States because of a defect that may cause the rearview camera display to fail, potentially limiting the driver’s visibility behind the vehicle, the U.S. National Highway Traffic Safety Administration said Friday. According to the regulator, the issue affects certain Ford Bronco and Ford Edge…

-

U.S. futures edge up as Middle East tensions persist; jobs report in focus: Dow Jones, S&P, Nasdaq, Wall Street

Futures tied to the main U.S. stock indices moved slightly higher on Friday as investors continued to evaluate the escalating conflict involving Iran, which has yet to show signs of easing. Oil prices remain on track for strong weekly gains amid concerns over supply disruptions through the crucial Strait of Hormuz. Meanwhile, markets are preparing…

-

U.S. Stocks Give Back Ground As Crude Oil Prices Resume Surge

After turning in a strong performance in the previous session, stocks moved back to the downside during trading on Thursday. The major averages all moved lower, with the Dow slumping to its lowest closing level in well over two months. The major averages saw a notable recovery attempt in the final hour of trading but…

-

Kroger issues cautious outlook as new CEO takes charge

Kroger (NYSE:KR) released its forecast for the current fiscal year, with guidance for both sales and profits coming in below Wall Street expectations as newly appointed CEO Greg Foran begins his tenure at a time of uncertainty around consumer spending. U.S. households continue to face several economic pressures, including elevated living costs, a labor market…

-

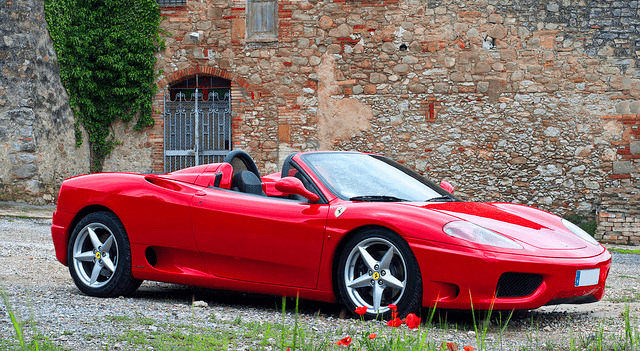

Ferrari Group posts 3% revenue growth to €359.4m in FY25

Ferrari Group Plc (NYSE:RACE) reported preliminary full-year 2025 revenue of €359.4 million on Thursday, representing a 3.0% increase compared with the previous year, though the figure came in slightly below analyst forecasts of €360.6 million. On a constant currency basis, revenue grew 4.8%, falling short of the company’s medium-term growth target of 6% to 8%.…

-

Robinhood unveils platinum credit card targeting affluent customers

Robinhood Markets Inc (NASDAQ:HOOD) on Wednesday introduced a new credit card designed for higher-income clients, marking another step in the company’s push to expand beyond its core trading platform and broaden its financial services offering. The company said the new Platinum card will carry an annual fee of $695 and will be issued through Visa…