Category: Top Story

-

Markets in Motion: Sentiment lows and market strength

In this week’s episode of Markets in Motion, Bruce Campbell breaks down a market that continues to show strength — even as consumer sentiment sits near levels historically associated with recessions. Bruce explains why deeply negative sentiment can act as a contrarian signal, often pointing to stronger markets ahead. He takes a closer look at…

-

Rising Geopolitical Concerns Contribute To Further Weakness On Wall Street

Following the modest pullback seen during Tuesday’s session, stocks saw further downside during the trading day on Wednesday. The major averages regained some ground after an early tumble but still all ended the day in negative territory. The tech-heavy Nasdaq led the way lower, slumping 238.12 points or 1.0 percent to 23,471.75. The S&P 500…

-

Citigroup Q4 Profit Weighed by Russia Exit Charge, Beats Estimates on Underlying Basis

Citigroup (NYSE:C) reported a mixed set of fourth-quarter results, with earnings exceeding expectations once a Russia-related charge is stripped out, while headline revenue came in below forecasts. Citi shares rose about 0.6% in premarket trading. The stock gained 65.8% over the course of 2025. For the three months ended December, the bank posted net income…

-

Wells Fargo Beats Earnings Forecasts but Falls Short on Revenue

Wells Fargo & Co (NYSE:WFC) reported fourth-quarter 2025 adjusted earnings that exceeded analyst expectations, but its shares slid about 2% after revenue came in below forecasts. The U.S. lender posted adjusted earnings per share of $1.76, topping the consensus estimate of $1.66. Revenue for the quarter reached $21.29 billion, however, missing analysts’ expectations of $21.64…

-

Bank of America Tops Profit Forecasts as Trading Performance Lifts Q4 Results

Bank of America (NYSE:BAC) reported stronger-than-expected fourth-quarter earnings, supported by a sharp pickup in trading activity as market volatility boosted results at the second-largest U.S. bank. As with several Wall Street rivals, BofA benefited from turbulent market conditions through 2025, driven by factors such as shifting White House trade policies and investor concerns over a…

-

Wall Street Futures Signal a Softer Start to Trading

U.S. stock index futures are pointing to a weaker open on Wednesday, suggesting equities could extend recent losses after finishing Tuesday’s volatile session slightly lower. Pre-market declines in Wells Fargo (NYSE:WFC) are adding pressure to sentiment, with the bank’s shares down about 2.6%. The move comes after the lender posted fourth-quarter earnings that topped expectations,…

-

Tesla to End One-Off Sales of FSD, Shift Fully to Subscription Model, Musk Says

Tesla Inc (NASDAQ:TSLA) will stop offering its Full Self-Driving (FSD) software as a one-time purchase from mid-February and will instead make it available exclusively through a monthly subscription, chief executive Elon Musk said on Wednesday. In a post on X, Musk said Tesla will “stop selling FSD after Feb 14. FSD will only be available…

-

Coca-Cola Drops Costa Coffee Sale After Offers Fall Short, FT Says

Coca-Cola (NYSE:KO) has decided to halt efforts to sell its Costa Coffee business after receiving bids from private equity firms that did not match its valuation expectations, the Financial Times reported on Wednesday, citing sources familiar with the process. According to the report, the U.S. beverage group ended discussions with the remaining bidders in December,…

-

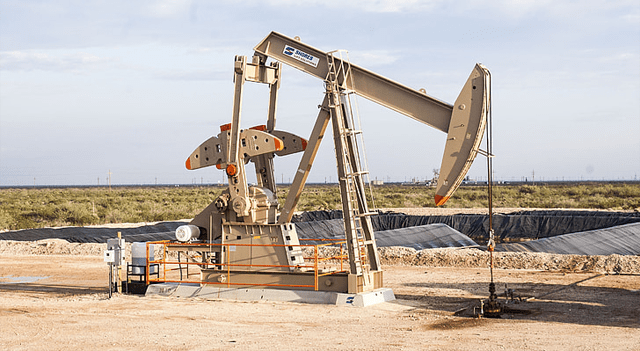

Chevron, Exxon and BP Hold Talks With Mexico on New Oil Exploration Projects

Chevron (NYSE:CVX), Exxon Mobil (NYSE:XOM) and BP (NYSE:BP) are in discussions with the Mexican government and state-owned oil company Pemex over potential oil exploration and production projects that could collectively add up to 200,000 barrels per day of output, according to a report by El CEO. The three oil majors have already submitted proposals to…

-

BP Shares Weaken After Q4 Impairment Warning and Softer Gas Pricing

BP Plc (NYSE:BP) said it expects to recognise post-tax impairment charges of between $4 billion and $5 billion in the fourth quarter of 2025, largely tied to its gas and low-carbon energy businesses, after lower oil and gas prices pressured asset valuations. The update pushed the shares lower on Wednesday. The group said the write-downs…