Category: Top Story

-

Dow Jones, S&P, Nasdaq, Wall Street Futures, Palantir Results on Deck; Trump Weighs In on Nvidia Chip Exports — Market Movers Today

U.S. stock futures were little changed early Monday, as traders looked ahead to another round of corporate earnings while bracing for a lack of key U.S. economic data amid the protracted government shutdown. The closure, now lasting over a month, threatens to delay another critical snapshot of the labor market. Meanwhile, attention is also on…

-

Dollar Inches Higher as Markets Await Key U.S. Economic Data

The U.S. dollar edged higher on Monday, staying close to a three-month high as investors awaited private sector reports that could offer new clues about the health of the U.S. economy. By 04:15 ET (09:15 GMT), the Dollar Index — which measures the greenback’s value against a basket of six major currencies — rose 0.1%…

-

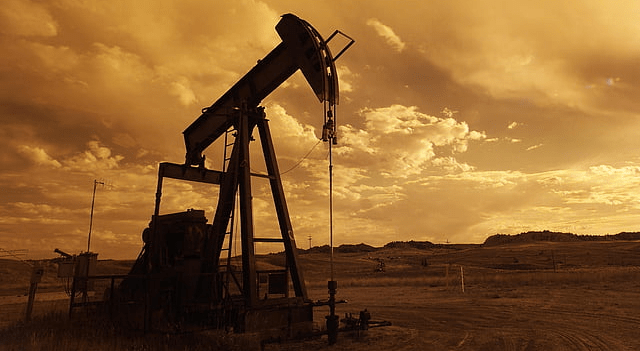

Oil Prices Rise as OPEC+ Freezes First-Quarter Output Increases

Oil prices edged higher on Monday after OPEC+ announced it would delay production hikes scheduled for the first quarter of next year, a move that helped calm fears of oversupply. However, lackluster manufacturing data from major Asian economies limited the rally. As of 07:22 GMT, Brent crude futures were up 28 cents, or 0.43%, at…

-

Gold Rises Slightly but Faces Ongoing Pressure from Fed Caution and Improved Trade Outlook

Gold prices edged up in early Asian trading on Monday, though the precious metal remained under strain after two consecutive weeks of declines. Lingering uncertainty over future U.S. interest rate cuts and easing global trade tensions continued to dampen safe-haven demand. Spot gold was up 0.4% at $4,017.13 an ounce by 01:19 ET (06:19 GMT),…

-

BofA upbeat on long-term stock outlook, sees improving fundamentals

Analysts at Bank of America said they remain constructive on the long-term performance of equities, pointing to better operational efficiency, healthier balance sheets, and what they describe as “a higher quality corporate sector than prior cycles.” In a note published Monday, strategist Savita Subramanian told investors that the bank’s U.S. Regime Indicator “barely extended its…

-

Wells Fargo calls for an ‘everything rally’ heading into year-end

Wells Fargo is forecasting a broad-based rally in risk assets into the end of 2025, predicting multiple market tailwinds will align to push equities higher. The bank sees the S&P 500 reaching 7,100 by year-end, citing seasonal strength, AI-driven capital expenditure, fiscal catalysts, and consumer stimulus. In a note led by Ohsung Kwon, analysts said…

-

Goldman Sachs warns high S&P 500 short interest could trigger squeeze risk

A surge in short positioning around the current S&P 500 level has created “a dangerous cocktail for right tail, or squeeze, risk,” according to a note from the trading desk at Goldman Sachs. As of October 22, the median S&P 500 stock had short interest equal to 2.3% of market capitalization, wrote John Flood, citing…

-

Top AI Chip Stocks to Watch in 2025: NVIDIA Dominates as Broadcom and Oracle Rise

The artificial intelligence chip sector remains one of the strongest growth engines in technology, and heading into 2025, several major players are leading the way. Based on analyst forecasts, financial fundamentals, and strategic developments, three companies in particular stand out: NVIDIA, Broadcom, and Oracle. NVIDIA NVIDIA (NASDAQ:NVDA) continues to dominate the AI infrastructure market, commanding…

-

‘Buy American?’ Barclays says U.S.-centric firms remain best positioned heading into 2026

The S&P 500 has continued to outperform most global equity markets this year, but according to strategists at Barclays, the leadership is narrowing to a few key sectors — and U.S.-focused companies are still better positioned as 2026 approaches. “Earnings beats remain strong, and margins, FY25 growth outlook and FY25/FY26 EPS revisions outpace global peers,”…

-

Amazon shares jump 11% after strong earnings on AWS momentum and AI-driven demand

Shares of Amazon.com Inc. (NASDAQ:AMZN) surged more than 11% in early trading Friday after the tech giant reported better-than-expected third-quarter results, fueled by renewed growth in its Amazon Web Services (AWS) division and soaring demand for artificial intelligence (AI) infrastructure. The company posted earnings per share of $1.95, surpassing Wall Street’s estimate of $1.56, while…