Category: Top Story

-

Dow Jones, S&P, Nasdaq, Wall Street Futures, AI Trade Shows Signs of Fracturing; Dell Lifts Outlook; Deere Earnings on Deck – What’s Moving Markets

U.S. stock futures ticked higher early Wednesday as investors assessed shifting dynamics in the artificial intelligence trade. Dell Technologies (NYSE:DELL) lifted its full-year outlook on the back of soaring demand for AI-focused servers, while Deere & Co prepares to issue its latest quarterly numbers. Traders will also be watching for the Federal Reserve’s upcoming release…

-

A tungsten miner positioned to bolster US national security

Mills grinding tungsten ore at the Sangdong mine. Source: Almonty Industries Relations between the United States and Chinese governments are currently contentious, marked by public spats to and fro, in unwavering attempts to gain the upper hand in the global industrial complex. As the world’s two largest economies, their cooperation places a great deal at stake, including unmatched consumer…

-

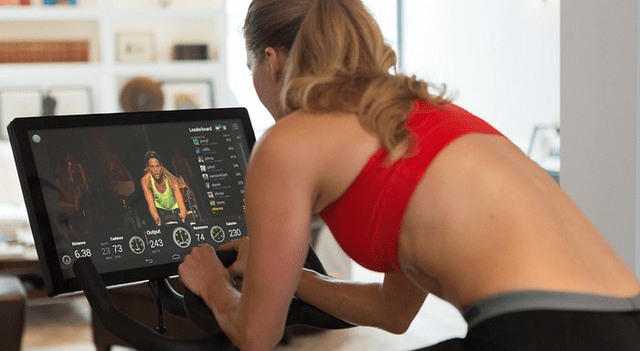

Peloton stock rebounds after report suggests slow initial uptake of new AI-driven equipment

Peloton Interactive (NASDAQ:PTON) shares dipped about 0.5% early Tuesday but quickly rebounded after a Bloomberg report indicated that the company’s latest AI-enabled fitness products are off to a soft start. Bloomberg stated that Peloton’s new Cross Training Series has seen only limited early traction at major U.S. retail partners in the eight weeks since launch.…

-

Dow Jones, S&P, Nasdaq, Futures Signal Flat Start on Wall Street as Traders Pause After Sharp Rebound

U.S. stock index futures pointed to a largely unchanged open on Tuesday, suggesting equities may take a breather after a strong rally in the prior session. Following several days of pronounced volatility, investors appear poised to step back and reassess the near-term market landscape. Monday’s advance extended the powerful rebound that began on Friday, undoing…

-

Nvidia Faces $180 Billion Market Cap Hit as Meta Explores Using Google AI Chips

NVIDIA (NASDAQ:NVDA) is poised for a steep market-value decline on Tuesday after a report indicated that Meta Platforms (NASDAQ:META) is weighing a potential shift toward Google-designed chips for its future data centers — a move that could reshape the competitive dynamics of the AI hardware sector. According to The Information, Meta is evaluating whether to…

-

Meta in Talks to Purchase Billions in Google AI Chips, Report Says

Meta Platforms (NASDAQ:META) is reportedly negotiating a multi-billion-dollar agreement with Google (NASDAQ:GOOG) to acquire AI chips for its data centers starting in 2027, according to a Tuesday report from The Information. People familiar with the discussions said the talks also involve Meta potentially renting Google Cloud chips as early as next year. The arrangement would…

-

Alphabet Poised to Hit $4 Trillion Valuation as AI-Fueled Rally Accelerates

Alphabet (NASDAQ:GOOG) is on track to potentially join the exclusive $4 trillion market-cap club on Tuesday, with the Google parent’s shares climbing more than 4% in premarket trading. The sharp premarket move puts the tech giant within striking distance of the milestone as soon as the opening bell. The company’s rapid ascent reflects a year-long…

-

Alibaba Beats Revenue Expectations as AI-Powered Cloud Business Delivers Strong Quarter

Alibaba (NYSE:BABA) reported stronger-than-expected second-quarter revenue, driven by a solid performance from its cloud division, which has been increasingly enhanced by artificial intelligence capabilities. The company has been aggressively investing in AI to accelerate growth across both its cloud and consumer businesses, committing billions of yuan to new models and infrastructure as it seeks to…

-

Zoom Raises Full-Year Profit Outlook, Shares Gain in Premarket Trading

Zoom Video Communications (NASDAQ:ZM) boosted its annual earnings guidance after delivering stronger quarterly revenue and profit, supported by continued expansion in its enterprise segment and disciplined cost management. The stock climbed roughly 3% in U.S. premarket trading on Tuesday. During its fiscal third quarter, Zoom reported adjusted earnings of $1.52 per share, surpassing analyst expectations…

-

Dow Jones, S&P, Nasdaq, Wall Street Futures, Markets Eye Fresh U.S. Data, Fed Signals, and Upcoming Dell Earnings

U.S. equity futures slipped early Tuesday as traders positioned themselves for a wave of delayed economic releases. A wide set of reports—including retail sales and producer price data—will give investors fresh insight into the state of the economy, while Federal Reserve officials continue to debate the direction of interest rates. Meanwhile, Google (NASDAQ:GOOG) is said…