Category: Top Story

-

Goldman Sachs Warns of Rising Disruption Risks in Global Rare Earth Supply Chains

Goldman Sachs has issued a warning about increasing threats to global supply chains for rare earths and other critical minerals, underscoring China’s overwhelming dominance in both mining and refining and highlighting the obstacles countries face in developing their own independent supply capabilities. China’s Expanding Control The alert comes shortly after Beijing expanded its export restrictions…

-

Gold’s historic rally shows no signs of fading as uncertainty deepens

Gold has smashed through roughly 50 record highs in 2025, cementing its position as one of the strongest-performing assets this year. According to strategists at RBC Capital Markets, this remarkable run is being powered less by standard macroeconomic tailwinds and more by what they call “compounding uncertainty” — a persistent buildup of geopolitical and financial…

-

Apple Stock Seen as Overpriced Despite Strong Metrics, Says Analyst

Apple Inc. (NASDAQ:AAPL) shares may be reflecting excessive optimism, according to a Wall Street analyst who kept a Sector Weight rating on the stock despite better-than-expected September data. KeyBanc Capital Markets analyst Brandon Nispel acknowledged that Apple’s hardware performance was solid, but argued that it doesn’t justify the current valuation. “With AAPL trading at all-time…

-

AI Stocks Still Not Showing Classic Bubble Signs: Citi

Artificial intelligence shares may look pricey after their powerful rally this year, but Citigroup Inc. believes they have not yet entered true bubble territory. “AI does not look like a bubble yet based on our valuation monitor,” analysts at Citi wrote, while also cautioning that “there are some growing pockets of valuation concern when we…

-

Goldman Sachs: Hedge Funds Cut U.S. Equity Exposure at Fastest Pace Since April

Goldman Sachs Group, Inc. reported that hedge funds accelerated their selling of U.S. equities last week to the quickest pace since early April, even as major indexes finished higher with the S&P 500 up 1.7%. According to the bank’s Prime Brokerage data, the bulk of the selling came from short positions in Macro Products and…

-

Next DRONE BOOST ahead: NEO Battery Materials, Kratos Defense, AeroVironment

Drones have become indispensable in modern warfare. That much is now clear. NATO and EU countries are therefore pooling considerable resources for unmanned systems: this year, NATO allies decided to increase defense spending to a total of 5% of economic output. Germany alone announced that it would invest EUR 10 billion in drones of all…

-

Dow Jones, S&P, Nasdaq, Futures, Wall Street set to open lower as earnings and geopolitical concerns weigh on sentiment

U.S. equity futures pointed to a soft start on Thursday, signaling further downside for the market as investors digest weaker-than-expected earnings and rising geopolitical uncertainty. The early pressure stems largely from earnings reactions involving some of the market’s most closely watched names, including Tesla, Inc. (NASDAQ:TSLA) and International Business Machines Corporation (NYSE:IBM). Tesla shares fell…

-

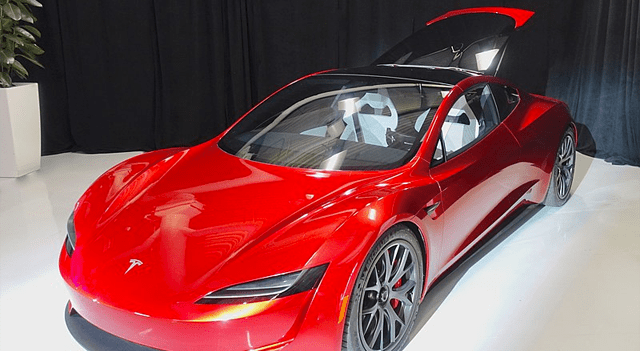

Tesla, Inc. shares drop after profit miss despite higher sales

Tesla, Inc. (NASDAQ:TSLA) saw its stock fall more than 3% in after-hours trading after the electric vehicle maker reported third-quarter results that came in below Wall Street forecasts. Rising operating costs offset stronger sales as the company prepares for softer demand in the U.S. following the expiration of a federal EV tax credit. For the…

-

International Business Machines Corporation shares slide as guidance and cloud slowdown overshadow Q3 beat

International Business Machines Corporation (NYSE:IBM) delivered stronger-than-expected third-quarter earnings on Thursday, but its shares tumbled more than 7% in premarket trading as investors focused on a more cautious revenue outlook and signs of slowing growth in its cloud unit. The company posted adjusted earnings per share of $2.65, exceeding analyst expectations of $2.44. Revenue reached…

-

TransUnion stock gains after Q3 beat and upgraded full-year outlook

TransUnion (NYSE:TRU) saw its shares rise 2.3% on Thursday after the company reported third-quarter results that topped expectations and raised its full-year guidance. The performance was fueled by strength in its Financial Services and Emerging Verticals businesses. The company posted adjusted earnings of $1.10 per share, beating the analyst consensus of $1.04. Revenue reached $1.17…