Category: Top Story

-

Amazon Prepares New Wave of Layoffs Targeting HR and Other Departments

Amazon (NASDAQ:AMZN) is planning significant workforce reductions, with up to 15% of its human resources staff set to be laid off, according to a report by Fortune on Tuesday citing several people familiar with the matter. Additional cuts are expected in other divisions of the company. The downsizing is expected to heavily affect Amazon’s People…

-

Luxury Stocks Surge as LVMH Signals Demand Recovery with First Quarterly Growth of 2025

Luxury shares rallied on Wednesday after LVMH (EU:MC) delivered stronger-than-expected third-quarter results, suggesting a stabilization in global luxury demand and sparking a sector-wide rebound. LVMH stock jumped 12% to above €599 in early trading. Shares of rivals Hermès (EU:RMS), Kering (EU:KER), Richemont (BIT:1CFR), Burberry (LSE:BRBY) and Moncler (BIT:MONC) also climbed between 5% and 8%, underscoring…

-

Oil Slides Further as Oversupply Concerns and U.S.-China Trade Dispute Weigh on Market

Oil prices edged lower again on Wednesday, extending the previous session’s slump as traders reacted to forecasts of a looming supply glut and renewed trade tensions between the world’s top two oil consumers. By 06:40 GMT, Brent crude futures were down 9 cents, or 0.14%, at $62.30 a barrel, while U.S. West Texas Intermediate futures…

-

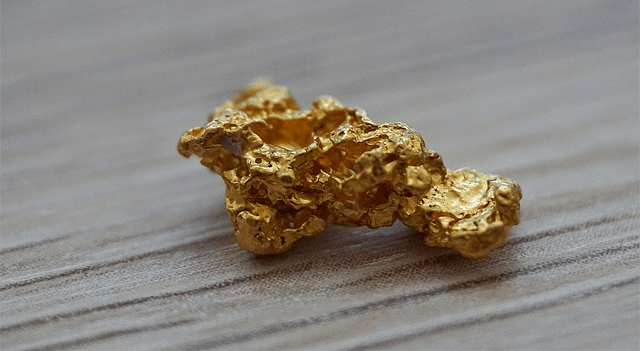

Gold Breaks Another Record, Closing In on $4,200 as Fed Cut Bets and U.S.-China Trade Tensions Drive Safe-Haven Rally

Gold prices soared to a fresh all-time high in Asian trading on Wednesday, extending a powerful rally fueled by growing expectations of U.S. interest rate cuts and renewed friction between Washington and Beijing. Investors piled into the safe-haven metal for a third consecutive session, pushing it closer to the $4,200 per ounce mark. Spot gold…

-

Dow Jones, S&P, Nasdaq, Wall Street, Futures Inch Higher as Earnings Ramp Up, ASML Outlook Cools Sentiment, Beige Book in Focus

U.S. stock futures edged up Wednesday as investors positioned for a busy day of corporate earnings releases and awaited the Federal Reserve’s Beige Book for fresh clues on the economic outlook amid the ongoing government shutdown. A cautious sales outlook from ASML Holding (EU:ASML), including a warning about a “significant” drop in Chinese demand, added…

-

Stellantis Recalls Nearly 300,000 Dodge Dart Cars in the U.S. Over Safety Issue

Stellantis (NYSE:STLA) has issued a recall for 298,439 units of the Dodge Dart in the United States after identifying a defect in the shifter cable that may prevent the transmission from properly locking into park. The National Highway Traffic Safety Administration announced the recall on Wednesday, warning that the problem could cause vehicles to roll…

-

Chip Stocks Advance in Europe and U.S. After ASML Beats Booking Forecasts

Semiconductor shares rose on Wednesday across Europe and the U.S. after ASML Holding (EU:ASML) posted stronger-than-expected quarterly net bookings, though the company paired the upbeat figure with a cautious financial outlook. In early trading, ASML climbed 3.3%, helping lift its European peers. Infineon Technologies AG (TG:IFX), Siltronic AG (TG:WAF), and STMicroelectronics N.V. (NYSE:STM) all gained…

-

Stellantis Commits $13 Billion to U.S. Expansion, Adding 5,000 Jobs

Stellantis (NYSE:STLA) has unveiled a sweeping $13 billion investment plan in the United States aimed at launching five new vehicle models and creating 5,000 jobs at its Midwest manufacturing facilities over the next four years. The initiative, which includes both fresh capital and previously announced commitments, is also seen as a strategic step to cushion…

-

Vor Biopharma Shares Climb After Positive Phase 3 Results for Sjögren’s Treatment

Vor Biopharma Inc (NASDAQ:VOR) rose 3.8% in premarket trading Tuesday after its partner RemeGen announced encouraging 48-week Phase 3 results for telitacicept in patients with primary Sjögren’s syndrome. The China-based trial met its primary endpoint — change from baseline in ESSDAI (EULAR Sjögren’s Syndrome Disease Activity Index) at week 24 — as well as all…

-

StableX Shares Surge After $100M Digital Treasury Partnership With BitGo

StableX Technologies, Inc. (NASDAQ:SBLX) jumped 20% on Tuesday after announcing a strategic partnership with BitGo to secure and manage its $100 million digital asset treasury. As part of the agreement, BitGo Trust Company will act as institutional custodian for StableX’s crypto holdings, offering regulated cold storage solutions and compliance oversight. Additionally, BitGo’s affiliated trading platforms…