Category: Top Story

-

VCI Global Limited Stock Soars 30% on Strong 2025 Growth Outlook

Shares of VCI Global Limited (NASDAQ:VCIG) surged 30% on Monday after the company issued bullish full-year 2025 guidance, projecting a 70% increase in revenue fueled by growth in artificial intelligence, cybersecurity, fintech, and GPU cloud services. The cross-sector technology platform company expects 2025 revenue to reach $47.3 million, up from an estimated $27.8 million in…

-

AlphaTON Capital Corp. Stock Soars on Strategic AI Partnership with Morpheus AI

Shares of AlphaTON Capital Corp. (NASDAQ:ATON) surged 10% in premarket trading Monday after the company announced a strategic collaboration with Morpheus AI (ETH:MOR) to build out advanced AI infrastructure for the TON and Telegram ecosystem. The deal positions AlphaTON as a central provider of AI solutions to Telegram’s network of more than 1 billion monthly…

-

Tvardi Therapeutics Stock Plunges 30% After Disappointing IPF Trial Results

Shares of Tvardi Therapeutics (NASDAQ:TVRD) dropped 30% on Monday after the company released weak preliminary results from its Phase 2 REVERT clinical trial testing TTI-101 for the treatment of idiopathic pulmonary fibrosis (IPF). The clinical-stage biotech firm said the trial failed to meet its objectives based on an initial review of safety and exploratory efficacy…

-

Bloom Energy Stock Jumps After Sealing $5 Billion AI Infrastructure Deal with Brookfield Corporation

Shares of Bloom Energy (NYSE:BE) surged 20% on Monday following the announcement of a landmark $5 billion strategic partnership with Brookfield Corporation to develop next-generation AI infrastructure powered by Bloom’s proprietary fuel cell technology. Under the agreement, Bloom will serve as the preferred onsite power provider for Brookfield’s global network of AI factories. This initiative…

-

Vulcan Materials Company Names Ronnie Pruitt as Next CEO, Succeeding Tom Hill in 2026

Vulcan Materials Company (NYSE:VMC) announced that its board of directors has appointed Ronnie Pruitt as chief executive officer, effective January 1, 2026. Current Chairman and CEO Tom Hill will step into the role of executive chairman at the same time, ensuring a structured leadership transition at the company. Pruitt, 55, currently serves as chief operating…

-

Fastenal Company Shares Slip After Q3 Earnings Fall Short of Expectations

Fastenal Company (NASDAQ:FAST) saw its stock drop 4% in pre-market trading Monday after reporting third-quarter earnings that came in slightly below analyst forecasts, even as revenue showed double-digit growth. For the quarter ended September 30, 2025, the company posted earnings per share of $0.29, missing the consensus estimate of $0.30. Revenue totaled $2.13 billion, matching…

-

Walt Disney Company Shares Jump as Taylor Swift Unveils New Disney+ Content

Walt Disney Company (NYSE:DIS) shares climbed 3% on Monday after pop icon Taylor Swift announced new exclusive programming for the Disney+ streaming platform. In a post on X, Swift revealed that “The Eras Tour | The Final Show”—a full concert film including her complete “Tortured Poets Department” set—will premiere on Disney+ on December 12. The…

-

Dow Jones, S&P, Nasdaq, Futures, Bargain Hunting Poised to Drive Early Rebound on Wall Street

U.S. stock index futures pointed sharply higher early Monday, suggesting a potential recovery at the opening bell after the steep declines recorded on Friday. Investors may seize the opportunity to buy shares at cheaper levels following the previous session’s sharp sell-off. On Friday, the major indexes sank to their lowest point in a month amid…

-

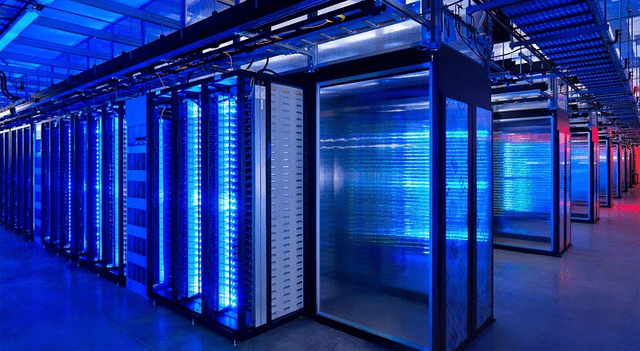

Solidion Technology Launches Next-Generation UPS Battery System for AI Infrastructure

Solidion Technology Inc. (NASDAQ:STI) has introduced a new Uninterruptible Power Supply (UPS) system specifically engineered to meet the unique energy demands of artificial intelligence data centers. Known as the PEAK Series, the system is powered by the company’s 5500 battery cell, which incorporates advanced silicon-carbon anode technology. The Dallas-headquartered firm said the PEAK Series can…

-

Deutsche Bank Says Gold’s Rally Could Be Nearing a Plateau, But Sharp Drop Unlikely

The powerful upswing in gold prices appears to be losing some momentum, with technical indicators suggesting the rally may be approaching its peak, according to analysts at Deutsche Bank. The September–October advance has now stretched to 29 trading sessions — notably longer than the historical median of 18–19 days. Michael Hsueh, analyst at the bank,…