ADVFN US – Market Content Editor

-

BriaCell Therapeutics Shares Sink After $30 Million Capital Raise

BriaCell Therapeutics Corp. (NASDAQ:BCTX) saw its shares plunge 55% in pre-market trading on Wednesday after the clinical-stage biotech company unveiled the pricing of a $30 million public offering. The cancer immunotherapy developer’s stock traded at $4.97 before the open, sharply lower than Tuesday’s closing price of $10.92. The offering was priced at $5.59 per unit,…

-

Horizon Aircraft Posts Q2 Loss While Pushing Ahead With eVTOL Program

New Horizon Aircraft Ltd. (NASDAQ:HOVR) reported a fiscal second-quarter 2026 loss of $0.21 per share on Wednesday as it continues to invest in the development of its hybrid-electric vertical takeoff and landing (VTOL) aircraft. The company’s shares edged up 0.50% following the update. The aerospace developer said it is making solid progress toward assembling its…

-

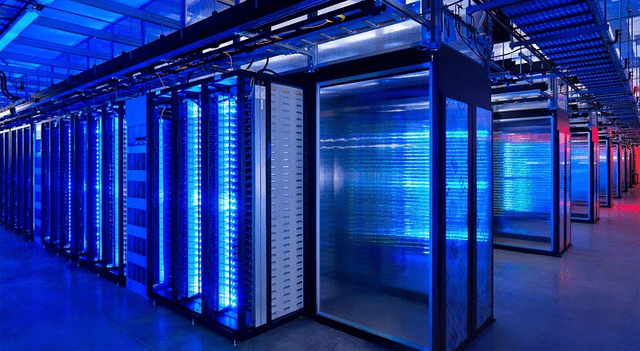

CleanSpark Shares Climb After Expanding Texas Presence for AI Data Centers

Shares of CleanSpark, Inc. (NASDAQ:CLSK) rose 3.5% on Wednesday morning after the company unveiled a major land purchase in Texas aimed at supporting its push into artificial intelligence and high-performance computing infrastructure. The bitcoin miner said it has signed a definitive agreement to acquire up to 447 acres in Brazoria County, Texas, together with a…

-

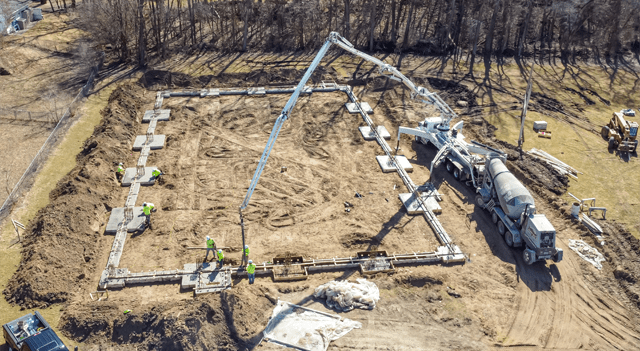

Concrete Pumping Holdings Tops Q4 Forecasts, Shares Slide on Cautious Outlook

Concrete Pumping Holdings, Inc. (NASDAQ:BBCP) delivered fourth-quarter results on Wednesday that comfortably beat analyst expectations, but its shares fell 5.3% as investors focused on the company’s guarded outlook for fiscal 2026. The concrete pumping services group reported adjusted earnings of $0.09 per share for the quarter, well ahead of the consensus forecast for a loss…

-

Rocky Mountain Chocolate Factory Shares Slide 2% After Q3 Results Come in Below Forecasts

Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF) posted a smaller loss for its third quarter, reflecting early progress from its margin-focused turnaround, but the results still fell short of market expectations. Shares of the chocolate maker and franchiser dropped 2.34% in pre-market trading following the announcement. For the fiscal third quarter ended November 30, 2025, the…

-

UnitedHealthcare Rolls Out Pilot Program to Accelerate Medicare Advantage Payments

UnitedHealthcare (NYSE:UNH) said on Wednesday it is launching a six-month pilot initiative designed to speed up Medicare Advantage payments to rural hospitals by significantly shortening reimbursement timelines. Under the program, average payment collection periods will be reduced from less than 30 days to under 15 days, improving cash flow for independent rural hospitals that are…

-

Honeywell Shares Gain as Quantinuum Moves Toward IPO Filing

Honeywell (NASDAQ:HON) shares advanced 1.7% on Wednesday morning after the industrial group said its majority-owned quantum computing arm, Quantinuum, plans to confidentially submit paperwork for an initial public offering. In a statement, Honeywell said Quantinuum intends to file a draft registration statement on Form S-1 with the U.S. Securities and Exchange Commission on a confidential…

-

Wells Fargo Beats Earnings Forecasts but Falls Short on Revenue

Wells Fargo & Co (NYSE:WFC) reported fourth-quarter 2025 adjusted earnings that exceeded analyst expectations, but its shares slid about 2% after revenue came in below forecasts. The U.S. lender posted adjusted earnings per share of $1.76, topping the consensus estimate of $1.66. Revenue for the quarter reached $21.29 billion, however, missing analysts’ expectations of $21.64…

-

Bank of America Tops Profit Forecasts as Trading Performance Lifts Q4 Results

Bank of America (NYSE:BAC) reported stronger-than-expected fourth-quarter earnings, supported by a sharp pickup in trading activity as market volatility boosted results at the second-largest U.S. bank. As with several Wall Street rivals, BofA benefited from turbulent market conditions through 2025, driven by factors such as shifting White House trade policies and investor concerns over a…

-

Biogen’s Q4 Preliminary EPS Misses Market Expectations

Biogen (NASDAQ:BIIB) said its preliminary adjusted earnings per share for the fourth quarter of 2025 are expected to be about $1.26, below the consensus analyst forecast of $1.68. The biotechnology group noted that both its GAAP and non-GAAP results for the quarter will reflect roughly $222 million in pre-tax charges. These costs relate primarily to…