ADVFN US – Market Content Editor

-

Cybersecurity Shares Slide After Report of China Restricting Foreign Software

Shares of several cybersecurity companies moved lower on Wednesday following a Reuters report that Chinese authorities have instructed domestic businesses to stop using security software supplied by around a dozen firms based in the United States and Israel, citing national security risks. Reuters said the guidance was circulated in recent days, although it remains unclear…

-

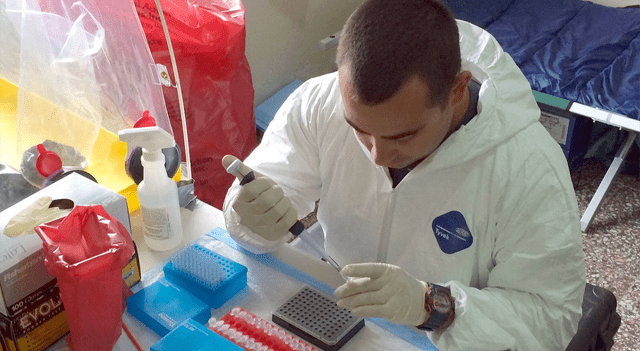

ImmunityBio Shares Jump After Saudi Approval of ANKTIVA for Lung Cancer

Shares of ImmunityBio (NASDAQ:IBRX) climbed 6% on Wednesday morning after the company said Saudi Arabia’s Food and Drug Authority had granted accelerated approval for its ANKTIVA treatment, to be used alongside checkpoint inhibitors in patients with metastatic non-small cell lung cancer. The decision represents the first regulatory approval globally for ANKTIVA, a subcutaneously delivered IL-15…

-

U.S. Retail Sales Beat Forecasts With 0.6% Monthly Increase in November

U.S. retail spending rose more than expected in November, bouncing back from a decline in the previous month and pointing to continued resilience in consumer demand as the year drew to a close. Retail sales increased 0.6% from October, outpacing market forecasts for a 0.5% rise, according to data released Wednesday by the U.S. Census…

-

U.S. Producer Prices Show Modest Gains, While Core Measure Signals Stronger Pressure

U.S. producer prices recorded only limited increases in recent months, but a firmer rise in underlying measures has added to uncertainty around the Federal Reserve’s policy path. On a month-on-month basis, producer price inflation slowed sharply in October and remained restrained in November. The Labor Department’s Bureau of Labor Statistics said the producer price index…

-

Wall Street Futures Signal a Softer Start to Trading

U.S. stock index futures are pointing to a weaker open on Wednesday, suggesting equities could extend recent losses after finishing Tuesday’s volatile session slightly lower. Pre-market declines in Wells Fargo (NYSE:WFC) are adding pressure to sentiment, with the bank’s shares down about 2.6%. The move comes after the lender posted fourth-quarter earnings that topped expectations,…

-

Tesla to End One-Off Sales of FSD, Shift Fully to Subscription Model, Musk Says

Tesla Inc (NASDAQ:TSLA) will stop offering its Full Self-Driving (FSD) software as a one-time purchase from mid-February and will instead make it available exclusively through a monthly subscription, chief executive Elon Musk said on Wednesday. In a post on X, Musk said Tesla will “stop selling FSD after Feb 14. FSD will only be available…

-

Coca-Cola Drops Costa Coffee Sale After Offers Fall Short, FT Says

Coca-Cola (NYSE:KO) has decided to halt efforts to sell its Costa Coffee business after receiving bids from private equity firms that did not match its valuation expectations, the Financial Times reported on Wednesday, citing sources familiar with the process. According to the report, the U.S. beverage group ended discussions with the remaining bidders in December,…

-

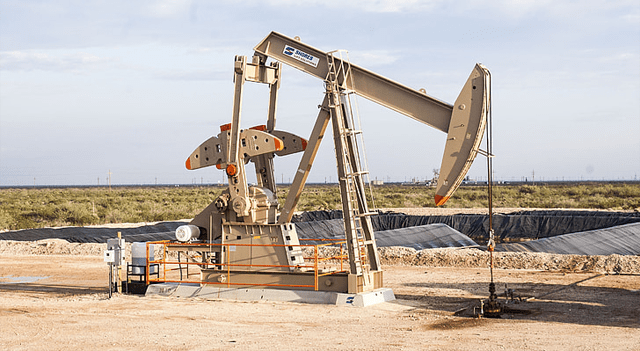

Chevron, Exxon and BP Hold Talks With Mexico on New Oil Exploration Projects

Chevron (NYSE:CVX), Exxon Mobil (NYSE:XOM) and BP (NYSE:BP) are in discussions with the Mexican government and state-owned oil company Pemex over potential oil exploration and production projects that could collectively add up to 200,000 barrels per day of output, according to a report by El CEO. The three oil majors have already submitted proposals to…

-

Amazon Plans Appeal of Italian Antitrust Penalty Despite Reduction, Report Says

Amazon (NASDAQ:AMZN) is preparing to challenge an Italian court decision that lowered a major antitrust fine, arguing that the penalty should be scrapped entirely, according to Italian newspaper MF on Wednesday. Earlier this week, Italy’s competition authority said it had cut the fine imposed on the U.S. e-commerce group to €752.4 million ($876.3 million), down…

-

BP Shares Weaken After Q4 Impairment Warning and Softer Gas Pricing

BP Plc (NYSE:BP) said it expects to recognise post-tax impairment charges of between $4 billion and $5 billion in the fourth quarter of 2025, largely tied to its gas and low-carbon energy businesses, after lower oil and gas prices pressured asset valuations. The update pushed the shares lower on Wednesday. The group said the write-downs…