ADVFN US – Market Content Editor

-

Kamada shares climb after upbeat 2026 outlook points to double-digit growth

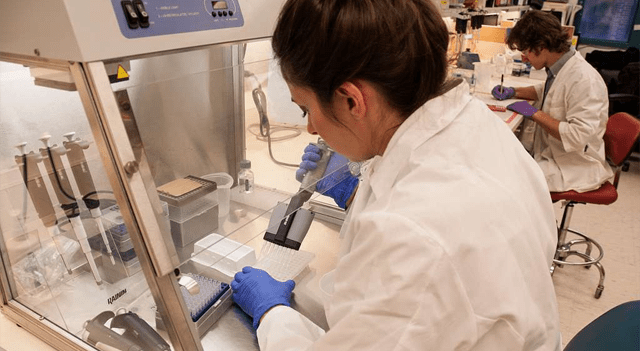

Shares of Kamada Ltd. (NASDAQ:KMDA) rose about 8% after the biopharmaceutical group released its financial guidance for 2026, forecasting another year of strong double-digit growth in both revenue and earnings. The Israel-based specialist in plasma-derived therapies said it expects 2026 revenue to reach between $200 million and $205 million, alongside adjusted EBITDA of $50 million…

-

Aspire Biopharma shares surge after FDA talks support heart attack drug pathway

Shares of Aspire Biopharma Holdings Inc (NASDAQ:ASBP) jumped more than 60% in premarket trading on Wednesday after the company said a pre-IND meeting with the Food and Drug Administration had produced positive feedback for its emergency heart attack treatment. Aspire said the FDA endorsed its proposed regulatory approach for OTASA, a sublingual aspirin powder intended…

-

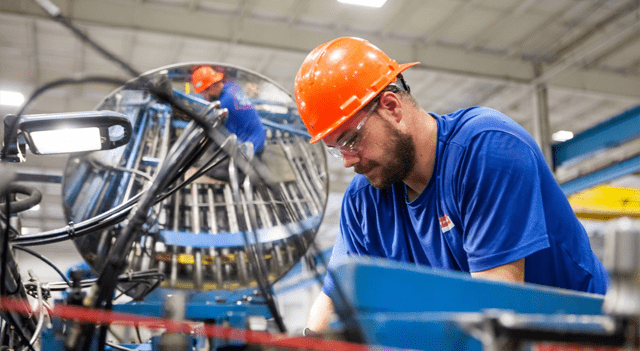

UniFirst shares drop after Q1 earnings fall short despite revenue beat

Shares of UniFirst Corporation (NYSE:UNF) slid about 5% in premarket trading on Wednesday after the company posted first-quarter results that missed profit expectations, even as revenue edged past forecasts. For its fiscal first quarter ended November 29, 2025, the uniform and facility services provider reported adjusted earnings per share of $1.89, below the $2.10 analysts…

-

AST SpaceMobile shares slide after Scotiabank cuts rating to Underperform

Shares of AST SpaceMobile (NASDAQ:ASTS) dropped 6.8% in premarket trading on Wednesday after Scotiabank downgraded the satellite communications firm from Sector Perform to Sector Underperform. The downgrade came from analyst Andres Coello, who also set a new price target of $45.60, pointing to valuation concerns and ongoing operational hurdles. At Tuesday’s closing price of $97.60,…

-

Munters shares slide as NVIDIA’s Rubin chip signals shift in data center cooling standards

Shares in Munters (USOTC:MMNNF) fell by more than 5% on Wednesday after NVIDIA unveiled details of its new Rubin chip, which is designed to operate at substantially higher temperatures than conventional data center processors. NVIDIA (NASDAQ:NVDA) said the Rubin chip can run efficiently at temperatures of around 42–45°C (108–113°F), a sharp contrast to traditional chilled-water…

-

Compass Pathways gains after FDA clears IND for PTSD trial of COMP360

Shares of Compass Pathways Plc (NASDAQ:CMPS) rose about 3% in premarket trading on Wednesday after the company said the U.S. Food and Drug Administration has accepted its Investigational New Drug (IND) application for COMP360, paving the way for a late-stage study in patients with post-traumatic stress disorder. With the IND now in place, Compass will…

-

Netflix reiterates support for $82.7bn Warner Bros. Discovery merger after rival bid rejected

Netflix (NASDAQ:NFLX) said it remains fully committed to its $82.7 billion merger agreement with Warner Bros. Discovery (NASDAQ:WBD), after Warner Bros. Discovery’s board turned down a revised proposal from Paramount Skydance (NASDAQ:PARA). The Warner Bros. Discovery board concluded that the agreement with Netflix offers superior value for shareholders. Under the terms of the deal, Netflix…

-

Albertsons posts Q3 profit beat as sales come in just below forecasts

Albertsons Companies, Inc. (NYSE:ACI) reported third-quarter fiscal 2025 results that exceeded earnings expectations, even as revenue narrowly missed estimates, reflecting continued investment in digital capabilities and technology across the grocery chain. For the quarter ended November 29, the retailer delivered adjusted earnings of $0.72 per share, ahead of the consensus forecast of $0.68. Revenue totaled…

-

MSC Industrial tops Q1 forecasts as revenue climbs despite shutdown impact

MSC Industrial Supply Co. (NYSE:MSM) delivered a stronger-than-expected set of fiscal first-quarter results, posting solid profit growth and higher sales even as operations were weighed down by disruption linked to the U.S. government shutdown. Despite the earnings beat, the distributor’s shares slipped about 1.11% in pre-market trading after the update. For the quarter ended November…

-

StoneCo shares slide as CEO signals planned exit in 2026

Shares in StoneCo Ltd. (NASDAQ:STNE) fell about 5% on Wednesday after the Brazilian fintech group said chief executive Pedro Zinner will step down from his role in March 2026 for personal reasons. The company said that Mateus Scherer, currently serving as Chief Financial Officer and Head of Investor Relations, will take over as CEO. Scherer…