ADVFN US – Market Content Editor

-

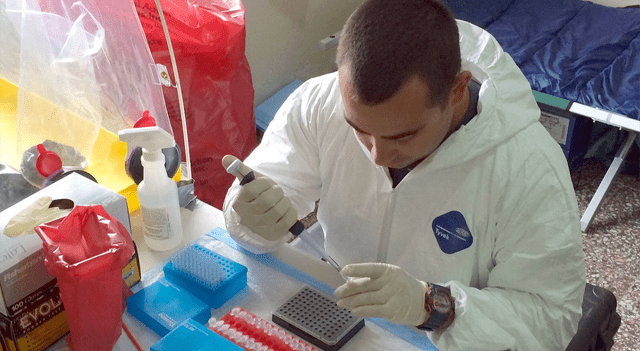

Monte Rosa shares jump after early trial data shows sharp drop in inflammation marker

Shares in Monte Rosa Therapeutics (NASDAQ:GLUE) climbed around 13% after the company released encouraging interim results from a Phase 1 study of its experimental drug MRT-8102, pointing to a marked reduction in inflammation among individuals at elevated risk of cardiovascular disease. The clinical-stage biotech said its molecular glue degrader achieved an 85% reduction in C-reactive…

-

Apogee Enterprises shares slide after Q3 earnings disappoint and outlook is lowered

Apogee Enterprises, Inc. (NASDAQ:APOG) saw its shares drop sharply on Wednesday after the company reported third-quarter results that missed market expectations and trimmed its full-year guidance. The architectural products group’s stock sank by more than 10% in pre-market trading following the announcement. For the third quarter of fiscal 2026, Apogee posted adjusted earnings per share…

-

U.S. private hiring grows modestly in December, ADP shows

Hiring in the U.S. private sector picked up in December, but the increase fell short of economists’ expectations, according to new data published Wednesday by payroll services firm ADP. The report showed that private-sector employment rose by 41,000 jobs during the month, following a revised decline of 29,000 positions in November. Economists had been forecasting…

-

Dow Jones, S&P, Nasdaq, Wall Street Futures, U.S. stocks seen opening unevenly as investors pause after recent rally

U.S. equity index futures are indicating a largely flat start to trading on Wednesday, suggesting stocks could struggle to find clear direction after advancing over the past two sessions. After a strong start to the first full trading week of the new year, some investors may be inclined to step back and reassess positions. That…

-

Chevron and Quantum Energy line up joint bid for Lukoil’s overseas portfolio, FT reports

U.S. energy major Chevron (NYSE:CVX) is working with private equity firm Quantum Energy Partners on a potential bid for the international assets of Russian oil producer Lukoil, which are estimated to be worth about $22 billion, according to a report by the Financial Times on Wednesday. In a statement emailed to Reuters, a Chevron spokesperson…

-

Strategy jumps after MSCI drops plan to remove crypto treasury firms from indexes

Shares in Strategy (NASDAQ:MSTR), the company chaired by billionaire Michael Saylor, climbed around 6% in premarket trading on Wednesday after index provider MSCI abandoned a proposal to exclude the bitcoin-heavy firm and other crypto treasury companies from its indexes. So-called digital asset treasury companies (DATCOs) gained significant traction in 2025 as a growing number of…

-

Newmont shares slide after bushfires disrupt water supply at Boddington mine

Newmont Corporation (NYSE:NEM) said bushfire damage has disrupted critical water supply infrastructure at its Boddington gold operation in Western Australia, prompting concerns over near-term production. The miner expects repairs to the affected infrastructure to be completed by February. In the meantime, Newmont estimates that gold production in the first quarter of 2026 will be reduced…

-

Cal-Maine Foods shares rise as earnings top forecasts despite weaker sales

Cal-Maine Foods (NASDAQ:CALM) posted quarterly results that exceeded profit expectations even as revenue fell sharply, sending the company’s shares higher. The egg producer reported diluted earnings per share of $2.13, beating the consensus forecast of $2.08. Revenue, however, declined 19.4% year on year to $769.5 million, coming in below market expectations of $814.21 million. The…

-

Qualcomm explores 2nm chip production talks with Samsung, report says

Qualcomm (NASDAQ:QCOM) is holding discussions with Samsung Electronics (USOTC:SSNHZ) over potential contract manufacturing of advanced two-nanometre chips, according to comments from chief executive Cristiano Amon cited by South Korea’s Korea Economic Daily on Wednesday. The newspaper reported that Amon said Qualcomm has begun talks with Samsung Electronics ahead of other semiconductor foundry players regarding the…

-

Oil prices extend losses as Trump signals Venezuelan crude inflows to the U.S.

Oil markets moved lower on Wednesday, with prices extending recent declines after U.S. President Donald Trump said Washington had reached an agreement that would allow up to $2 billion worth of Venezuelan crude to be imported into the United States. The development is expected to add supply to the world’s largest oil-consuming market and reinforce…