ADVFN US – Market Content Editor

-

Harley-Davidson Recalls More Than 9,000 Sportster S Motorcycles Over Safety Concern

Harley-Davidson (NYSE:HOG) is recalling 9,401 motorcycles due to a possible defect involving the upper triple clamp, according to a filing with the National Highway Traffic Safety Administration. The recall covers model years 2021 through 2026 of the RH1250S, also known as the Sportster S. The issue relates to the upper triple clamp, which could crack…

-

Palo Alto Networks Falls in Premarket Trade After Weaker Annual Profit Outlook

Palo Alto Networks (NASDAQ:PANW) shares dropped in U.S. premarket trading after the cybersecurity firm posted quarterly results that topped expectations but issued a softer-than-forecast earnings outlook for the year ahead. Based in Santa Clara, California, Palo Alto provides AI-powered cybersecurity platforms designed to safeguard networks and cloud environments. Its offerings include firewalls, threat intelligence, zero-trust…

-

JPMorgan to Launch Over 160 New U.S. Branches in 2026 – FT

JPMorgan Chase (NYSE:JPM) intends to open more than 160 additional bank branches across upwards of 30 U.S. states in 2026, according to a report by the Financial Times on Wednesday. The move forms part of a multibillion-dollar push to expand the lender’s physical footprint, with new locations planned in states such as North Carolina, South…

-

Grandson of Reese’s Peanut Butter Cup Founder Challenges Hershey Over Ingredient Changes

The grandson of the inventor of the Reese’s Peanut Butter Cup has publicly questioned The Hershey Company (NYSE:HSY) over what he claims are alterations to the iconic candy’s ingredients. Brad Reese, grandson of H.B. Reese, posted an open letter on LinkedIn criticizing Hershey for allegedly substituting traditional components such as milk chocolate and peanut butter…

-

Alcoa to Pay $39 Million Over Unauthorized Clearing of Australian Native Forest

Alcoa (NYSE:AA) will pay A$55 million (about $38.9 million) to restore areas of native forest it cleared without authorization in Western Australia for bauxite mining, the country’s environment ministry said Wednesday. The penalty relates to nearly 2,100 hectares (5,190 acres) of land in the Northern Jarrah Forest, located south of Perth, that were cleared between…

-

Western Digital to Raise $3.17 Billion by Selling Part of Sandisk Stake to Reduce Debt

Western Digital (NASDAQ:WDC) is set to generate approximately $3.17 billion by divesting a portion of its holding in former subsidiary Sandisk (NASDAQ:SNDK), as part of efforts to lower its debt burden. Sandisk said Wednesday that the shares are being offered through a secondary sale at a 7.7% discount to the stock’s previous closing price. Under…

-

Microsoft Plans $50 Billion Investment in Global South to Boost AI Infrastructure

Microsoft (NASDAQ:MSFT) said Wednesday it intends to invest $50 billion by the end of the decade to strengthen artificial intelligence capabilities across developing countries in the Global South. The announcement was made during an AI summit in New Delhi, where leaders from major technology firms are gathering alongside policymakers and heads of state. The Global…

-

Qualcomm Commits Up to $150 Million to India-Focused AI Investment Fund

Qualcomm (NASDAQ:QCOM) announced Wednesday that it plans to allocate as much as $150 million to a new fund dedicated to backing artificial intelligence startups in India. The pledge comes as Qualcomm CEO Cristiano Amon attends the India AI Impact Summit in New Delhi, where he reaffirmed the company’s intention to deepen its engagement with India’s…

-

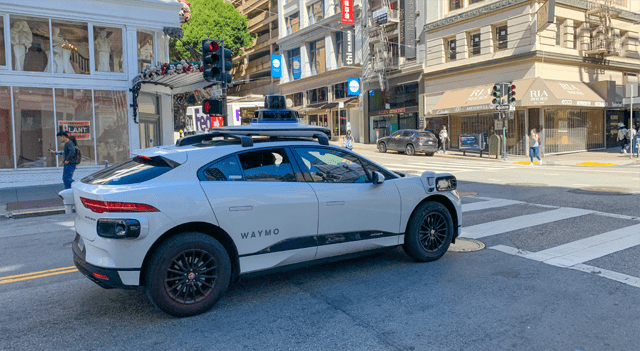

Waymo Says Remote Staff Do Not “Directly” Operate Its Robotaxis

Waymo, the self-driving division of Alphabet (NASDAQ:GOOG), said Tuesday that its remote workers have not been used to directly control its robotaxis in U.S. service, as questions mount over the company’s reliance on overseas personnel. In a blog post, Waymo stated that about 70 “remote assistance agents” are on shift globally at any given time.…

-

Fed Minutes in Focus; Palo Alto Networks Slides – Key Market Drivers: Dow Jones, S&P, Nasdaq, Wall Street Futures

U.S. equity futures edged higher early Wednesday as investors prepared for the release of the Federal Reserve’s January meeting minutes and digested fresh corporate developments. Shares of cybersecurity firm Palo Alto Networks (NASDAQ:PANW) declined after issuing weaker-than-expected profit guidance. Meanwhile, Warren Buffett’s final quarter leading Berkshire Hathaway (NYSE:BRK.B) featured notable portfolio shifts, including trims to…