ADVFN US – Market Content Editor

-

Compugen Shares Jump After $65 Million Royalty Monetization Deal With AstraZeneca

Shares of Compugen Ltd. (NASDAQ:CGEN) rose 12.8% in premarket trading on Wednesday after the company unveiled a strategic agreement with AstraZeneca to monetize part of its future royalty stream tied to the cancer therapy rilvegostomig. Under the non-dilutive arrangement, Compugen will receive an upfront payment of $65 million, with the potential to earn an additional…

-

Toro Shares Climb After Earnings Beat and Upgraded 2026 Outlook

Shares of The Toro Company (NYSE:TTC) rose 3.2% in premarket trading on Wednesday after the outdoor power equipment maker delivered fourth-quarter results that topped expectations and issued an upbeat forecast for fiscal 2026. Toro reported adjusted earnings of $0.91 per share for the fourth quarter, slightly ahead of analyst estimates of $0.90. Quarterly revenue totaled…

-

QuantumScape Shares Jump on Joint Development Deal With Major Automaker

QuantumScape Corp (NYSE:QS) shares rose 6.6% in premarket trading on Wednesday after the solid-state battery company announced it had entered into a joint development agreement (JDA) with a Top-10 global automotive manufacturer. QuantumScape, which is focused on advancing solid-state lithium-metal battery technology, said the agreement marks the completion of its final strategic objective for 2025.…

-

Two Harbors Shares Rally on $1.3 Billion All-Stock Takeover by UWM Holdings

Shares of Two Harbors Investment Corp (NYSE:TWO) jumped 6.2% in premarket trading on Wednesday after UWM Holdings Corporation (NYSE:UWMC) revealed plans to acquire the mortgage servicing rights–focused REIT in an all-stock deal valued at approximately $1.3 billion. Under the agreement, Two Harbors shareholders will receive 2.3328 shares of UWMC Class A common stock for each…

-

ZIM Shares Edge Higher After Company Reaches Deal to Resolve Proxy Dispute

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) shares gained 2.1% in premarket trading on Wednesday after the shipping company said it had reached an agreement with a group of shareholders, bringing an end to a proxy battle ahead of its upcoming annual meeting. Under the agreement, reached with a shareholder group led by Mor Gemel Pension…

-

Udemy Shares Jump After Coursera Agrees to Acquire Company in Stock-Only Deal

Shares of Udemy (NASDAQ:UDMY) surged 25.7% in premarket trading on Wednesday after education technology peer Coursera (NYSE:COUR) announced an agreement to acquire the online learning platform through an all-stock transaction. Coursera’s own shares also moved higher, rising 10% ahead of the market open. Under the terms of the deal, Udemy shareholders will receive 0.800 shares…

-

ABM Industries Posts Record Q4 Revenue but Falls Short on Earnings

ABM Industries (NYSE:ABM) reported record revenue for the fourth quarter on Wednesday, surpassing market expectations, but fell short on earnings as results were weighed down by self-insurance adjustments related to the prior year. The facility services provider’s shares slipped 1.07% in premarket trading following the release. For the quarter ended October 31, 2025, ABM generated…

-

Jabil Shares Rally After Q1 Results and Outlook Top Forecasts

Jabil Inc. (NYSE:JBL) shares rose more than 4% in premarket trading on Wednesday after the electronics manufacturing services company reported first-quarter fiscal 2026 earnings that exceeded market expectations and issued an upgraded full-year forecast. The company delivered adjusted earnings of $2.85 per share for the quarter, outperforming analysts’ expectations of $2.69 by roughly 6%. Quarterly…

-

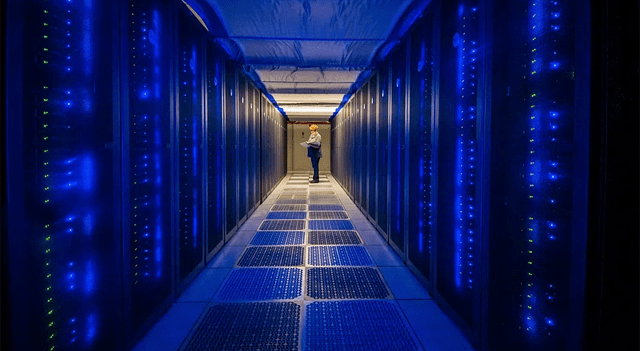

Hut 8 Shares Jump After Signing $7 Billion Data Center Lease Backed by Google

Hut 8 Corp. (NASDAQ:HUT) shares climbed 25.4% in premarket trading on Wednesday after the energy infrastructure firm announced a long-term data center leasing agreement valued at $7 billion with Fluidstack. The 15-year deal covers 245 megawatts of IT capacity at Hut 8’s River Bend data center campus in Louisiana. The agreement is supported by a…

-

Vyne Therapeutics Shares Surge on Merger Deal With Yarrow Bioscience

Shares of Vyne Therapeutics Inc (NASDAQ:VYNE) jumped 77.9% in premarket trading on Wednesday after the company unveiled a definitive agreement to merge with Yarrow Bioscience, a clinical-stage biotech focused on autoimmune disorders affecting the thyroid. The proposed all-share transaction will result in a newly combined company operating under the Yarrow Bioscience name and trading on…