ADVFN US – Market Content Editor

-

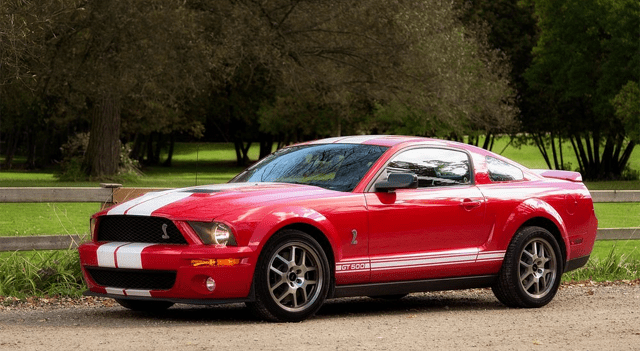

Ford recalls 625,000 vehicles in the U.S. over safety concerns

Ford Motor Company (NYSE:F) is recalling nearly 625,000 vehicles across the United States due to seatbelt malfunctions and rear-view camera display issues, according to the National Highway Traffic Safety Administration (NHTSA) on Friday. The recall covers 332,778 Ford Mustang vehicles impacted by problems related to seatbelt components, according to NHTSA notices. In addition, a separate…

-

Micron to withdraw from China’s server chip market after 2023 ban

Micron Technology (NASDAQ:MU) is planning to end the supply of server chips to data centers in China following the 2023 government ban, according to a Friday report from Reuters citing two sources familiar with the matter. The company will continue to sell to two Chinese clients that operate major data centers outside of China, one…

-

Novo Nordisk shares tumble after Trump pledges weight-loss drug price cut

Novo Nordisk (NYSE:NVO) saw its shares sink 5.6% in early Friday trading after U.S. President Donald Trump vowed to lower the cost of the company’s top-selling weight-loss medication. The statement came during a White House event focused on fertility treatments and drug pricing, when Trump was pressed by reporters to name the specific drug he…

-

Dow Jones, S&P, Nasdaq, Wall Street, Futures Slide on Banking Fears; Oracle Sets Ambitious Outlook; CSX Tops Expectations; Micron Plans Chip Halt; Gold Extends Record Rally

Wall Street futures moved lower on Friday as renewed concerns about the health of U.S. regional banks combined with persistent trade tensions between Washington and Beijing. Oracle Corporation (NYSE:ORCL) shared a bullish long-term outlook fueled by soaring AI demand, CSX Transportation (NASDAQ:CSX) posted earnings that beat expectations despite weaker profit, and Micron Technology (NASDAQ:MU) is…

-

Oil Slips Toward Weekly Loss as Trump-Putin Meeting Fuels Market Uncertainty

Crude oil prices softened on Friday, putting the market on course for a nearly 3% weekly decline, as traders digested the planned summit between Donald Trump and Vladimir Putin and renewed signals of a potential supply glut. Brent crude futures eased 16 cents, or 0.26%, to $60.90 a barrel at 06:45 GMT, while U.S. West…

-

Gold Soars to New Record as Fed Rate Cut Bets and Trade Tensions Drive Safe-Haven Rush

Gold prices climbed to fresh record highs in early Asian trading on Friday, edging closer to the $4,400 per ounce milestone as mounting expectations of a rate cut by the Federal Reserve and heightened U.S.-China trade tensions triggered a flight to safe-haven assets. Spot gold gained 0.9% to $4,362.63 an ounce at 01:49 ET (05:49…

-

Dollar Extends Losses as Banking Turmoil Fuels Rate-Cut Bets

The U.S. dollar weakened further on Friday, heading for its steepest weekly slide in nearly three months, as renewed anxiety over the banking sector reinforced expectations of additional interest rate cuts from the Federal Reserve later this year. At 04:10 ET (08:10 GMT), the U.S. Dollar Index — a gauge of the dollar’s strength against…

-

Banking Stocks Tumble as U.S. Credit Concerns Rattle Global Markets

Global financial stocks fell sharply on Friday after renewed concerns about U.S. credit quality triggered a selloff in regional banks, unsettling investors and reigniting fears over lending standards. The sector’s exposure to two recent U.S. auto-related bankruptcies has raised fresh questions about credit risk, echoing the uncertainty that followed Silicon Valley Bank’s collapse more than…

-

U.S. Stocks Come Under Pressure Amid Concerns About Bad Loans

Stocks showed a strong move to the upside early in the session on Thursday but came under pressure over the course of the trading day. The major averages pulled back well off their highs of the session and into negative territory. The major averages climbed off their worst levels going into the end of the…

-

HPE Shares Drop After Fiscal 2026 Outlook Disappoints, But Analysts See Upside

Hewlett Packard Enterprise (NYSE:HPE) shares fell more than 8% Thursday morning after the company’s investor day in New York revealed fiscal 2026 guidance that came in below expectations. Despite the near-term caution, analysts signaled confidence in HPE’s long-term growth story, particularly in networking, cloud, and AI. Barclays said the company’s fiscal 2026 outlook “underwhelmed for…