ADVFN US – Market Content Editor

-

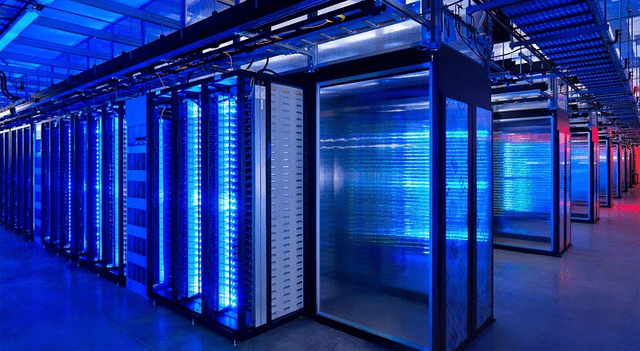

Google Unveils $9 Billion Investment Plan to Boost AI Infrastructure in South Carolina

Google, a subsidiary of Alphabet Inc. (NASDAQ:GOOGL), announced Monday that it will invest $9 billion in South Carolina to expand its artificial intelligence infrastructure and strengthen its presence in the state. The multiyear investment will run through 2027 and focus on scaling operations at Google’s existing data center campus in Berkeley County, while also supporting…

-

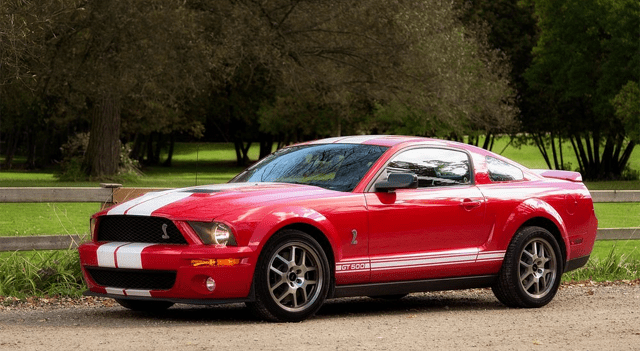

NHTSA Closes Recall Inquiry Into Ford Vehicles After Engine Power Loss Complaints

The National Highway Traffic Safety Administration (NHTSA) announced on Tuesday that it has officially closed its recall investigation involving more than 456,000 vehicles from Ford Motor Company (NYSE:F), which had been launched following reports of sudden engine power loss. The probe focused on Ford Bronco Sport and Maverick models. The agency said the decision to…

-

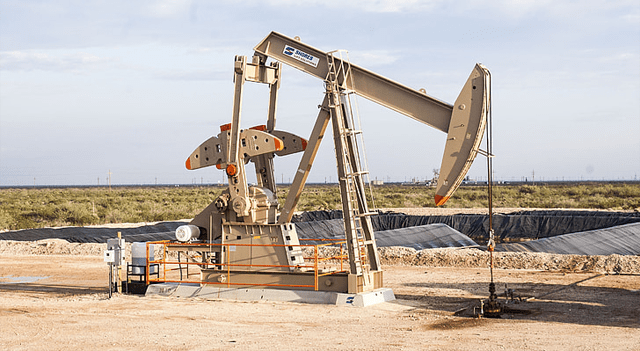

BP Boosts Production Outlook but Cautions on Weak Trading Before Q3 Earnings

BP (NYSE:BP) raised its third-quarter production guidance on Tuesday, pointing to stronger upstream performance supported by increased output from both its oil and gas and low-carbon operations. Higher gas production at its U.S. shale unit, bpx energy, is expected to be a major factor behind the improvement. The company had previously indicated output could dip…

-

Vodafone and Ericsson Launch Five-Year Partnership to Accelerate 5G Network Modernization

Vodafone Group Plc (LSE:VOD) and Ericsson (NASDAQ:ERIC) have unveiled a new five-year strategic partnership focused on upgrading Vodafone’s network infrastructure in key European markets, advancing its 5G capabilities and network performance. Under the agreement, Ericsson will become Vodafone’s exclusive radio access network (RAN) supplier in Ireland, the Netherlands, and Portugal, while retaining a key vendor…

-

U.S. Dollar Demand Hits 2025 Peak as Investors React to Global Uncertainty

The U.S. dollar saw its highest investor demand of the year last week, according to data from Bank of America released Monday, as geopolitical and economic concerns in Japan and France fueled a shift toward the safe-haven currency. The move was largely driven by hedge funds and asset managers, with traders increasing long dollar positions…

-

Gold Prices Hover Near Record High as Trade Tensions Intensify

Gold prices held steady in Asian trading on Tuesday after spiking to an all-time high above $4,100 per ounce earlier in the day, as escalating trade frictions between the U.S. and China intensified investor demand for safe-haven assets. Silver followed a similar path, briefly touching new peaks before reversing course. Spot gold rose 0.4% to…

-

Oil Prices Drop as U.S.–China Trade Dispute Stokes Demand Concerns

Crude prices slipped on Tuesday, reversing earlier gains, as investors grew increasingly uneasy over intensifying trade frictions between the U.S. and China — a development that could dampen global energy demand. Brent crude futures declined 28 cents, or 0.4%, to $63.04 a barrel by 06:30 GMT, while U.S. West Texas Intermediate fell 23 cents, or…

-

Dow Jones, S&P, Nasdaq, Wall Street, U.S. Futures Dip Ahead of Major Bank Earnings, Powell Remarks, and Record Gold Rally

U.S. stock index futures edged lower on Tuesday as investors awaited a heavy slate of earnings from major Wall Street banks and a closely watched speech from Federal Reserve Chair Jerome Powell. The cautious tone comes amid rising U.S.–China trade tensions, fresh gains in gold prices, and a pullback in oil. Futures Weaken as Risk…

-

U.S. Stocks Show Substantial Rebound After Last Friday’s Sell-Off

After moving sharply higher early in the session, stocks continue to turn in a strong performance throughout the trading day on Monday. The major averages all showed strong moves to the upside, partly offsetting the steep losses posted last Friday. The major averages moved roughly sideways after the early surge, hovering near their best levels…

-

SPAC News From The Last Seven Days

The Last Week’s Deals Haymaker Acquisition Corp. 4 (NYSE:HYAC) has announced it will acquire Suncrete, a pure-play ready-mix concrete company which is strategically positioned across Arkansas and Oklahoma. The deal reflects an enterprise value of $973mm and includes an $83mm PIPE, and is expected to close in the first quarter of 2026. Goldenstone Acquisition Ltd.…