ADVFN US – Market Content Editor

-

Vertiv Holdings Co Shares Gain After Naming New CFO

Shares of Vertiv Holdings Co (NYSE:VRT) climbed 3.1% on Monday after the company announced the appointment of Craig Chamberlin as its new Executive Vice President and Chief Financial Officer, effective November 10, 2025. Chamberlin joins Vertiv from Wabtec Corporation, where he served as Group Vice President and CFO of the Transit segment. He succeeds David…

-

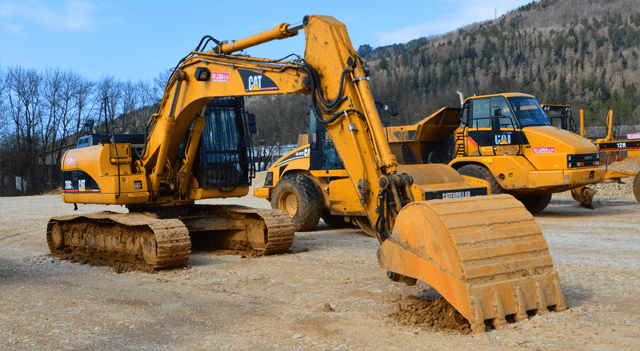

Caterpillar Inc Stock Climbs After Announcing Acquisition of RPMGlobal Holdings Limited

Shares of Caterpillar Inc (NYSE:CAT) gained 2.4% in premarket trading Monday after the company said it has reached an agreement to acquire Australian mining software company RPMGlobal Holdings Limited (ASX:RUL). The acquisition aims to boost Caterpillar’s technological footprint in the mining industry by integrating RPMGlobal’s advanced data-driven software solutions, which cover key phases of the…

-

Beyond Meat Shares Plunge After Early Debt Exchange Settlement

Shares of Beyond Meat (NASDAQ:BYND) collapsed more than 60% on Monday after the company announced the early settlement of its convertible debt exchange offer, part of a broader push to ease its heavy debt burden. The plant-based meat producer said nearly 97% of bondholders agreed to swap their existing 0% Convertible Senior Notes due 2027…

-

Bicara Therapeutics Inc. Shares Surge After FDA Grants Breakthrough Therapy Designation

Shares of Bicara Therapeutics Inc. (NASDAQ:BCAX) jumped 9.4% in Monday premarket trading after the company announced that its investigational cancer therapy ficerafusp alfa has received Breakthrough Therapy Designation (BTD) from the U.S. Food and Drug Administration (FDA). The designation applies to ficerafusp alfa in combination with pembrolizumab as a first-line treatment for patients with metastatic…

-

American Battery Technology Company Shares Surge After Completing NEPA Baseline Studies

Shares of American Battery Technology Company (NASDAQ:ABAT) jumped 23% Monday after the company announced it has completed all required National Environmental Policy Act (NEPA) baseline studies for its Tonopah Flats Lithium Project in Nevada — a key step toward advancing one of the largest lithium developments in the U.S. The company said it has submitted…

-

StubHub Shares Rally on Bullish Analyst Calls After September IPO

Shares of StubHub (NYSE:STUB) surged more than 6% in premarket trading Monday, fueled by a series of upbeat analyst initiations from major Wall Street banks following its recent IPO. Analysts highlighted StubHub’s commanding position in the secondary ticketing market and its growth potential in direct issuance and advertising. BMO Capital Markets said StubHub’s “scale, differentiated…

-

Broadcom Inc. Soars After 10GW AI Chip Partnership With OpenAI

Shares of Broadcom Inc. (NASDAQ:AVGO) jumped 12% Monday morning after the company unveiled a landmark strategic collaboration with OpenAI to co-develop and deploy 10 gigawatts of custom AI accelerators. Under the multi-year agreement, OpenAI will design the chips, while Broadcom will oversee development and deployment. Both companies have signed a term sheet to deploy racks…

-

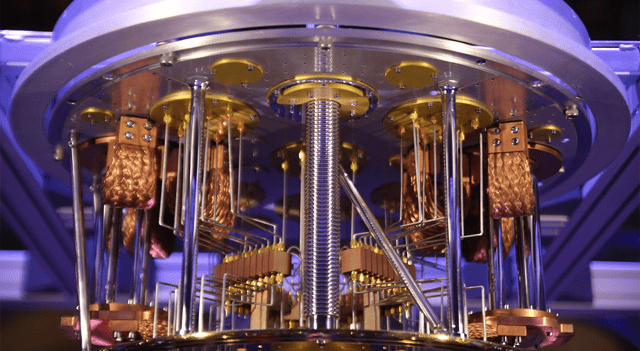

IonQ Stock Rises on Quantum Chemistry Milestone

Shares of IonQ (NYSE:IONQ) climbed 4.4% in premarket trading Monday after the company unveiled a major leap forward in quantum chemistry simulations — a breakthrough that could accelerate the development of next-generation decarbonization technologies. Working with a top Global 1000 automotive manufacturer, IonQ successfully demonstrated the precise computation of atomic-level forces using the quantum-classical auxiliary-field…

-

VCI Global Limited Stock Soars 30% on Strong 2025 Growth Outlook

Shares of VCI Global Limited (NASDAQ:VCIG) surged 30% on Monday after the company issued bullish full-year 2025 guidance, projecting a 70% increase in revenue fueled by growth in artificial intelligence, cybersecurity, fintech, and GPU cloud services. The cross-sector technology platform company expects 2025 revenue to reach $47.3 million, up from an estimated $27.8 million in…

-

AlphaTON Capital Corp. Stock Soars on Strategic AI Partnership with Morpheus AI

Shares of AlphaTON Capital Corp. (NASDAQ:ATON) surged 10% in premarket trading Monday after the company announced a strategic collaboration with Morpheus AI (ETH:MOR) to build out advanced AI infrastructure for the TON and Telegram ecosystem. The deal positions AlphaTON as a central provider of AI solutions to Telegram’s network of more than 1 billion monthly…