ADVFN US – Market Content Editor

-

IEA Flags Slower Oil Demand Growth in 2026 as Supply Expansion Cools

Global oil demand is expected to grow more modestly in 2026, while supply gains are also set to slow following weather-related disruptions and production setbacks earlier this year, according to the International Energy Agency. In its latest monthly report, the IEA said worldwide oil supply slipped to 106.6 million barrels per day in January, down…

-

Falconedge PLC Outperforms Market Volatility with Successful Bitcoin Yield Strategy and US Expansion

In a recent interview on The Watchlist, Ricki Lee sat down with Roy Kashi, CEO of Falconedge PLC (USOTC:FEDGF), to discuss the company’s impressive early-year performance. Despite a turbulent period for cryptocurrency prices, Falcon Edge has reported a second consecutive month of gains from its Bitcoin yield strategy and successfully extended its reach into the…

-

U.S. Stocks Move Sharply Lower Amid AI Disruption Concerns

After ending Wednesday’s choppy trading session modestly lower, stocks showed a more substantial move to the downside during trading on Thursday. The major averages once again failed to sustain an early upward move and pulled sharply as the day progressed. The major averages saw further downside going into the end of the day, closing near…

-

Crocs soars on earnings beat and upbeat 2026 profit forecast

Crocs (NASDAQ:CROX) shares jumped roughly 15% in premarket trading Thursday after the footwear group delivered a stronger-than-expected fourth quarter and issued an earnings outlook for 2026 that comfortably topped Wall Street forecasts. For the fourth quarter, Crocs reported earnings per share of $2.29, beating the consensus estimate of $1.91. Revenue reached $958 million, exceeding analyst…

-

Tripadvisor shares slide after sharp fourth-quarter earnings miss

Tripadvisor Inc. (NASDAQ:TRIP) shares dropped more than 4% in premarket trading Thursday after the online travel group reported fourth-quarter results that fell well short of Wall Street expectations. The company posted adjusted earnings of $0.04 per share for the quarter, missing analyst forecasts of $0.17. Revenue totaled $411 million, slightly below the consensus estimate of…

-

American Electric Power tops Q4 forecasts, sticks with 2026 profit targets

American Electric Power (NASDAQ:AEP) reported fourth-quarter 2025 operating earnings that beat Wall Street expectations and reiterated its outlook for 2026, sending shares modestly higher in premarket trading. The utility posted operating earnings of $1.19 per share for the quarter, ahead of analyst estimates of $1.14. Revenue climbed to $5.31 billion, comfortably above the $4.99 billion…

-

BioMarin, Ascendis slide as BridgeBio shakes up achondroplasia landscape

Shares of BioMarin Pharmaceutical (NASDAQ:BMRN) and Ascendis Pharma (NASDAQ:ASND) fell roughly 6% after rival BridgeBio Pharma (NASDAQ:BBIO) reported encouraging Phase 3 results for its experimental achondroplasia therapy. BridgeBio said its oral drug infigratinib achieved the primary endpoint in the late-stage PROPEL 3 trial, delivering superior annualized height velocity compared with placebo. The company cited a…

-

BridgeBio rallies on strong Phase 3 data for achondroplasia pill

BridgeBio Pharma (NASDAQ:BBIO) shares climbed about 9% on Thursday after the biotech group unveiled positive Phase 3 topline results for its oral drug infigratinib in achondroplasia, marking what it said were the first statistically significant gains in body proportionality seen in the condition. The late-stage PROPEL 3 study met its primary endpoint, showing that patients…

-

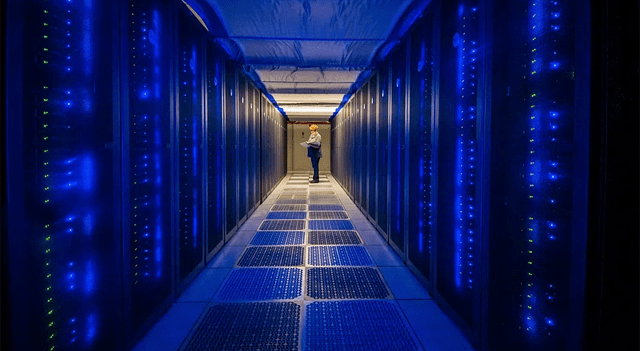

Iron Mountain tops Q4 forecasts, shares gain on strong 2026 outlook

Iron Mountain Incorporated (NYSE:IRM) delivered fourth-quarter results ahead of market expectations, capping a year of record-setting performance and lifting its shares more than 2% in premarket trading on Thursday. The information management and data services group reported adjusted earnings per share of $0.61, edging past analyst estimates of $0.60. Revenue rose 16.6% year over year…

-

Howmet Aerospace guides above Street for Q1, shares rise premarket

Howmet Aerospace (NYSE:HWM) issued a first-quarter outlook that topped Wall Street expectations, sending its shares more than 2% higher in premarket trading on Thursday, as the jet engine components supplier pointed to improving profitability and cash flow in 2026. The upbeat forecast comes as production of popular single-aisle aircraft by Boeing and Airbus continues to…