ADVFN US – Market Content Editor

-

Vontier tops Q4 forecasts, unveils initial 2026 outlook

Vontier Corporation (NYSE:VNT) reported fourth-quarter 2025 results that came in ahead of Wall Street expectations and introduced guidance for 2026. The mobility and fueling technology group posted adjusted earnings per share of $0.86, edging past consensus estimates by $0.01. Revenue reached $808.5 million, comfortably above the $764.99 million analysts had projected. Despite the earnings beat,…

-

Utz Brands matches Q4 profit estimates but revenue comes in light

Utz Brands Inc. (NYSE:UTZ) reported fourth-quarter results that met earnings expectations but missed on revenue, as the snack maker delivered modest sales growth in a mixed operating environment. Adjusted earnings per share totaled $0.26, in line with analyst forecasts. Revenue reached $342.2 million, falling short of the $346.17 million consensus estimate. Net sales for the…

-

PBF Energy climbs more than 3% after Q4 profit crushes forecasts

PBF Energy Inc. (NYSE:PBF) gained over 3% in after-hours trading Thursday after reporting fourth-quarter earnings that far exceeded Wall Street expectations. The refiner posted net income of $78.4 million, or $0.66 per share, for the fourth quarter of 2025 — a sharp beat compared with analyst estimates that had called for a loss of $0.20…

-

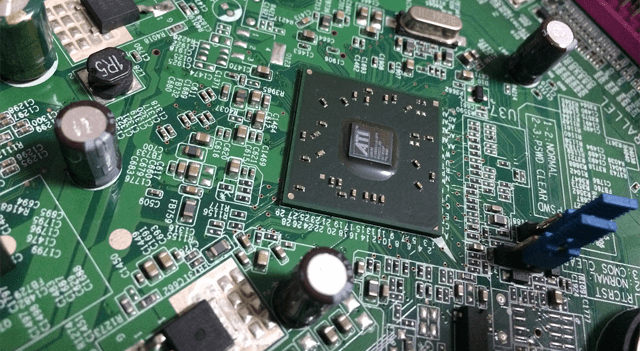

Applied Materials slips before earnings as Lynx flags valuation risks

Applied Materials (NASDAQ:AMAT) edged 1.14% lower in premarket trading after Lynx Equity Strategies struck a cautious tone ahead of the chip equipment maker’s upcoming earnings release. The brokerage warned that investor expectations may be running ahead of fundamentals as markets await the company’s latest results. Attention is focused on how Applied Materials will navigate the…

-

Zebra Technologies jumps nearly 9% on Q4 revenue beat and upbeat 2026 outlook

Zebra Technologies Corporation (NASDAQ:ZBRA) surged almost 9% in premarket trading Thursday after posting fourth-quarter results that featured stronger-than-expected revenue growth and a confident forecast for 2026. The workflow automation and digitization specialist reported adjusted earnings per share of $4.33 for the quarter, in line with analyst projections. Revenue rose 10.6% year over year to $1.48…

-

U.S. Weekly Jobless Claims Edge Lower, But Four-Week Average Climbs

The Labor Department reported Thursday that new applications for U.S. unemployment benefits declined slightly in the week ended February 7. Initial jobless claims fell by 5,000 to 227,000, down from the prior week’s revised total of 232,000. Economists had forecast a sharper drop to 220,000 from the originally reported 231,000. At the same time, the…

-

Futures Signal Early Bounce for Wall Street: Dow Jones, S&P, Nasdaq

U.S. stock futures are pointing to a firmer open on Thursday, suggesting equities could recover after finishing Wednesday’s uneven session slightly in the red. Contracts extended gains following fresh Labor Department data showing that initial claims for unemployment benefits declined less than economists had anticipated last week. According to the report, first-time jobless claims fell…

-

Gold, silver retreat as upbeat U.S. jobs data tempers rate cut expectations

Gold and silver prices moved lower in Asian trading on Thursday after stronger-than-anticipated U.S. employment figures dampened hopes for additional interest rate cuts from the Federal Reserve. Even so, declines were cushioned by continued demand for safe-haven assets. Despite the pullback, precious metals have held on to most of this week’s gains, supported by broader…

-

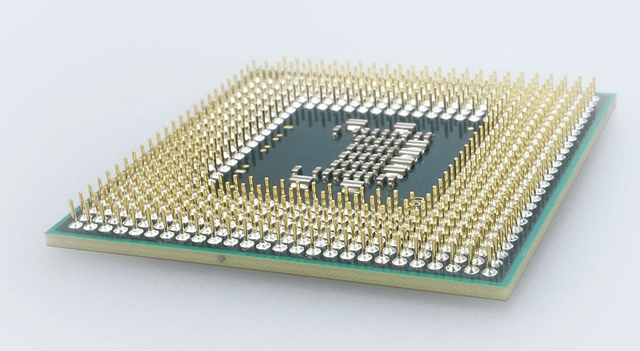

Micron Advances on Early HBM4 Shipments, Reassures on Product Quality

Micron Technology (NASDAQ:MU) moved higher after executives signaled that volume shipments of its next-generation HBM4 memory have begun earlier than previously indicated. Speaking at Wolfe Research’s Autos/Semis conference on Wednesday, Micron’s leadership team — including CFO Mark Murphy — addressed market speculation around potential technical issues with its HBM4 chips. Management said the company now…

-

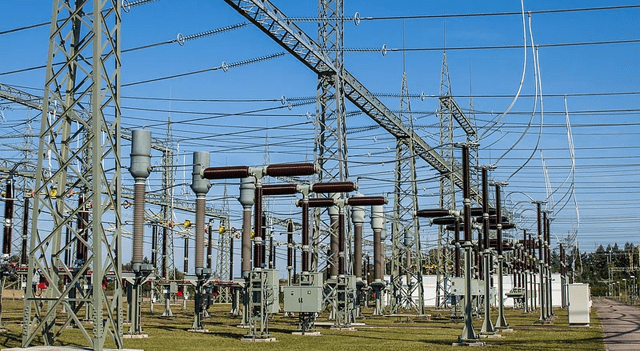

PG&E Slips 2% After Q4 EPS Miss Despite Higher 2026 Outlook

PG&E Corporation (NYSE:PCG) declined more than 2% in premarket trading Thursday after posting fourth-quarter earnings that came in just below expectations, even as the company lifted its 2026 earnings outlook above consensus. The California-based utility reported adjusted earnings of $0.36 per share for the fourth quarter, narrowly missing analyst estimates of $0.37. For full-year 2025,…