ADVFN US – Market Content Editor

-

CVS Health tops Q4 forecasts but trims operating cash flow outlook

CVS Health Corporation (NYSE:CVS) reported fourth-quarter results that came in ahead of market expectations, though the update was met with a cautious market reaction as the company lowered its outlook for operating cash flow. Shares slipped about 2.5% in premarket trading. The healthcare group delivered adjusted earnings of $1.09 per share for the quarter, beating…

-

Aramark shares climb after Q1 results beat forecasts on solid revenue growth

Aramark (NYSE:ARMK) delivered stronger-than-expected first-quarter fiscal 2026 results on Thursday, as the food services group posted solid revenue growth despite the impact of a calendar-related headwind. Shares in the company rose 1.98% in after-hours trading following the earnings release. Aramark reported adjusted earnings per share of $0.51 for the quarter, edging past analysts’ expectations of…

-

Canaan shares advance as Q4 revenue tops forecasts despite deeper loss

Canaan Inc. (NASDAQ:CAN) reported fourth-quarter revenue that came in ahead of market expectations on Tuesday, even as the company posted a larger-than-anticipated loss for the period. Shares in the cryptocurrency mining hardware maker rose 2.14% in premarket trading following the results. The company generated $196.3 million in revenue for the quarter, comfortably above the consensus…

-

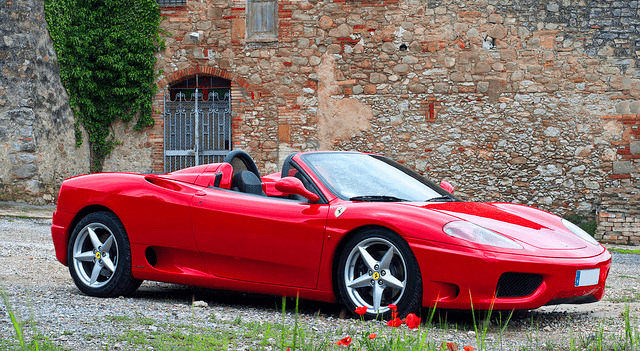

Ferrari sets confident earnings target for the year ahead

Ferrari (NYSE:RACE) delivered an upbeat outlook for the current financial year, saying it expects adjusted earnings before interest, taxes, depreciation and amortization to reach at least €2.93 billion, slightly ahead of the €2.91 billion forecast by Bloomberg consensus. The luxury sports car manufacturer also exceeded market expectations in the fourth quarter, reporting core income of…

-

Gold prices ease but hold above $5,000/oz as markets brace for U.S. data

Gold prices ticked lower on Tuesday, giving back part of the previous session’s strong advance as investors stayed cautious ahead of a heavy slate of U.S. economic releases later this week. Other precious metals also moved lower. Silver and platinum declined despite some overnight support from a weaker dollar, which later stabilized during Asian trading…

-

U.S. Retail Sales Stall in December, Missing Growth Expectations

U.S. retail spending showed little momentum at the end of the year, with sales unexpectedly flattening in December, according to data released by the Commerce Department on Tuesday. The report showed overall retail sales were essentially unchanged from November, following a 0.6% increase the previous month. Economists had been forecasting a 0.4% rise. Even after…

-

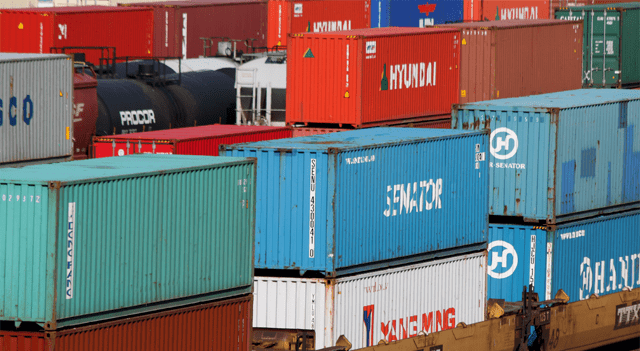

U.S. Import Prices Edge Higher in December as Export Costs Rise Faster Than Expected

U.S. import prices rose slightly in December, broadly matching market expectations, according to data published by the Labor Department on Tuesday. The report showed import prices increased by 0.1% during the month, in line with economists’ forecasts. On an annual basis, import prices were unchanged from December a year earlier. Export prices, however, posted a…

-

Flat U.S. retail sales raise caution ahead of Wall Street open: Dow Jones, S&P, Nasdaq, Futures

U.S. stock index futures pointed to a modestly weaker start on Tuesday, suggesting equities could give back some ground after two consecutive sessions of solid gains. Futures dipped after data from the Commerce Department showed U.S. retail sales unexpectedly stalled in December, raising concerns about the momentum of consumer spending. According to the report, retail…

-

Hasbro shares rise after upbeat fourth-quarter results

Hasbro (NASDAQ:HAS) shares were up around 2% in premarket trading on Tuesday after the toy maker reported fourth-quarter earnings and sales that comfortably exceeded market expectations. The company delivered earnings per share of $1.51 for the quarter, far ahead of the $0.95 analysts had forecast. Revenue jumped 31% year over year to $1.45 billion, surpassing…

-

Under Armour slides after Citi downgrade flags rising risks to turnaround

Under Armour (NYSE:UAA) shares fell sharply on Tuesday after Citi cut its rating on the stock to Sell from Neutral, citing growing challenges facing the company’s North America turnaround and a risk profile tilted to the downside. The sportswear group’s shares were down roughly 6% in premarket trading by 05:39 ET. The downgrade follows a…