ADVFN US – Market Content Editor

-

Exclusive: Netflix has financial firepower to sweeten Warner Bros bid if rivalry intensifies, sources say

Netflix (NASDAQ:NFLX) has significant cash reserves and retains the flexibility to raise its offer for Warner Bros Discovery (NASDAQ:WBD) should rival bidder Paramount Skydance improve its proposal, according to two people familiar with the situation. The streaming heavyweight and the rival studio have been engaged in a high-stakes contest for Warner Bros and its vast…

-

Tesla rolls out lower-cost Cybertruck option, trims Cyberbeast price amid softer demand

Tesla (NASDAQ:TSLA) introduced a more affordable version of its Cybertruck in the U.S. on Thursday and reduced the price of its top-tier Cyberbeast model, as the electric vehicle manufacturer works to stimulate demand for its pickup lineup. The company set the price of the new dual-motor, all-wheel-drive Cybertruck at $59,990, positioning it as the brand’s…

-

Grail stock tumbles after pivotal trial misses main goal

Shares of Grail (NASDAQ:GRAL) plunged almost 47% in premarket trading on Friday after the company announced that its landmark NHS-Galleri study did not achieve its primary endpoint — a statistically significant drop in late-stage (Stage III and IV) cancer diagnoses. Despite the clinical setback, the California-based biotech posted fourth-quarter results that exceeded expectations. The company…

-

Oil set for first weekly rise in three weeks as US-Iran tensions escalate

Oil prices advanced on Friday and were on track to post their first weekly gain in three weeks, as mounting fears of a potential confrontation between the United States and Iran unsettled markets. The move followed Washington’s warning that Tehran could face consequences within days if it fails to reach an agreement over its nuclear…

-

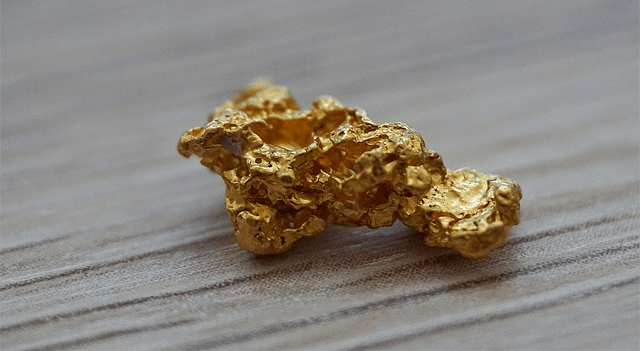

Gold edges higher on US-Iran strains and Fed caution, but heads for weekly decline

Gold prices inched up during Asian trading on Friday, building on gains from the previous two sessions. However, the metal remained on course for a weekly loss as investors balanced renewed tensions between the United States and Iran with expectations surrounding upcoming U.S. inflation data. Spot gold rose 0.4% to $5,017.85 per ounce as of…

-

Private Credit Worries Mount; U.S. PCE and GDP Data in Focus – Market Movers: Dow Jones, S&P, Nasdaq, Wall Street Futures

U.S. equity futures moved modestly higher on Friday as investors prepared for key inflation and growth readings, while unease spread through private credit markets following a move by Blue Owl Capital (NYSE:OWL). Oil prices steadied amid ongoing geopolitical strains between Washington and Tehran. Futures Edge Higher By 03:09 ET, Dow futures were up 54 points,…

-

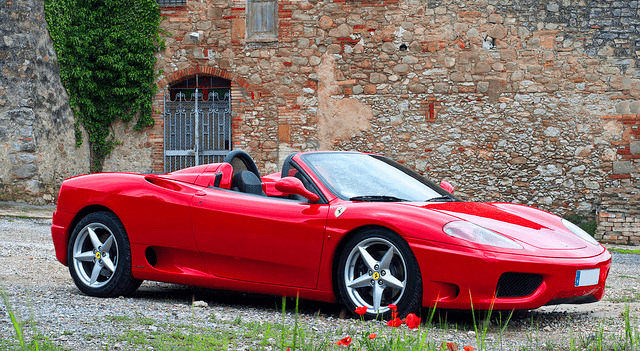

Ferrari to Lift Dividend Significantly in 2026

Ferrari (NYSE:RACE) is set to reward shareholders with a substantially higher dividend in 2026. The board of directors of the Maranello-based luxury carmaker has approved a proposal for the upcoming Shareholders’ Meeting to distribute €3.615 per ordinary share — roughly 21% more than last year. The total payout would amount to about €640 million. The…

-

From raw material to reactor: How Cameco, Stallion Uranium, and Constellation Energy are capitalizing on the AI-driven energy crisis

Artificial intelligence and its thirsty data centers are driving electricity demand to new heights, while geopolitical tensions and years of underinvestment are strangling the supply of uranium. Analysts predict a multiplication of the price of uranium, as mines are currently producing only three-quarters of the material needed. At the same time, US policy is pushing…

-

Palo Alto, NEO Battery Materials, ITM Power – On the verge of a breakthrough

Raised sales forecasts in the hydrogen sector, a potential technological breakthrough in silicon-based high-performance batteries, and a cybersecurity heavyweight that is coming under pressure despite strong figures due to a weak outlook – the markets in 2026 are reacting with increasing selectivity. While future-oriented technologies such as electrolysis and next-generation battery materials are gaining operational…

-

U.S. Stocks Move Mostly Lower On Disappointing Walmart Guidance, Iran Concerns

Stocks moved mostly lower during trading on Thursday, giving back ground after turning in a strong performance in the previous session. The major averages all moved to the downside, although selling pressure was somewhat subdued. The major averages finished the day off their lows of the session but still in negative territory. The Dow slid…