ADVFN US – Market Content Editor

-

Bitcoin dips under $70,000 in choppy trading as key U.S. data approaches

Bitcoin (COIN:BTCUSD) slipped back below the $70,000 mark during Asian trading on Tuesday, once again struggling to hold onto recent gains after rebounding from lows near $60,000, as investors adopted a cautious stance ahead of important U.S. labour market and inflation data. The world’s largest cryptocurrency was last down 2.2% at $69,392.7 as of 05:58…

-

Tech Bounce Holds Attention as Earnings Roll In; U.S. Retail Sales Awaited: Dow Jones, S&P, Nasdaq, Wall Street Futures

Futures tied to the main U.S. equity benchmarks were little changed on Tuesday as investors weighed a recent rebound in technology shares against a packed earnings calendar and key U.S. economic data due later this week. Results are scheduled from a range of blue chips, including CVS Health (NYSE:CVS) and Coca-Cola (NYSE:KO). Elsewhere, Japan’s Nikkei…

-

Playboy: A solid investment proposition built on licensing, de‑leveraging, and priceless IP

The “household name” gets thrown around a lot, but in this case, it is actually true. A powerhouse global lifestyle brand is accelerating its transformation through a high‑value international partnership, debt‑reducing cash infusion, and a bold shift toward scalable, recurring revenue. Playboy Inc. (NASDAQ:PLBY) continues to reposition itself as a global pleasure and leisure powerhouse…

-

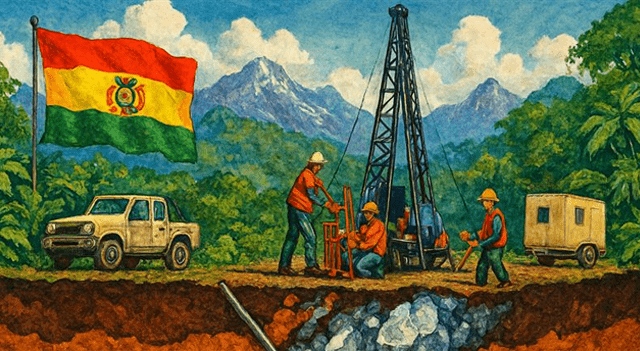

Silver Miners and Investors Find Promise in Mining-Friendly, Underdeveloped Bolivia

As the world’s need for electronic devices and renewable energy accelerates, silver is hitting record highs in demand and pricing, and the surge shows no signs of easing. This article is disseminated on behalf of New Pacific Metals Corp. It is intended to inform investors and should not be taken as a recommendation or financial…

-

Nasdaq Moves Sharply Higher, Dow Inches Up To New Record Closing High

Stocks moved mostly higher over the course of the trading day on Monday, extending the strong upward move seen last Friday’s session. While the Dow crept up to a new record closing high, the tech-heavy Nasdaq showed a more notable move to the upside. The major averages all finished the day in positive territory. The…

-

Precious Metals & Critical Minerals Virtual Investor Conference Set to Showcase Global Resource Leaders (Feb. 10–12, 2026)

The Precious Metals & Critical Minerals Virtual Investor Conference, hosted by VirtualInvestorConferences.com, has published its full agenda for the three-day event taking place February 10–12, 2026. The fully digital investor forum aims to connect mining and resource companies with individual and institutional investors, analysts, and advisors through live presentations, interactive Q&A sessions, and one-on-one meetings…

-

SoFi Shares Gain After Citizens Lifts Rating and Sees Upside

SoFi Technologies (NASDAQ:SOFI) shares climbed 2.9% on Monday after Citizens analyst Devin Ryan upgraded the fintech firm to Market Outperform from Market Perform and set a new price target of $30.00. The upgrade follows a pullback in SoFi’s stock to around $21, roughly 20% lower year to date after peaking above $30 late in 2025.…

-

Eltek Shares Jump After Landing $12.2 Million U.S. Defense Contract

Eltek Ltd. (NASDAQ:ELTK) shares surged about 15% on Monday after the company said it had secured new purchase orders worth $12.2 million from a U.S. defense customer. The printed circuit board maker said the orders will be fulfilled over 2026 and 2027 and relate to components destined for use in a defense program. The deal…

-

Once Upon a Farm Jumps Again After NYSE Debut, Extending IPO Rally

Shares of Once Upon a Farm (NYSE:OFRM), the children’s organic food group co-founded by actor Jennifer Garner, climbed a further 17.3% in premarket trading on Monday to $24.70, building on momentum from its strong first day on the New York Stock Exchange. The Berkeley, California-based company closed Friday up 17% at $21.05 after pricing its…

-

Hain Celestial Slides After Q2 Earnings and Revenue Come Up Short

Hain Celestial Group Inc. (NASDAQ:HAIN) shares fell more than 3% in premarket trading on Monday after the health and wellness group reported fiscal second-quarter results that missed expectations on both earnings and revenue. The company posted an adjusted loss of $0.03 per share, underperforming the consensus forecast of breakeven results. Revenue totaled $384 million, slightly…