ADVFN US – Market Content Editor

-

Alibaba’s Qwen Halts AI Coupon Push After Order Surge Overloads System

Alibaba’s AI chatbot Qwen has temporarily stopped issuing shopping coupons after a wave of demand overwhelmed its systems, complicating the group’s efforts to reposition the tool as a transaction-enabled shopping assistant rather than a simple Q&A bot. U.S.-listed shares of Alibaba (NYSE:BABA) slipped about 1% in premarket trading following the news. Qwen began handing out…

-

Cleveland-Cliffs Slides After Q4 Revenue Comes Up Short

Cleveland-Cliffs Inc. (NYSE:CLF) shares fell 3.4% in premarket trading on Thursday after the steelmaker reported a smaller-than-expected fourth-quarter loss but missed revenue forecasts, as subdued automotive production continued to weigh on results. The Ohio-based group posted fourth-quarter revenue of $4.3 billion, below the analyst consensus of $4.59 billion, and unchanged from the same period a…

-

Edgewell Personal Care Tops Q1 Forecasts, Finalizes Exit From Feminine Care

Edgewell Personal Care Company (NYSE:EPC) reported stronger-than-expected results for the first quarter of fiscal 2026 on Monday, with both adjusted earnings and revenue beating market forecasts as the company completed the sale of its Feminine Care unit. Shares were flat in after-hours trading following the announcement. For the quarter ended December 31, 2025, the personal…

-

Loews Posts Strong Q4 as Earnings More Than Double Year on Year

Loews Corporation (NYSE:L) reported a sharp improvement in fourth-quarter results on Monday, with net income rising to $402 million, or $1.94 per share, compared with $187 million, or $0.86 per share, in the same quarter a year earlier. Quarterly revenue increased to $4.73 billion from $4.55 billion last year. Despite the stronger earnings, Loews shares…

-

CNA Financial Falls Short of Q4 Forecasts as Underwriting Performance Softens

CNA Financial Corporation (NYSE:CNA) reported fourth-quarter core income of $317 million, or $1.16 per diluted share, missing analysts’ expectations of $1.19 per share. Revenue totaled $2.79 billion, also below the consensus forecast of $2.88 billion. Shares of the insurer slipped 0.11% in after-hours trading following the release. Compared with the same period a year earlier,…

-

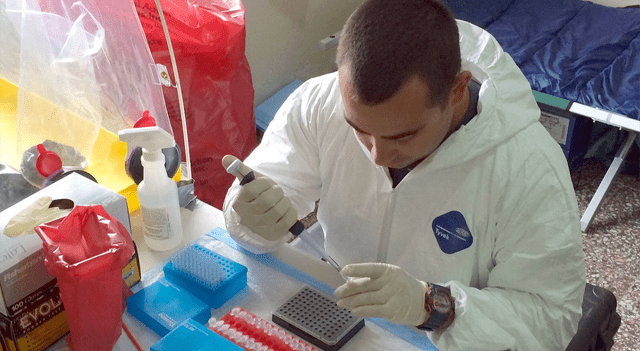

Biofrontera Reports Positive Phase 3 Data for Ameluz in Actinic Keratosis

Biofrontera Inc. (NASDAQ:BFRI) said on Monday that its Phase 3 clinical study of Ameluz photodynamic therapy (PDT) successfully achieved its primary endpoint in the treatment of actinic keratoses affecting the extremities, neck and trunk. Despite the encouraging trial outcome, shares of the micro-cap company—currently trading around $0.82 and valued at roughly $9.56 million—have fallen 8.37%…

-

Momentus Shares Jump After NASA Deal to Advance In-Orbit Servicing

Momentus (NASDAQ:MNTS) shares surged about 30% after the company announced it has signed a Space Act Agreement with NASA to jointly develop new in-orbit servicing and space operations capabilities. Under the agreement, the commercial space company will deploy a NASA CubeSat into low Earth orbit to demonstrate rendezvous and proximity operations, as well as formation…

-

Gold Advances as Precious Metals Rally Builds Ahead of Crucial U.S. Data

Gold prices climbed close to 1% on Monday, extending gains from last week after a sharp 4% surge on Friday, as investors positioned themselves ahead of a series of delayed U.S. economic releases. The yellow metal traded firmly throughout the session, adding to a strong run that lifted prices to their highest levels in several…

-

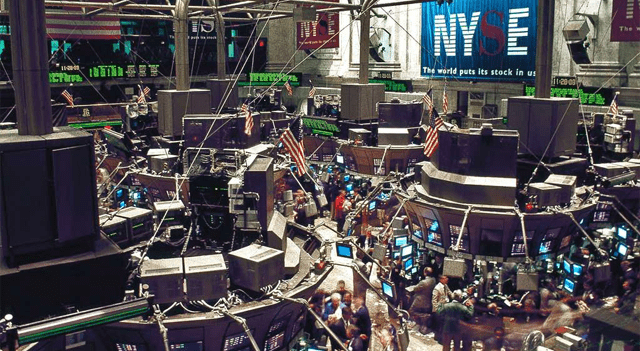

Wall Street Faces Potential Volatility as Key Economic Reports Approach: Dow Jones, S&P, Nasdaq, Futures

U.S. stock index futures are signaling a largely flat start to trading on Monday, suggesting markets may struggle to find clear direction after the strong rebound seen at the end of last week. Investors appear to be pausing to digest recent market swings, which included a sharp, technology-led selloff midweek followed by a powerful recovery…

-

FedEx-Advent Consortium Moves to Acquire InPost for $9.2bn as Shares Jump

A consortium led by FedEx Corporation (NYSE:FDX) and private equity group Advent has agreed terms to acquire Polish parcel locker operator InPost SA (AS:INPST) in a transaction valuing the company at around €7.79 billion ($9.22 billion), according to a joint statement released on Monday. Under the proposal, the consortium is offering €15.60 per InPost share,…