ADVFN US – Market Content Editor

-

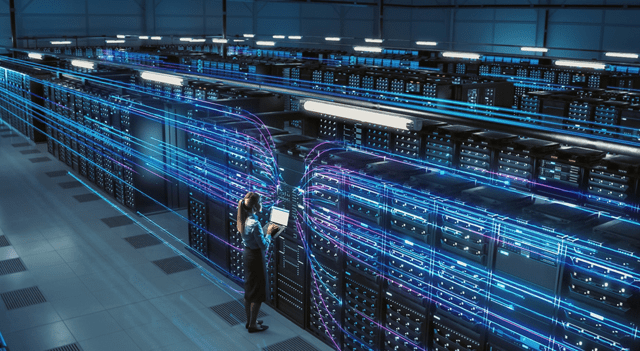

Sandisk Shares Soar After Blowout FQ2 Results and Eye-Catching Outlook

Shares in Sandisk (NASDAQ:SNDK) jumped more than 20% in premarket trading on Friday after the data storage specialist delivered a fiscal second-quarter performance that far exceeded expectations and unveiled third-quarter guidance that caught the market off guard. For the quarter, Sandisk posted adjusted earnings of $6.20 per share, almost double the $3.49 forecast by analysts.…

-

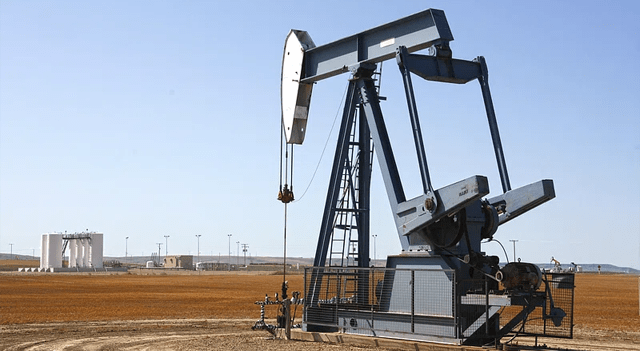

GeoPark Agrees $375m Cash Deal for Frontera Energy’s Colombia E&P Portfolio

Latin American oil and gas group GeoPark Ltd (NYSE:GPRK) has struck a definitive agreement to buy Frontera Energy’s Colombian upstream assets in an all-cash transaction. Under the terms, GeoPark will acquire 100% of Frontera Petroleum International Holdings—the vehicle that owns Frontera’s oil and gas interests in Colombia—for $375 million upfront, with a further $25 million…

-

Apple Posts Strongest iPhone Sales Growth in More Than Four Years

Apple (NASDAQ:AAPL) reported a clear beat on both earnings and revenue for its fiscal first quarter of 2026 on Thursday, underpinned by its fastest quarterly iPhone sales growth in over four years. iPhone revenue surged 23.3% year on year to $85.27 billion, marking the strongest increase since the December quarter of 2021 and reaffirming the…

-

Dutch Regulator Probes Roblox Over Safeguards for Young Users

The Netherlands’ consumer watchdog, the Authority for Consumers and Markets (ACM), has opened an inquiry into U.S.-based gaming platform Roblox (NYSE:RBLX) to examine potential risks faced by underage users within the European Union. The regulator said on Friday that the review will focus on whether the platform has put sufficient protections in place for minors.…

-

OPEC+ Expected to Extend Output Freeze Into March as Crude Prices Rally

OPEC+ is widely expected to roll over its current pause on oil production increases into March when it meets on Sunday, according to five delegates cited by Reuters, even as crude prices climb above $70 a barrel amid rising geopolitical tensions involving Iran. The alliance is facing a markedly firmer price backdrop, with concerns growing…

-

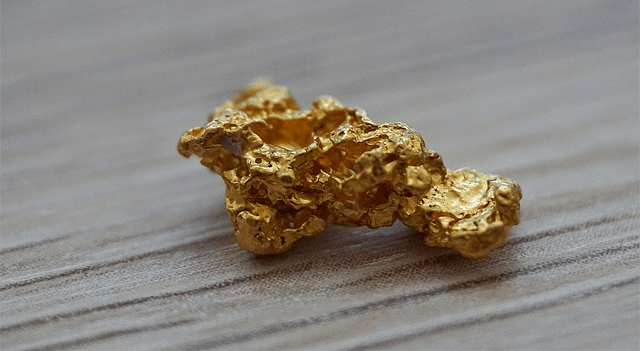

Gold Drops Almost 4% as Markets Await Trump’s Decision on Next Fed Chair

Gold prices extended their pullback during Asian trading on Friday, pressured by continued profit-taking after U.S. President Donald Trump indicated he would reveal his choice for the next Chair of the Federal Reserve later in the day. The prospect of greater clarity on U.S. monetary leadership prompted investors to trim positions after a strong rally…

-

Fed Chair Speculation, Apple Results and Shutdown Deal Shape Market Moves: Dow Jones, S&P, Nasdaq, Wall Street Futures

U.S. equity futures edged lower on Friday as investors assessed growing speculation that Kevin Warsh could be named the next chair of the U.S. Federal Reserve. Corporate news provided some support, led by a strong earnings update from Apple, while precious metals pulled back from record highs. Meanwhile, political risk eased after signs emerged that…

-

U.S. Stocks Stage Significant Recovery Attempt After Early Sell-Off

Following a nosedive seen early in the session, stocks showed a substantial recovery attempt over the course of the trading day on Thursday. The major averages climbed well off their worst levels of the day, with the Dow reaching positive territory. The Dow ended the day up 55.96 points or 0.1 percent at 49,071.56, while…

-

Sherwin-Williams tops Q4 forecasts, strikes guarded tone on 2026

Sherwin-Williams (NYSE:SHW) delivered fourth-quarter adjusted earnings ahead of market expectations, with revenue also edging past forecasts despite what management described as an environment of “continued demand choppiness.” Shares were little changed in pre-market trading following the release, slipping just 0.03%. Adjusted earnings per share for the quarter came in at $2.23, beating the consensus estimate…

-

Marsh shares climb after fourth-quarter earnings beat forecasts

Marsh (NYSE:MRSH) posted stronger-than-expected fourth-quarter results on Thursday, supported by solid execution across its operating divisions. The company’s shares rose about 1.3% in pre-market trading following the release. Adjusted earnings per share came in at $2.12 for the quarter, comfortably ahead of the analyst consensus of $1.98. Revenue increased 9% year over year to $6.6…