ADVFN US – Market Content Editor

-

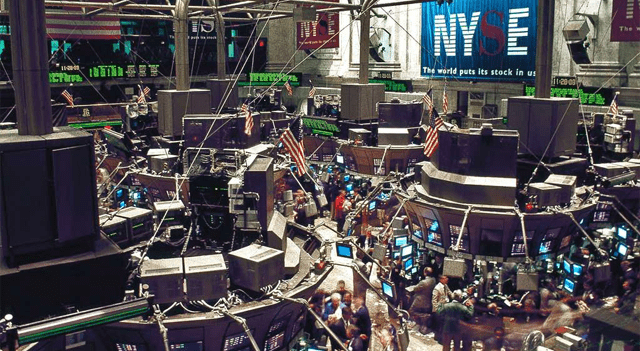

Futures little changed as markets eye Fed call, earnings and fresh Trump tariff threats: Dow Jones, S&P, Nasdaq, Wall Street

U.S. equity futures were subdued at the start of the week, with investors bracing for a Federal Reserve rate decision and a heavy slate of corporate earnings. Markets are also digesting renewed tariff rhetoric from President Donald Trump and monitoring fallout from protests in Minneapolis. Meanwhile, gold pushed to another record high. Futures muted U.S.…

-

Goldman sees “quiet outperformance” of value stocks continuing as growth picks up

Value stocks could remain in favor in the months ahead if U.S. economic momentum strengthens, according to analysts at Goldman Sachs. Value shares typically represent well-established, financially resilient companies that trade at relatively low prices compared with their underlying fundamentals, often below estimated intrinsic value. In a research note, Goldman said its sector-neutral measure tracking…

-

BCA Research flags possible “black swan” risks that could confront markets in 2026

Equity market sell-offs severe enough to force changes in U.S. policy may be less pronounced in 2026, as the Trump administration turns its focus to the pivotal midterm elections in November, according to analysts at BCA Research. In a note to clients, the team led by Matt Gertken noted that a 20% bear-market drop in…

-

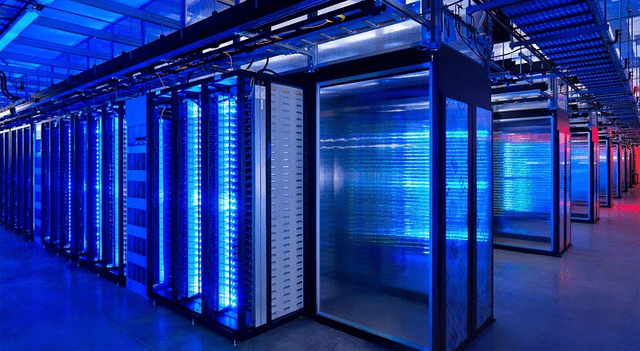

Wolfe sees data-center boom and policy clarity lifting clean energy into 2026

Clean energy stocks could find renewed support heading into 2026, helped by a more benign U.S. budget outcome than initially expected and the continued expansion of data-center infrastructure, according to analysts at Wolfe Research. In a research note, analysts including Steve Fleishman and Dylan Nassano said the sector is moving into 2026 “with the wind…

-

U.S. Stocks Turn In Mixed Performance Following Two-Day Rally

After moving sharply higher over the two previous sessions, the major U.S. stock indexes turned in a mixed performance during trading on Friday. While the Dow gave back ground, the tech-heavy Nasdaq saw further upside, closing higher for the third straight day. The major averages finished the choppy trading day on opposite sides of the…

-

Nvidia Shares Edge Higher After Report Signals China May Greenlight H200 Chip Orders

Nvidia (NASDAQ:NVDA) shares gained around 1.5% on Friday after a Bloomberg report suggested that Chinese regulators are moving closer to approving imports of the company’s H200 artificial intelligence chips. According to the report, Chinese authorities have informed several major technology groups that they may begin preparing orders for the advanced processors. Firms including Alibaba Group…

-

UK Regulator Opens Probe Into Meta Over WhatsApp Market Information

Ofcom has opened an investigation into Meta Platforms (NASDAQ:META) after raising concerns about information the company supplied regarding WhatsApp during a recent market assessment. The probe focuses on whether Meta provided incomplete or inaccurate details as part of Ofcom’s review last year into the wholesale market for business bulk SMS services, which are widely used…

-

Fortinet Shares Jump After TD Cowen Upgrade and $100 Valuation Call

Fortinet (NASDAQ:FTNT) shares climbed about 6% on Friday after TD Cowen upgraded the cybersecurity firm to Buy from Hold, reiterating a $100 price target. Analyst Shaul Eyal pointed to encouraging channel checks that suggest demand conditions remain steady as fiscal 2026 gets underway. Eyal left his existing financial model unchanged but highlighted potential upside to…

-

Erayak Power Shares Rise as Winter Storms Spark Surge in Generator Sales

Shares of Erayak Power Solution Group Inc (NASDAQ:RAYA) rose 7% in premarket trading on Friday after the company reported a sharp jump in demand for its portable, low-noise inverter generators amid severe winter storms hitting the U.S. East Coast. The power equipment maker said daily unit sales increased roughly twentyfold starting around January 20, 2026,…

-

Diginex Shares Jump After ESG Deal With Brazil’s Mato Grosso

Shares of Diginex Inc (NASDAQ:DGNX) climbed 31.9% in premarket trading on Friday after the ESG-focused technology company announced a framework agreement with the Brazilian state of Mato Grosso aimed at advancing large-scale sustainability projects. Under the agreement, Diginex will form a joint venture alongside BGlobal and the government of Mato Grosso to build a digital…