ADVFN US – Market Content Editor

-

Aptera Motors Shares Sink After $9 Million Equity Raise Announcement

Shares of Aptera Motors Corp (NASDAQ:SEV) plunged 40.3% in premarket trading on Friday after the electric vehicle manufacturer revealed the terms of a public share offering expected to raise about $9 million. The company said it priced 4.5 million shares of Class B common stock at $2.00 per share. Each share is being issued with…

-

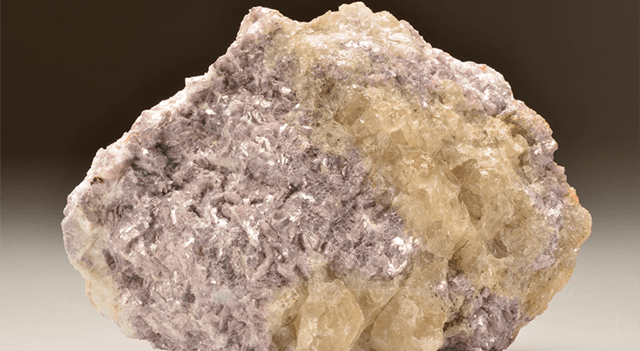

Sigma Lithium Shares Jump After High-Purity Lithium Sale and Pushback on Media Claims

Shares of Sigma Lithium Corporation (NASDAQ:SGML) surged 14.1% in premarket trading on Friday after the company disclosed the sale of 100,000 tonnes of high-purity lithium fines at a price exceeding its previous transaction. The lithium producer said the material was sold at market-linked pricing based on the Shanghai Metals Market index, resulting in an adjusted…

-

Robo.ai Shares Jump After Signing AI Infrastructure Distribution Deal

Shares of Robo.ai Inc. (NASDAQ:AIIO) jumped 23.8% in premarket trading on Friday after the autonomous systems specialist unveiled a strategic, multi-year partnership aimed at expanding its role in AI infrastructure. The company said it has entered into a three-year Gold Reseller Agreement with The Ghazi Group (TGG), under which Robo.ai will gain Gold Reseller status…

-

ClearPoint Neuro Shares Advance After Securing EU MDR Approval

Shares of ClearPoint Neuro Inc (NASDAQ:CLPT) rose 5.2% in premarket trading on Friday after the company said it had obtained EU MDR Certification for its ClearPoint Navigation Software Version 3.0.2. The approval enables the company to deploy a single navigation platform across global markets, a move expected to simplify user training and hospital IT integration.…

-

OLB Group Shares Sink After Heavily Discounted Equity Raise

Shares of OLB Group Inc (NASDAQ:OLB) slumped sharply in premarket trading on Friday, falling about 33.7% after the fintech company unveiled a new common stock offering priced well below its prior market value. The company said it has entered into a securities purchase agreement to sell 2,166,666 shares of common stock at $0.60 per share,…

-

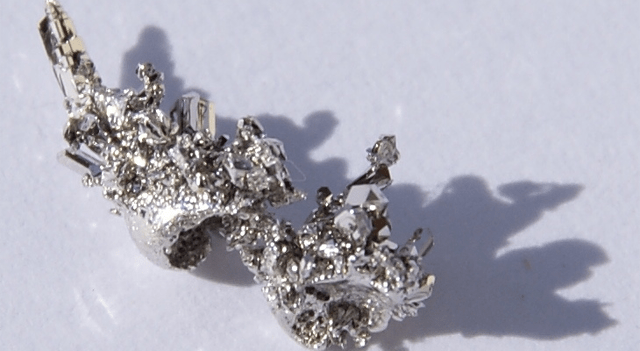

UBS Raises Palladium Price Outlook on Strong Investor Inflows

UBS has increased its outlook for palladium prices, lifting its forecast by $300 an ounce to $1,800, as renewed investor interest continues to drive momentum in the metal, the bank said in a client note on Friday. UBS analyst Giovanni Staunovo said the upward revision was “driven by solid investment demand in recent months,” adding…

-

Wall Street Futures Signal Early Dip After Two-Day Rally: Dow Jones, S&P, Nasdaq

U.S. stock index futures are pointing to a slightly weaker open on Friday, suggesting markets may give back some recent gains following two consecutive sessions of sharp advances. After the strong rebound seen over the past two days—one that largely erased Tuesday’s steep selloff—some investors appear poised to lock in profits. The recent upswing was…

-

Capital One Shares Slip Following Brex Deal Announcement and Q4 Earnings Miss

Capital One Financial Corporation (NYSE:COF) shares moved lower in U.S. premarket trading on Friday after the lender unveiled plans to acquire fintech firm Brex Inc. and reported fourth-quarter earnings that fell short of market expectations. Capital One said it has signed a definitive agreement to purchase Brex, a provider of corporate credit cards, in a…

-

United Bancshares Posts Modest Q4 Profit Growth and Lifts Dividend

United Bancshares, Inc. (USOTC:UBOH) reported slightly higher earnings for the fourth quarter, alongside an increase in its quarterly dividend, reflecting continued balance-sheet stability and improved profitability. The Ohio-based financial holding company posted fourth-quarter net income of $3.1 million, or $1.04 per share, up from $3.0 million, or $1.02 per share, in the same period a…

-

Lenovo Looks to Forge Global AI Alliances to Power Smarter Devices

Lenovo (USOTC:LNVGY) is stepping up efforts to build a global network of artificial intelligence partners, seeking to work with multiple large language model providers to enhance intelligence across its devices as it positions itself as a major player in AI. The world’s largest PC manufacturer plans to embed AI capabilities throughout its product lineup, spanning…