Category: Latest News

-

Target Stock Climbs 4% After Stronger-Than-Expected Sales Outlook

Target Corp (NYSE:TGT) shares gained about 4% to $117.50 in premarket trading Tuesday after the retailer issued a full-year same-store sales forecast that topped Wall Street projections. The Minneapolis-based company said it expects net sales to grow 2% in 2026 compared with 2025, ahead of analyst estimates of 1.76%, according to LSEG data. Management pointed…

-

Palantir Stock Slips After Thiel Reveals $280M Share Sale Plan

Palantir Technologies (NYSE:PLTR) shares fell 3.6% to $140 in premarket trading Tuesday after co-founder Peter Thiel disclosed intentions to offload 2 million shares, valued at roughly $280 million, according to a regulatory filing released late Monday. Thiel remains one of the five largest shareholders of the defense-focused artificial intelligence software company, based on LSEG data.…

-

Escalating Middle East Tensions Point to Fresh Wall Street Sell-Off: Dow Jones, S&P, Nasdaq, Futures

U.S. stock futures signal a sharply lower start to Tuesday’s session, raising the prospect of another early wave of selling after markets rebounded from steep losses to finish Monday mixed. Investor anxiety over the deepening conflict in the Middle East is resurfacing, particularly as crude oil prices continue to surge. Brent futures have climbed above…

-

Peer-Reviewed Study Validates Cannabis Breath Testing Method Developed by Omega and Cannabix

Cannabix Technologies Inc. (USOTC:BLOZF) (CSE:BLO) (TG:8CT), together with Omega Laboratories Inc., announced that a peer-reviewed validation study confirming the accuracy of their marijuana breath testing method has been published by Oxford University Press in the Journal of Analytical Toxicology. The study, titled “Simultaneous Analysis of Δ9 THC, Δ8 THC, CBD, and CBN in Breath Aerosols…

-

Building the West’s Tungsten Powerhouse

As governments scramble to secure critical minerals and defense budgets expand worldwide, tungsten has quietly become one of the most strategic metals on the planet. In this in-depth conversation, Lewis Black, CEO of Almonty Industries, shares the full story behind the redevelopment of the historic Sangdong Mine in South Korea — once the world’s largest…

-

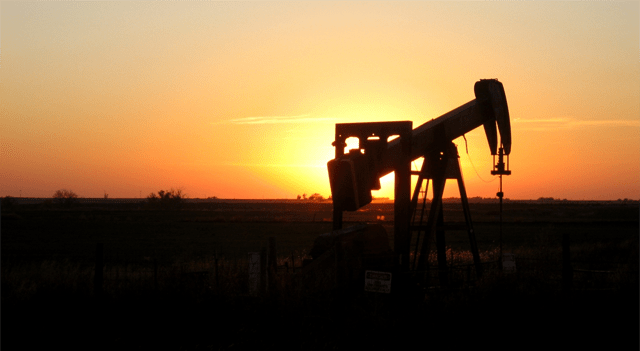

Oil builds on rally as Strait of Hormuz risks intensify

Crude prices pushed sharply higher on Tuesday, extending the previous session’s strong advance as escalating Middle East tensions and mounting threats to shipping through the Strait of Hormuz reinforced fears of supply disruptions. At 03:25 ET (08:25 GMT), May Brent futures climbed 3.7% to $80.58 per barrel, while U.S. West Texas Intermediate (WTI) crude rose…

-

Gold slips as dollar strength offsets safe-haven demand amid Iran tensions

Gold prices moved lower on Tuesday, giving back earlier gains as a firmer U.S. dollar pressured the metal, even as investors weighed escalating conflict in the Middle East and concerns over oil supply disruptions. Spot gold was down 0.4% at $5,303.12 an ounce as of 01:24 ET (06:24 GMT), after climbing as much as 1%…

-

Bitcoin steadies below $68K as Iran tensions curb risk appetite

Bitcoin (COIN:BTCUSD) edged higher on Tuesday but remained off recent highs as escalating tensions tied to the U.S.–Iran conflict continued to dampen investor appetite for risk. The largest cryptocurrency by market value is still confined to the range that has dominated trading for most of February and remains significantly lower on a year-to-date basis. Bitcoin…

-

Futures slide and oil surges as Iran conflict rattles markets – what’s driving moves: Dow Jones, S&P, Nasdaq, Wall Street Futures

U.S. equity futures are pointing decisively lower, even after Wall Street managed to recover on Monday in the wake of renewed hostilities involving Iran. President Donald Trump signaled that the joint U.S.-Israeli campaign could extend for weeks, stating Washington will do “whatever it takes.” Meanwhile, oil prices are climbing on fears of supply disruptions through…

-

The 2026 buildout that turns a resource into a platform

Part 2 of a 3‑part investor series In Part 1 of this series introduced U.S. Energy Corp. (NASDAQ:USEG) as a company undergoing a strategic transformation, then Part 2 marks the point where that transformation becomes visible. 2026 is a pivotal year—not just because of what U.S. Energy plans to build, but because of what that…