Category: Top Story

-

Target Stock Climbs 4% After Stronger-Than-Expected Sales Outlook

Target Corp (NYSE:TGT) shares gained about 4% to $117.50 in premarket trading Tuesday after the retailer issued a full-year same-store sales forecast that topped Wall Street projections. The Minneapolis-based company said it expects net sales to grow 2% in 2026 compared with 2025, ahead of analyst estimates of 1.76%, according to LSEG data. Management pointed…

-

Palantir Stock Slips After Thiel Reveals $280M Share Sale Plan

Palantir Technologies (NYSE:PLTR) shares fell 3.6% to $140 in premarket trading Tuesday after co-founder Peter Thiel disclosed intentions to offload 2 million shares, valued at roughly $280 million, according to a regulatory filing released late Monday. Thiel remains one of the five largest shareholders of the defense-focused artificial intelligence software company, based on LSEG data.…

-

Escalating Middle East Tensions Point to Fresh Wall Street Sell-Off: Dow Jones, S&P, Nasdaq, Futures

U.S. stock futures signal a sharply lower start to Tuesday’s session, raising the prospect of another early wave of selling after markets rebounded from steep losses to finish Monday mixed. Investor anxiety over the deepening conflict in the Middle East is resurfacing, particularly as crude oil prices continue to surge. Brent futures have climbed above…

-

Peer-Reviewed Study Validates Cannabis Breath Testing Method Developed by Omega and Cannabix

Cannabix Technologies Inc. (USOTC:BLOZF) (CSE:BLO) (TG:8CT), together with Omega Laboratories Inc., announced that a peer-reviewed validation study confirming the accuracy of their marijuana breath testing method has been published by Oxford University Press in the Journal of Analytical Toxicology. The study, titled “Simultaneous Analysis of Δ9 THC, Δ8 THC, CBD, and CBN in Breath Aerosols…

-

Building the West’s Tungsten Powerhouse

As governments scramble to secure critical minerals and defense budgets expand worldwide, tungsten has quietly become one of the most strategic metals on the planet. In this in-depth conversation, Lewis Black, CEO of Almonty Industries, shares the full story behind the redevelopment of the historic Sangdong Mine in South Korea — once the world’s largest…

-

Futures slide and oil surges as Iran conflict rattles markets – what’s driving moves: Dow Jones, S&P, Nasdaq, Wall Street Futures

U.S. equity futures are pointing decisively lower, even after Wall Street managed to recover on Monday in the wake of renewed hostilities involving Iran. President Donald Trump signaled that the joint U.S.-Israeli campaign could extend for weeks, stating Washington will do “whatever it takes.” Meanwhile, oil prices are climbing on fears of supply disruptions through…

-

U.S. Stocks Recover From Initial Sell-Off To Close Narrowly Mixed

Stocks moved sharply lower at the start of trading on Monday in reaction to the conflict in the Middle East but showed a substantial recovery over the course of the session. The major averages climbed well off their lows of the session before eventually ending the day narrowly mixed. After tumbling by as much as…

-

Five key market themes investors are watching this week

Geopolitical tensions in the Middle East are dominating attention heading into the new trading week, after U.S. and Israeli strikes on Iran triggered a selloff in equities and a sharp rally in oil prices. Alongside the geopolitical backdrop, markets will also focus on major economic data releases and corporate earnings, including the February U.S. jobs…

-

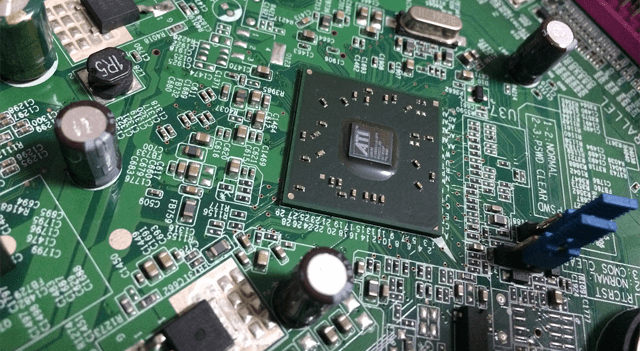

AMD unveils Ryzen AI 400 processors at MWC 2026, expanding push into AI-powered PCs

Advanced Micro Devices (NASDAQ:AMD) introduced its next generation of AI-enabled processors at Mobile World Congress 2026, launching the Ryzen AI 400 Series alongside the Ryzen AI PRO 400 Series desktop chips as the company deepens its push into on-device artificial intelligence computing. The new lineup is designed to deliver enhanced local AI processing and next-generation…

-

Wall Street set for sharp drop as U.S. strikes on Iran rattle markets: Dow Jones, S&P, Nasdaq, Futures

U.S. stock index futures pointed to a sharply lower open on Monday, suggesting equities could extend losses after two consecutive sessions of declines. Market sentiment weakened following joint U.S. and Israeli military strikes on Iran over the weekend that resulted in the death of Iranian Supreme Leader Ayatollah Ali Khamenei. Tensions escalated further after Israel…