ADVFN US – Market Content Editor

-

Oil edges higher as traders assess supply threats

Oil prices posted modest gains on Friday as investors continued to evaluate potential supply risks, even as fears of an imminent U.S. military strike on Iran faded. Brent crude added 5 cents, or 0.1%, to $63.81 a barrel, while U.S. West Texas Intermediate increased by 8 cents, or 0.1%, to $59.27 a barrel by 0749…

-

Gold steadies below peak levels after robust U.S. jobs data; weekly gain still in sight

Gold prices were mostly unchanged on Friday, remaining below the record highs reached earlier in the week, as strong U.S. employment data cooled expectations for near-term Federal Reserve interest rate cuts. At the same time, easing geopolitical tensions surrounding Iran reduced demand for traditional safe-haven assets. Spot gold was last down 0.1% at $4,608.55 an…

-

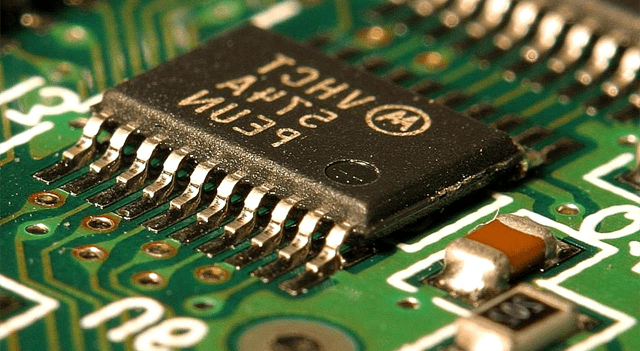

Futures edge up as TSMC results reignite AI momentum; banks in focus: Dow Jones, S&P, Nasdaq, Wall Street

U.S. equity futures tied to the major benchmarks traded modestly higher after robust earnings from Taiwan Semiconductor Manufacturing Co. (NYSE:TSM) lifted sentiment in the prior session. Shares of the world’s largest contract chipmaker advanced in Taiwan, while investors turned their attention to a fresh batch of U.S. bank earnings. In commodities, gold eased from record…

-

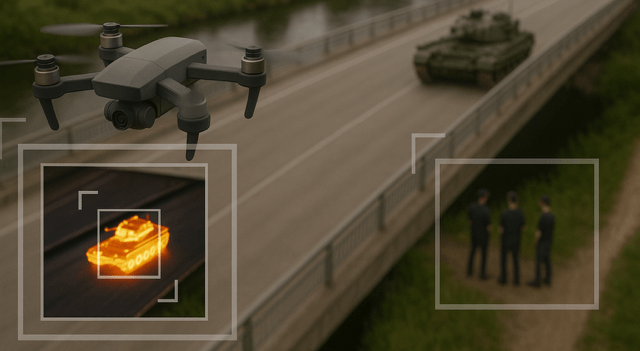

Lithium shortage grows: How BYD, NEO Battery Materials, and DroneShield are benefiting

A new era of scarcity is dawning. Lithium prices are skyrocketing. As lithium becomes the strategic oil of the 21st century, entirely new technologies are fueling the appetite for energy. Electric mobility, drones, robotics, and AI all have one thing in common: they are driving up demand for energy storage systems that need to be…

-

U.S. Stocks Pull Back Off Best Levels But Still Close Higher

After turning in a strong performance for much of the session, stocks gave back some ground in the latter part of the trading day on Thursday but managed to remain mostly higher. The major averages all ended the day in positive territory, regaining some ground following the pullback seen over the two previous sessions. The…

-

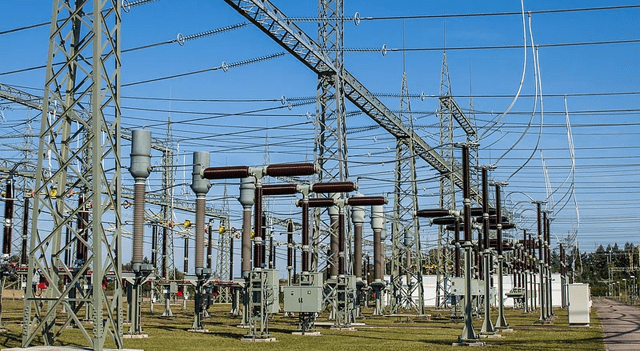

Talen Energy gains after announcing $3.45 billion gas plant acquisition

Talen Energy Corporation (NASDAQ:TLN) shares rose about 5% on Thursday after the company said it will acquire three natural gas-fired power plants from Energy Capital Partners in a deal valued at $3.45 billion. The transaction will add roughly 2.6 gigawatts of natural gas generation capacity to Talen’s portfolio through the purchase of the Waterford Energy…

-

First Horizon slides despite fourth-quarter earnings topping estimates

First Horizon Corporation (NYSE:FHN) reported fourth-quarter earnings on Thursday that beat analyst expectations, but shares fell nearly 5% in premarket trading as investors weighed margin pressure and loan growth dynamics. The regional lender posted earnings per share of $0.52, above consensus estimates of $0.46. Net income available to common shareholders totaled $257 million, up 1%…

-

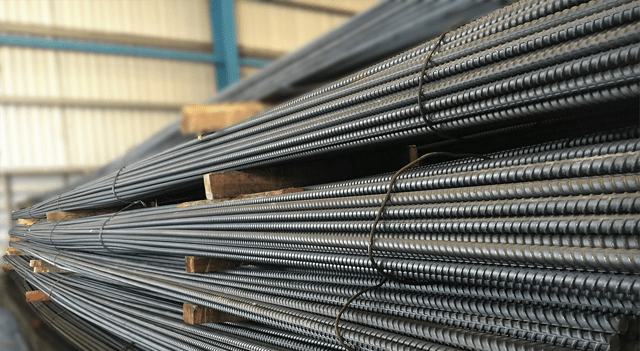

Insteel Industries slips after first-quarter revenue comes in below forecasts

Insteel Industries Inc. (NYSE:IIIN) reported first-quarter fiscal 2026 results on Thursday that showed a modest revenue shortfall despite a slight earnings beat, sending shares down 2.26% in premarket trading. The largest U.S. producer of steel wire reinforcing products for concrete construction posted earnings of $0.39 per share, edging past analyst expectations of $0.38. Revenue totaled…

-

Applied Materials jumps after Barclays lifts rating on AI-driven spending outlook

Applied Materials Inc (NASDAQ:AMAT) shares rose about 8% in premarket trading after Barclays upgraded the stock to Overweight from Underweight, citing improving prospects tied to artificial intelligence-related capital spending. According to the firm, proximity to AI has been the dominant factor behind U.S. semiconductor stock performance. While the timing and scale of AI deployments remain…

-

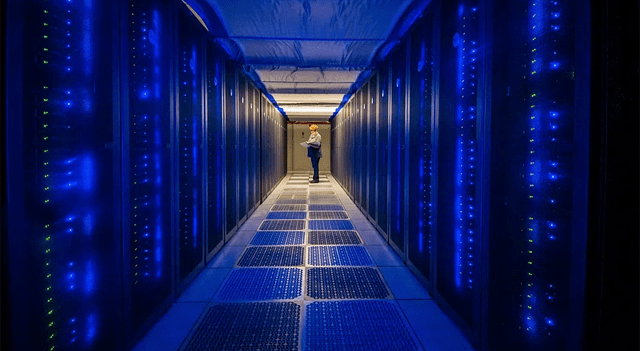

Aeva jumps after debuting high-power optical amplifier for AI data centers

Aeva (NASDAQ:AEVA) shares climbed about 8% after the company introduced a new high-power semiconductor optical amplifier (SOA) aimed at artificial intelligence data centers and physical AI applications. The Mountain View, California-based firm, best known for its sensing and perception systems, is extending its photonics capabilities beyond FMCW LiDAR into the fast-expanding AI infrastructure market. Aeva…